NORDIC | BIOTECH & HEALTHCARE Your insights into listed Danish & Nordic biotech & healthcare stocks.

In the past week, the Nordic biotech and healthcare stocks rose 0.6%, while the Danish rose 0.2%. Most notably, the CEO of Acarix bought shares, Genmab received approval of Epkinly in Japan, Medix submitted its application for Saniona’s Tesofensine, and Zealand Pharma released its 2024 results as well as disappointing guidance for 2025. New price targets for Genmab and Zealand Pharma were also set which you can find below.

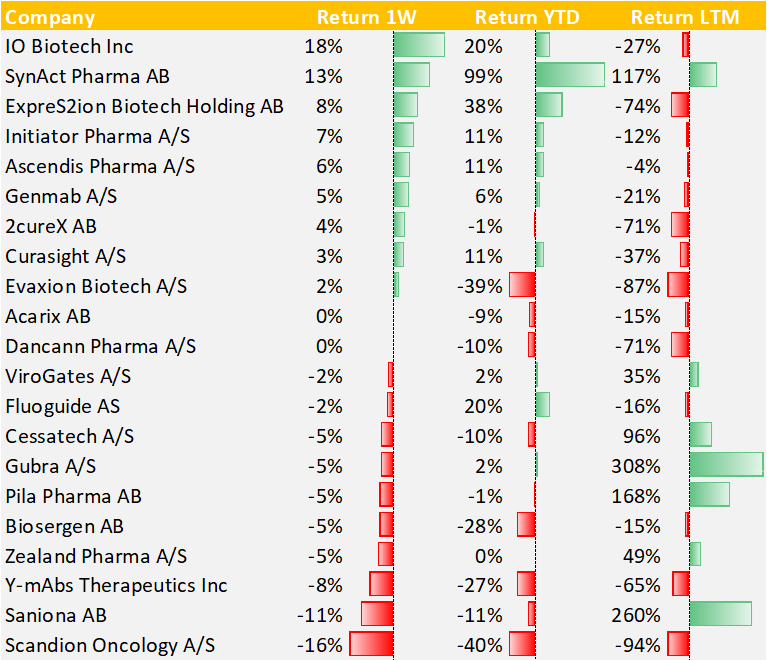

9 of the 21 Danish biotech companies had a positive share price development in the past week and 7 companies had a positive share price performance over the past 12 months. Obesity continues to drive the best performances with Gubra, Zealand Pharma, and Pila Pharma having strong LTM performances, but SynAct Pharma also joined the +100% return club. Gubra is the best performer with a return of 308% over the last twelve months.

Danish company news

The CEO of Acarix bought 2,300,257 shares at an average price of SEK 0.22.

No news in the past week

No news in the past week

No news in the past week

No news in the past week

DanCann Pharma A/S: Releases Q4-2024 report – Revenue (NET) up by 27.8% YoY and EBITDA up by 63.8% YoY (Link)

DanCann Pharma completes reverse share split with 1,000:1 ratio

No news in the past week

No news in the past week

No news in the past week

Genmab got approval of Epkinly in Japan

Several new price targets were set. Deutsche Bank lowered its target to 2,100 DKK, Carnegie to 2,491 DKK, Handelsbanken to 2,000 DKK, and Kempen to 3,070 DKK.

No news in the past week

No news the past week

IO Biotech to Present at the 45th Annual Cowen Health Care Conference

No news the past week

Medix has resubmitted Tesofensine application to COFEPRIS (Link)

No news in the past week

SynAct Pharma Year-end Report 2024 (Link)

SynAct’s Nomination Committee proposes Jeppe Ragnar Andersen to the Board (Link)

No news the past week

Zealand Pharma Announces Financial Results for the Full Year 2024 (Link)

Morgan Stanley set a new price target at 750 DKK and Goldman Sachs at 977 DKK.

Y-mAbs to Announce Fourth Quarter and Full Year 2024 Financial and Operating Results on March 4, 2025

No news the past week

Share price development – Danish stocks

On average, the Danish biotech and healthcare stocks deliverd a return of 0.2%. IO Biotech rose 18% without noticeable news. SynAct Pharma came in second with a 13% return following their year-end report with a significant decrease in operating expenses. Genmab rose 5% following the approval of Epkinly in Japan as well as new price targets. Although the new price targets were lowered, they are still significantly higher than the current share price. Furthermore, the CEO of Acarix bought shares at 0.22 SEK, but the stock ended in zero. On the other hand, Saniona declined 11% although Medix finally resubmitted the Tesofensine application to COFEPRIS. Zealand Pharma released its 2024 results, but the market reacted negatively to the guidance of the operating expenses in 2025 at DKK 2-2.5 billion versus DKK 1.33 billion in 2024.

SynAct Pharma just surpassed a 100% return in the last twelve months. Thus, 4 stocks are now above a 100% return in the last twelve months including Pila Pharma, Gubra, and Saniona within the diabetes and obesity area. Gubra is still the best performer with a 308% return over the last twelve months. In the last twelve months, the average return is 20%. Year-to-date with SynAct Pharma is having the best to the year with a return of 99%.

