The Nordic impact stocks delivered a positive return of 1.5% in the past week. Minesto got a boost for its underwater energy production system supporting a 10MW investment in the Faroe Islands, and SaltX achieved key milestones at its pilot facility with SMA Mineral. Further, the Energy Production & Storage sector rose 10% as EAM Solar surged 166%, and Circle Energy also did a 2x. Conversely, the PtX sector continues to face difficulties.

NORDIC | IMPACT Helps you to invest more sustainably in the businesses of tomorrow. We track the development of more than 100 Nordic impact companies within multiple impact sectors from small to large cap.

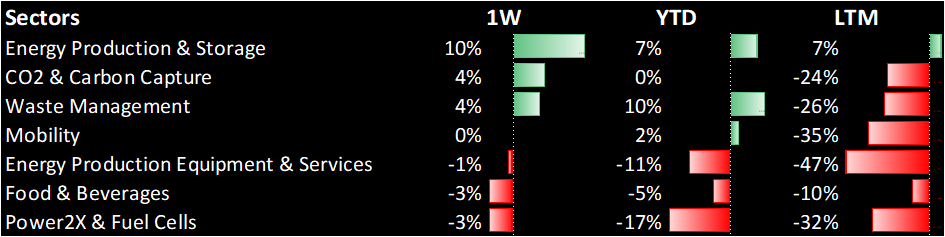

Energy Production & Storage in green for the past week, YTD and LTM.

In the past week, the Energy Production & Storage sector spurred 10% following EAM Solar stellar return of 166%. EAM Solar is an investment company that acquires, owns, and operates a number of photovoltaic systems. The Waste Management and CO2 & Carbon Capture sectors also did well with 4% increases driven by Circle Energy AB yet again and Aker Carbon Capture ASA. The Waste Management sector specifically is the best sector year-to-date driven mostly by Circle Energy AB and Vow Green Metals AS at 228% and 87% year-to-date returns. On the other end, the Energy Production Equipment & Services and Power2X & Fuel Cells continue to be down significantly in the last twelve months and -11-17% respectively year-to-date.

Overall, the average return for impact stocks over the past week was 1.5% and -0.7% year-to-date.

The impact sectors the past week, year-to-date, and last twelve months

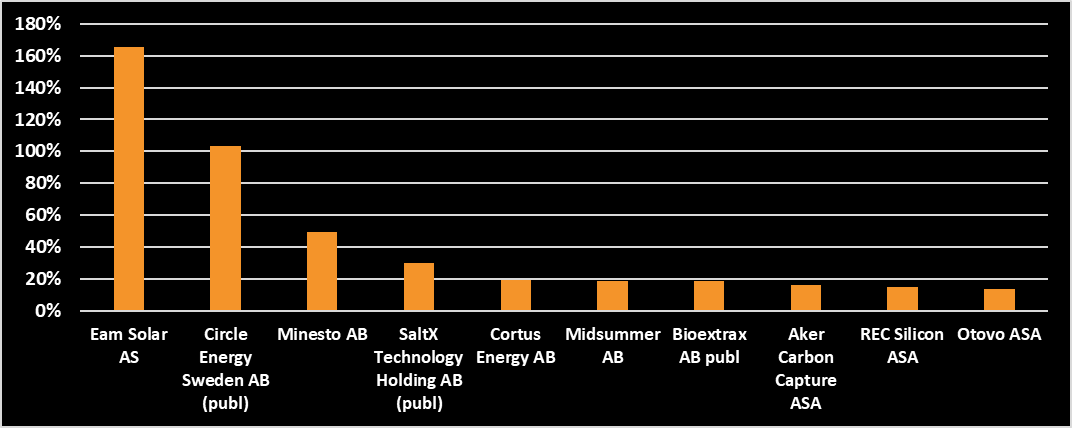

Top 10 Impact Stocks of the Week

EAM Solar (166%) is an investment company that acquires, owns, and operates a number of photovoltaic systems. The company acquires solar power plants that are mainly already in operation on the European market. The business is conducted on the basis of the subsidiaries, for example, EAM Solar Park Management, which takes care of the day-to-day operations of the business.

