The Nordic impact stocks delivered a positive return of 0.7% in the past week. Two sectors stood out but were driven by a few stocks with stellar performance following CEO changes. Year-to-date, the P2X and Energy Equipment sectors have come off to a poor start down 11%-15%, while Energy Production & Storage in particular has done well. Finally, 3 changes were made in the top 10 list, where an independent solar power producer is still above 100%. in YTD return.

NORDIC | IMPACT Helps you to invest more sustainably in the businesses of tomorrow. We track the development of more than 100 Nordic impact companies within multiple impact sectors from small to large cap.

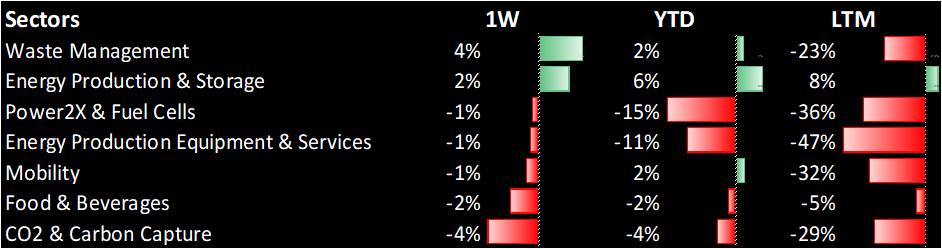

Energy Production & Storage in green for the past week, YTD and LTM.

In the past week, the Waste Management rose 4% driven by Circle Energy AB with a return of 123%. Energy Production & Storage also did well following a good performance by EAM Solar of 52%, and the sector remains the only sector in green for the past week, YTD and LTM. On the other side of the spectrum, CO2 & Carbon Capture stocks were all down including Enersize and Capsol Technologies at -6% to -8% without any news. So far this year, the P2X and Energy Production Equipment sectors have come off to a poor start down 11%-15%.

Overall, the average return for impact stocks over the past week was 0,7% and -2.5% year-to-date.

The impact sectors the past week, year-to-date, and last twelve months

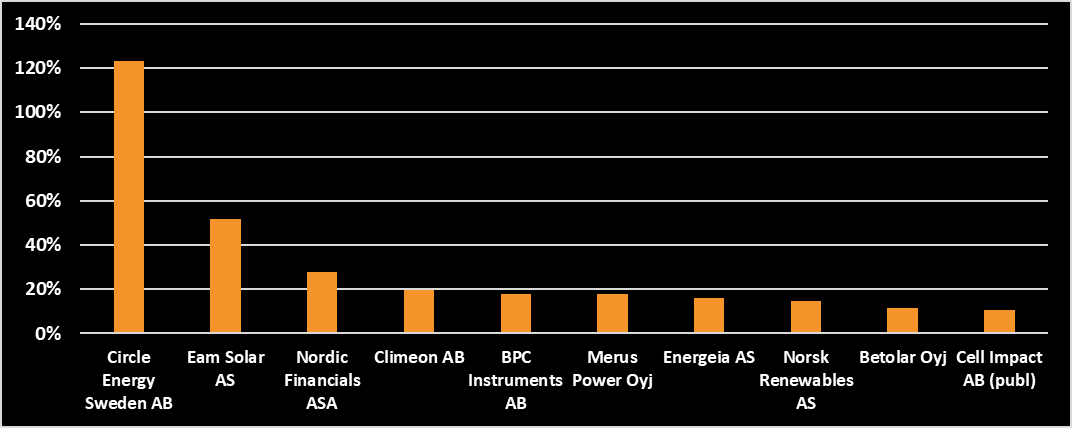

Top 10 Impact stocks of the Week: CEO Changes Driving the returns

Circle Energy Sweden AB (123%) aims to establish waste gasification and incineration plants that produce electricity and heat. The plants can also produce biochar and wood vinegar. The company sells turnkey facilities including construction, installation, training, and service. In addition, the company owns and operates facilities under its own auspices, in local markets where the company itself produces green electricity and heat, and in some cases also biochar and wood vinegar. The company announced changes to its CEO position.