Further reading: The Curasight investment case

Overview of share price development the past week, year-to-date, and the last twelve month

Nordic Biotech & Healthcare Developments

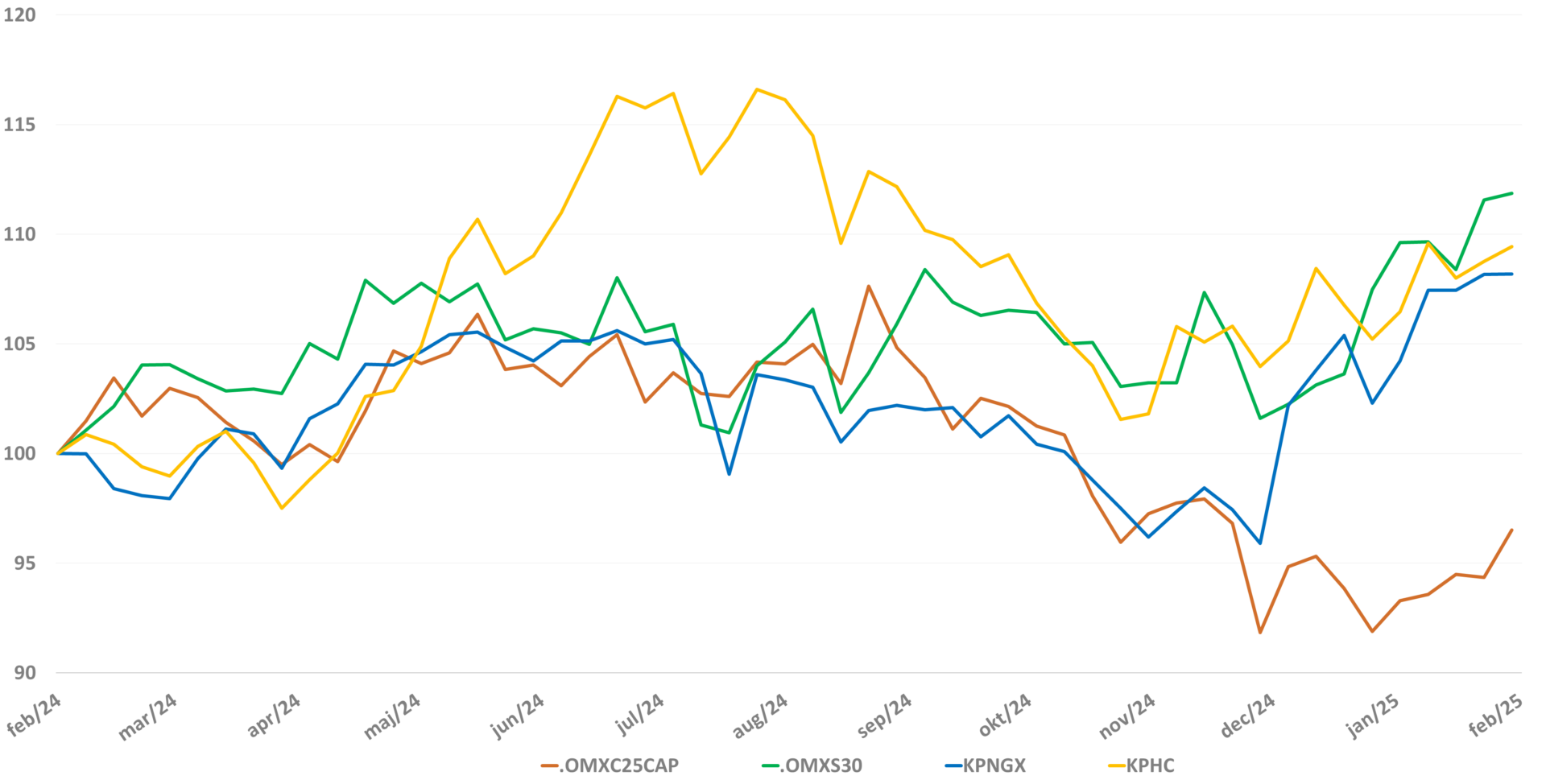

The Kapital Partner Nordic Healthcare Index (KPHC) increased 0.6% to 66.66 in the past week. The index had a poor start over the past 12 months, then made a comeback followed by another drawback, and now it seems to be on an upward trend in the past few months. The index has performed better than the C25 Index over the past year, and the return is almost 10%.

The Nordic healthcare stocks (KPHC) vs. the C25, S30, and KPNGX index the past year

The top three best-performing stocks in the past week

Alzecure AB (78%) focuses on research and development of drugs used for various brain diseases, with the greatest focus on Alzheimer’s disease, but also on pain. The technology and research are based on its own pharmaceutical platform, where the company develops various symptom-relieving and disease-modifying drug candidates. The stock rose following a grant at 2.5 MEUR from the EU for a Phase 2 clinical trial of NeuroRestore ACD856 for Alzheimer’s disease.

BrainCool (40%) develops products used for medical cooling of the human brain. The technology acts as cooling pads that are applied to different part of the patient’s body, where the system controls the body temperature and other movements. The products are used in the treatment of various severe conditions such as stroke, cardiac arrest, concussion, and migraine. The stock rose following an order worth 8 MSEK, which is set to be delivered in the first half of 2025.

Prolight Diagnostics (54%) develops test systems in POCT (Point of care testing). The tests are used outside of hospital laboratories to enable rapid assessments of the health of patients. The company’s POCT platform is under development with the intention of measuring various biomarkers simultaneously. An important component of the work is to reduce the time for test results, particularly important for patients with heart problems. During the week, the company received a second Notice of Intention to Grant from the European Patent Office for Psyros™ technology.

Resources: Refinitiv Eikon, Cision, Nordnet & company websites