Circle Energy Sweden AB (103%) aims to establish waste gasification and incineration plants that produce electricity and heat. The plants can also produce biochar and wood vinegar. The company sells turnkey facilities including construction, installation, training, and service. In addition, the company owns and operates facilities under its own auspices, in local markets where the company itself produces green electricity and heat, and in some cases also biochar and wood vinegar.

Minesto (52%) is active in renewable energy. The company’s proprietary technology is used to produce electricity from tidal and ocean currents and is aimed at electricity companies, other power producers, and project developers. Their product almost looks like an underwater plane, which is worth seeing. Operations are conducted mainly in Europe and Asia. The company was founded in 2007 as a spin-off from Saab. The stock rose after DNV conducted an independent review of Minesto’s Dragon-class technology, confirming its investment potential. The review supports plans for a 10MW array in the Faroe Islands and highlights cost-efficient energy production due to low system weight and efficient installation.

SaltX Technology came in at 4th following the news that the company has achieved key milestones in material quality and operational runtime at its pilot facility with SMA Mineral. The company has produced high-quality quicklime, now set for testing in steel production. This breakthrough supports commercialization and expansion. Since the fall of 2024, SaltX has focused on optimizing technology and material quality at its Hofors research facility, meeting its goals. A delivery of electrically produced quicklime will be tested in Swedish steel production in spring 2025.

The average return for the top 10 stocks in the past week was 45%.

The 10 best-performing stocks in the past week

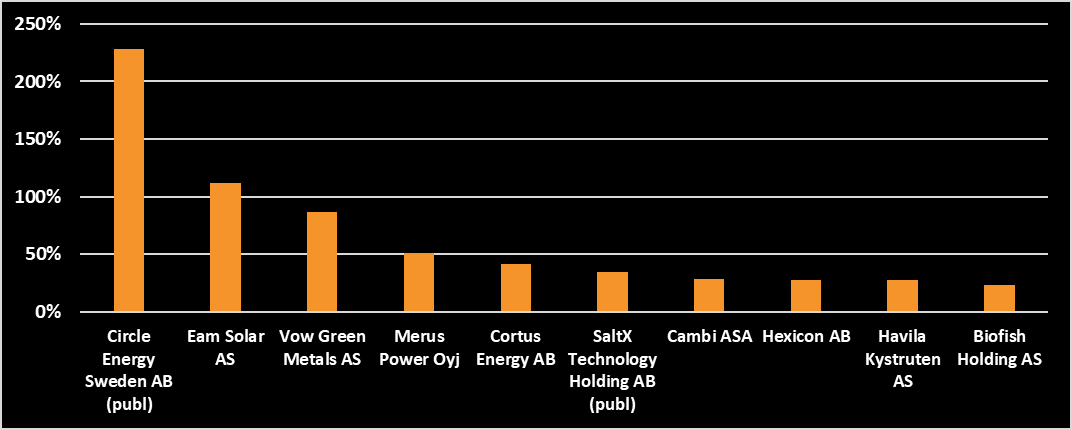

Top 10 impact stocks of the year

Alternus Energy Group, an independent solar power producer, was the best stock of the year until recently, and now the stock is no longer seen in the top 10 list. Circle Energy Sweden, aiming to establish waste gasification and incineration plants that produce electricity and heat, is now the best stock of the year with a return of over 200%. EAM Solar, an investment company in solar assets, is the second stock above 100%, while the rest of the top 10 is below 100% in year-to-date returns. In comparison to last week, 2 stocks were changed in the top 10. EAM Solar and SaltX Technology moved in, while EcoUp and Alternus Energy Group surprisingly moved out.

The average return for the top 10 stocks in the past week was 66%.