EAM Solar (52%) is an investment company that acquires, owns, and operates a number of photovoltaic systems. The company acquires solar power plants that are mainly already in operation on the European market. The business is conducted on the basis of the subsidiaries, for example, EAM Solar Park Management, which takes care of the day-to-day operations of the business. The company also announced changes to its CEO position.

Nordic Financials (28%) is an investment company in renewable energy, but the company does not have much activity going on at the moment. The stock became the best stock in 2024 with a return of 175% and was formerly known as AEGA ASA.

The average return for the top 10 stocks in the past week was 31%.

The 10 best-performing stocks in the past week

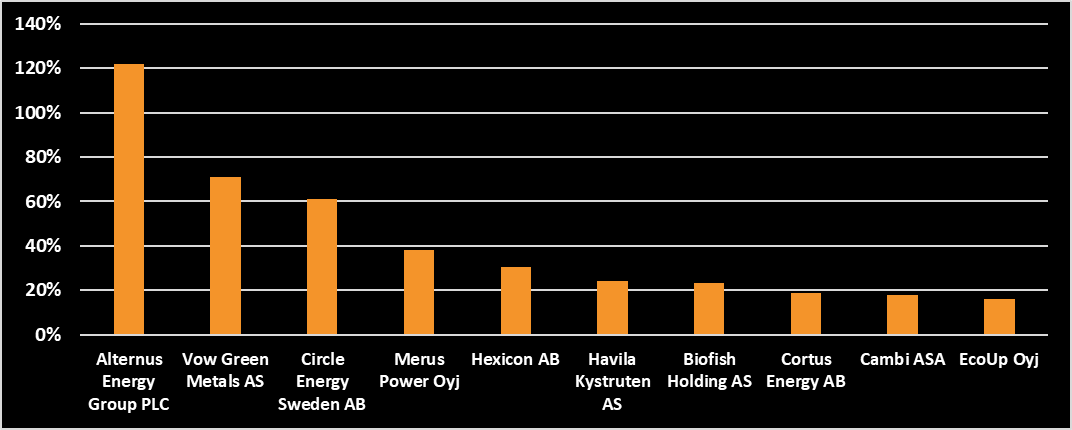

Top 10 impact stocks of the year

Alternus Energy Group, an independent solar power producer, is the only stock above 100% return year-to-date with a return of 122%. The stock is followed by Vow Green Metals at 71% and Circle Energy Sweden AB at 61%, while the rest of the top 10 stocks have significantly lower returns. In comparison to last week, 3 stocks were changed in the top 10. DUG Foodtech, Tomra Systems, and Norditek Group moved out. Conversely, Circle Energy Sweden, Cambi, and EcoUp moved in.

The average return for the top 10 stocks in the past week was 42%:

The return for the top 10 impact stocks year-to-date

Waste Management

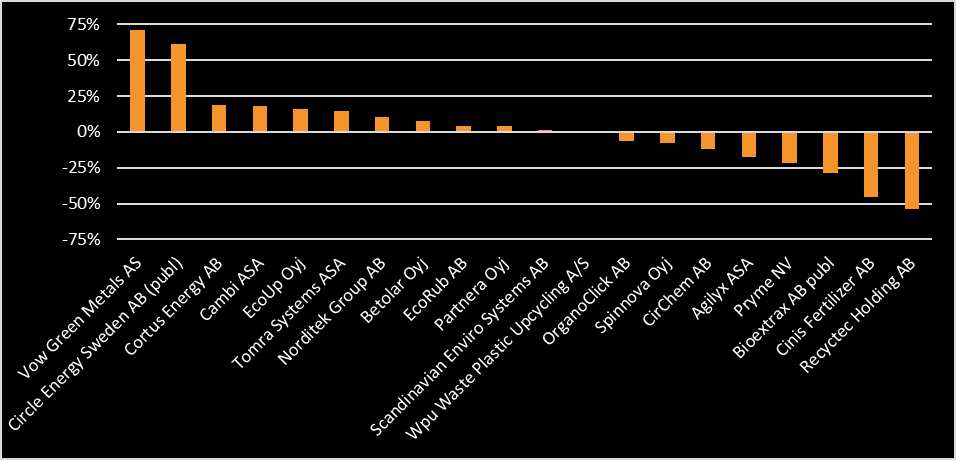

The waste management sector, characterized by its essential and non-cyclical nature, should present a stable investment opportunity with long-term potential, driven by increasing environmental awareness, regulatory demands, and the growing need for efficient waste disposal and recycling solutions. Despite this, the majority of the stocks have performed negatively this year. Circle Energy Sweden and Vow Green Metals stand out from everyone else in the sector with 61-71% returns. Cinis Fertilizer AB and Recyctec Holding are down 45-54%.