The return for the top 10 impact stocks year-to-date

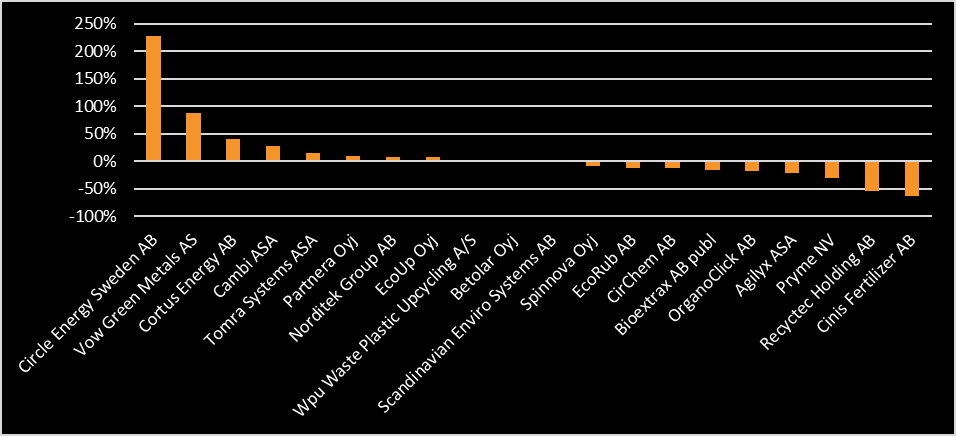

Waste Management

The waste management sector, characterized by its essential and non-cyclical nature, should present a stable investment opportunity with long-term potential, driven by increasing environmental awareness, regulatory demands, and the growing need for efficient waste disposal and recycling solutions. Despite this, the majority of the stocks have performed negatively this year. Circle Energy Sweden stands out from everyone else in the sector with a +200% return.

Waste Management – YTD

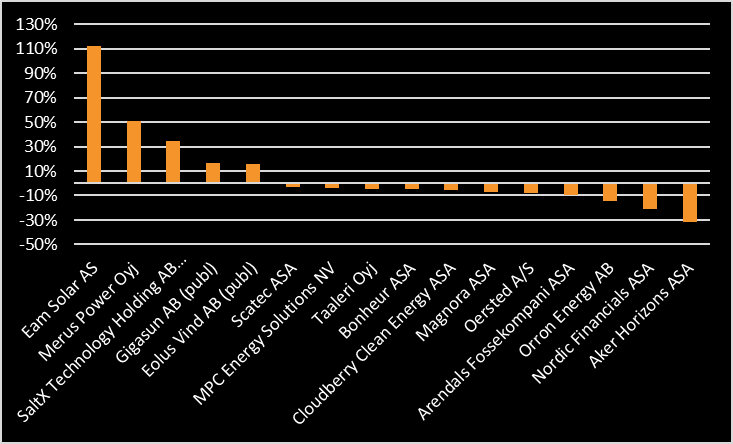

Energy Production & Storage

The Energy Production and Storage sector offers substantial investment opportunities, as it stands at the forefront of the transition towards renewable energy sources, driven by climate concerns and technological advancements. Year-to-date, 5 stocks have delivered a positive return.