Waste Management – YTD

Energy Production & Storage

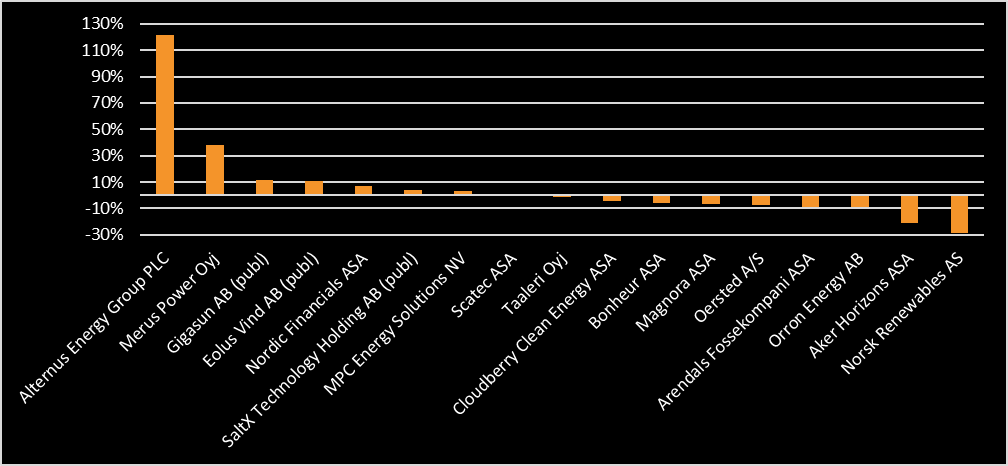

The Energy Production and Storage sector offers substantial investment opportunities, as it stands at the forefront of the transition towards renewable energy sources, driven by climate concerns and technological advancements. Year-to-date, 7 stocks have delivered a positive return.

Energy Production & Storage – YTD

Energy Production Equipment & Services

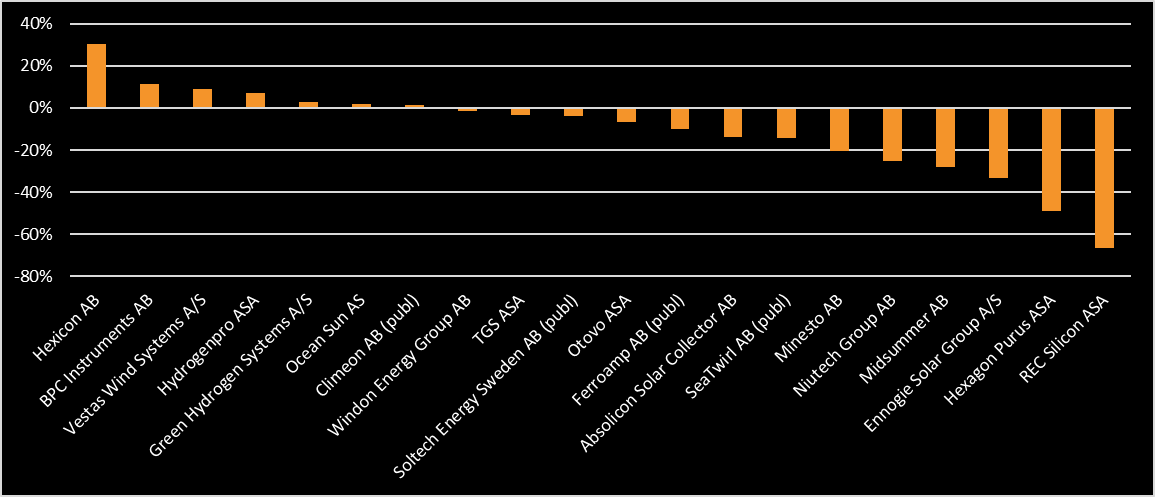

The Energy Production Equipment & Services provides technical equipment and machines to other energy-producing companies such as Ørsted. The sector is to some extent influenced by oil and gas price fluctuations and industry trends. Year-to-date, there is already quite a spread between Hexicon at 30% and REC Silicon at -66%.

Energy Production Equipment & Services – YTD

Power2X & Fuel Cells

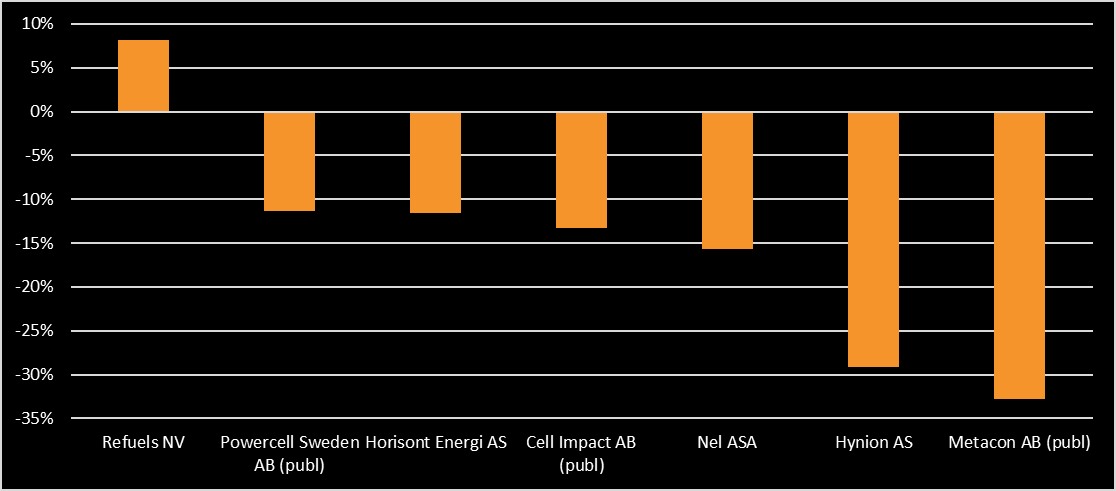

The Power-to-X and Fuel Cells sector offers exciting investment opportunities in the evolving landscape of clean and sustainable energy technologies, but investors should also be mindful of the evolving regulatory and competitive landscape in this rapidly advancing field. Every stock in the sector has declined except for Refuels NV.

Power2X & Fuel Cells – YTD

Food & Beverages

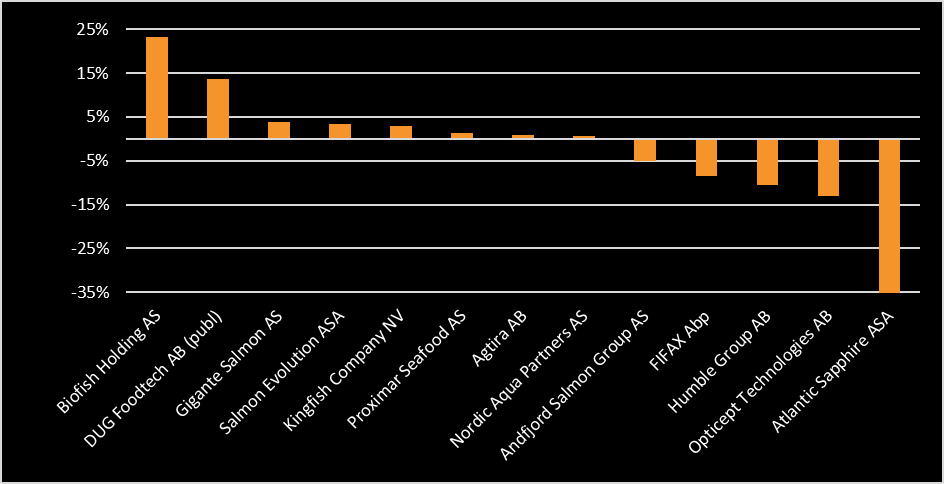

The food and beverages sector is heavily driven by consumer demand and having strong brands is a major advantage. Investors should consider factors such as changing consumer preferences, health and sustainability trends, and global supply chain dynamics to identify promising opportunities. The Food & Beverage sector is dominated by fish companies, and currently, we are seeing one in each end with Biofish Holding at 23%, and Atlantic Sapphire at -35%.