Energy Production & Storage – YTD

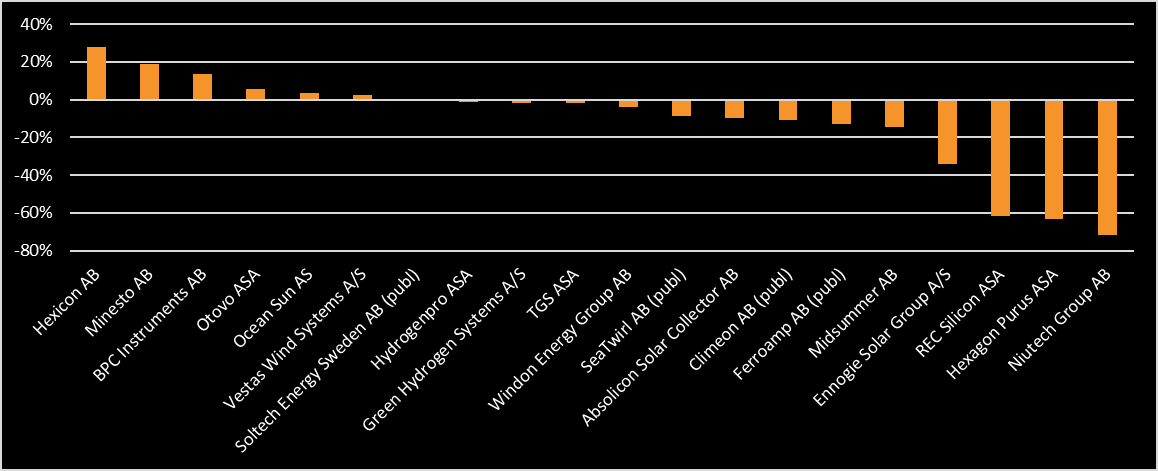

Energy Production Equipment & Services

The Energy Production Equipment & Services provides technical equipment and machines to other energy-producing companies such as Ørsted. The sector is to some extent influenced by oil and gas price fluctuations and industry trends. Year-to-date, there is already quite a spread between Hexicon at 28% and NiuTech AB at -72%.

Energy Production Equipment & Services – YTD

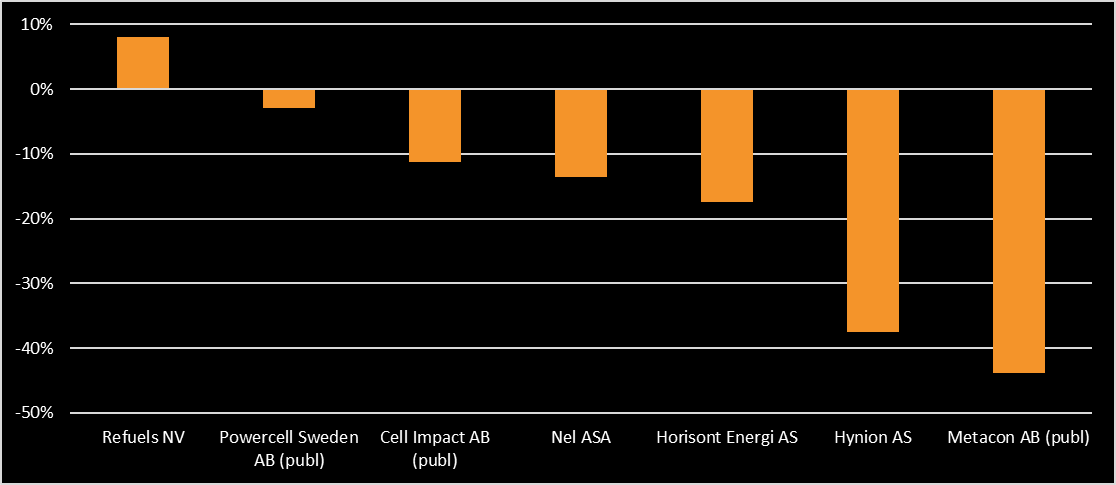

Power2X & Fuel Cells

The Power-to-X and Fuel Cells sector offers exciting investment opportunities in the evolving landscape of clean and sustainable energy technologies, but investors should also be mindful of the evolving regulatory and competitive landscape in this rapidly advancing field. Every stock in the sector has declined except for Refuels NV.