Food & Beverages – YTD

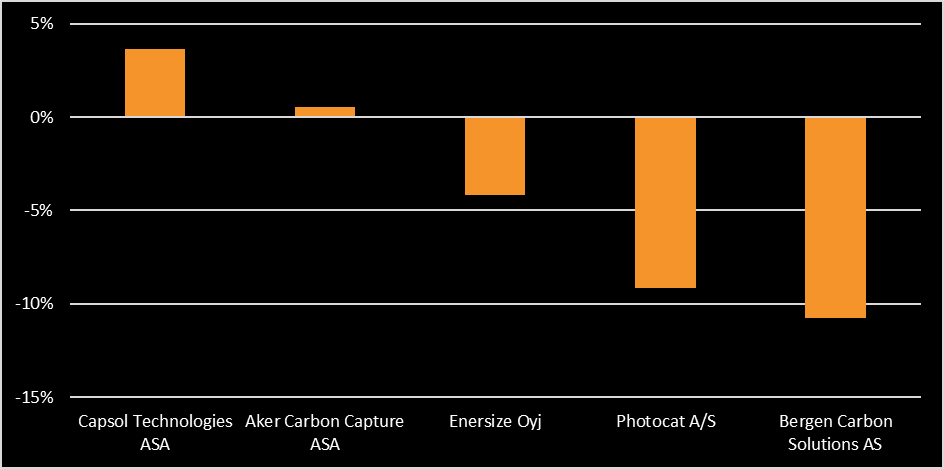

CO2 & Carbon Capture

The CO2 and Carbon Capture sector presents compelling investment opportunities for companies capturing and removing carbon dioxide from the atmosphere. It is a small sector comprising only 5 stocks, and every stock is within 5% and -15%.

CO2 & Carbon Capture sector YTD

Mobility

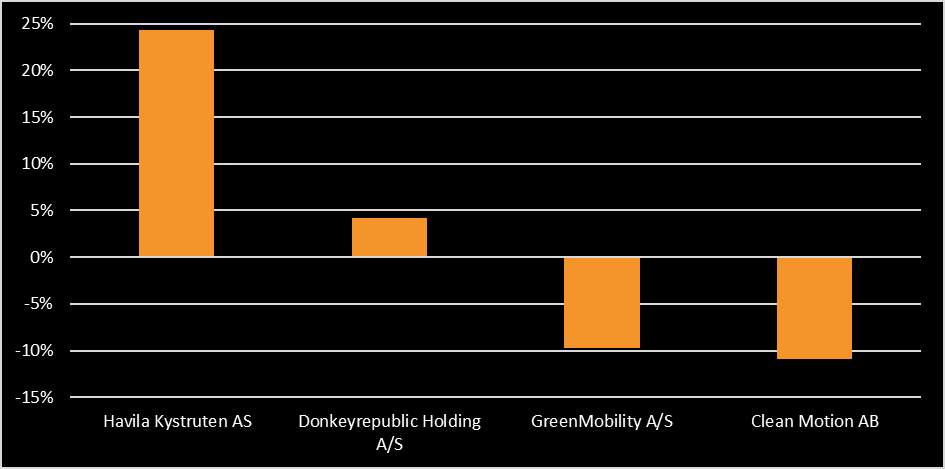

The mobility sector includes among others ride-sharing platforms and the development of electric vehicles to lower emissions and costs for consumers while increasing flexibility. Mobility is the smallest sector we track totaling only 4 stocks. Havila Kystruten is the stock with the highest return at 24%.

Mobility YTD