Power2X & Fuel Cells – YTD

Food & Beverages

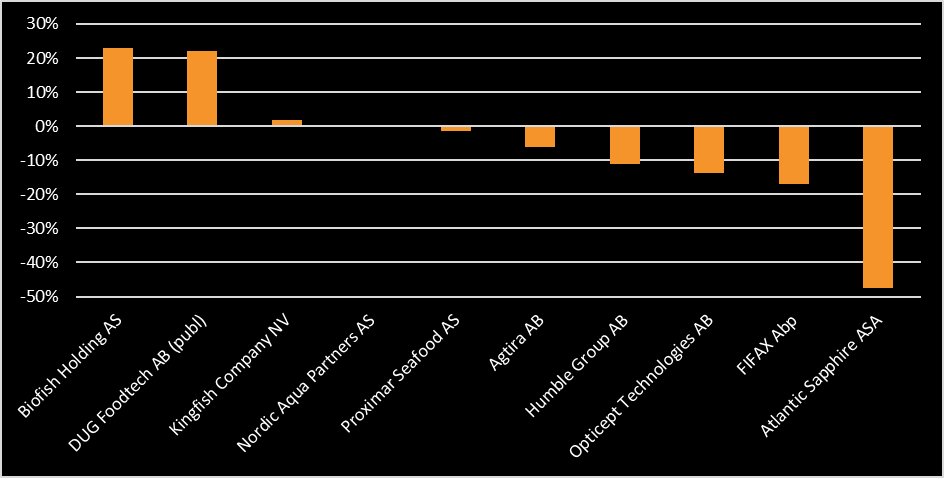

The food and beverages sector is heavily driven by consumer demand and having strong brands is a major advantage. Investors should consider factors such as changing consumer preferences, health and sustainability trends, and global supply chain dynamics to identify promising opportunities. The Food & Beverage sector is dominated by fish companies, and currently, we are seeing one in each end with Biofish Holding at 23%, and Atlantic Sapphire at -47%.

Food & Beverages – YTD

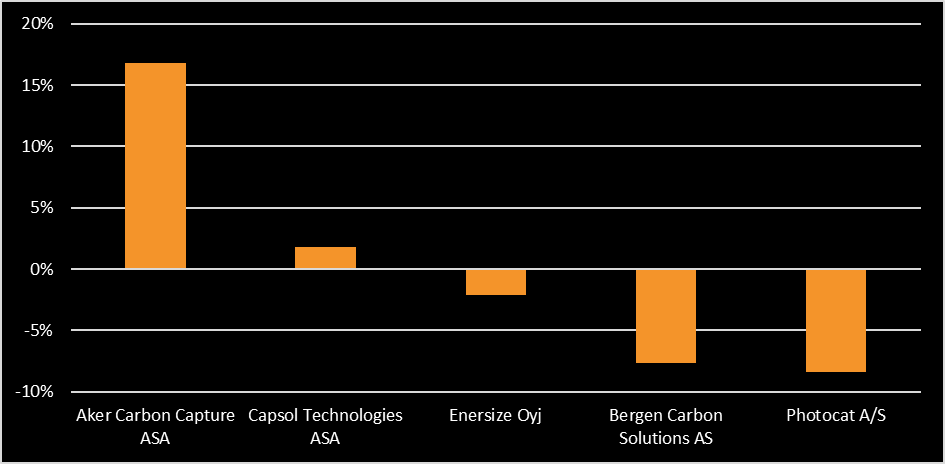

CO2 & Carbon Capture

The CO2 and Carbon Capture sector presents compelling investment opportunities for companies capturing and removing carbon dioxide from the atmosphere. It is a small sector comprising only 5 stocks, and every stock is within 20% and -10%.

CO2 & Carbon Capture sector YTD

Mobility

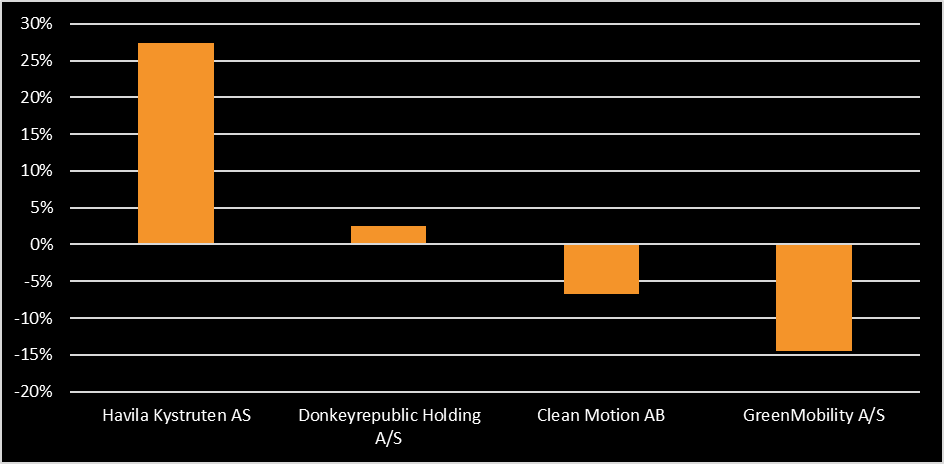

The mobility sector includes among others ride-sharing platforms and the development of electric vehicles to lower emissions and costs for consumers while increasing flexibility. Mobility is the smallest sector we track totaling only 4 stocks. Havila Kystruten is the stock with the highest return at 27%.

Mobility YTD