NORDIC | BIOTECH & HEALTHCARE Your insights into listed Danish & Nordic biotech & healthcare stocks.

In the past week, the Nordic biotech and healthcare stocks rose 0.5%, while the Danish ones declined 1.7%. Most notably, Genmab and Ascendis Pharma released their 2024 results as well as guidance and milestones for 2025. Both companies expect significant growth in 2025. Additionally, Saniona also released positive news as Medix, its partner for Mexico, is going to submit the final version of an application regarding their weight-loss drug Tesofensine.

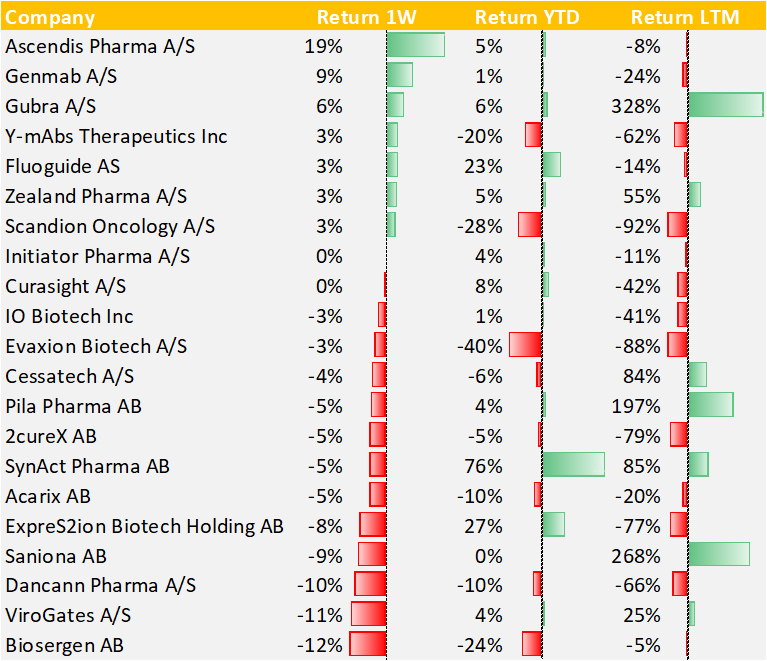

7 of the 21 Danish biotech companies had a positive share price development in the past week and 12 companies had a positive share price performance over the past 12 months. Obesity continues to drive the best performances with Gubra, Zealand Pharma, and Pila Pharma having strong LTM performances Gubra is the best performer with a return of 328% over the last twelve months.

Danish company news

Acarix AB Publishes Year-End Report 2024 – Sales and revenue for the CADScor System and patches are surging amid ongoing U.S. expansion efforts (Link)

Ascendis Pharma Reports Fourth Quarter and Full Year 2024 Financial Results (Link)

Ascendis Pharma A/S Announces Share Repurchase Program & Net Settlement of Certain RSUs (Link)

No news in the past week

No news in the past week

No news in the past week

No news in the past week

Nasdaq confirms Evaxion is fully compliant, withdraws delisting determination (Link)

No news in the past week

No news in the past week

Genmab Publishes 2024 Annual Report (Link).

Following Genmab’s annual report, Cowen lowered their price target from DKK 1,806 to DKK 1,431.

No news in the past week

No news the past week

No news the past week

No news the past week

Medix to submit final version of tesofensine application following interaction with COFEPRIS (Link)

No news in the past week

No news the past week

No news the past week

No news the past week

No news the past week

No news the past week

Share price development – Danish stocks

On average, the Danish biotech and healthcare stocks delivered a negative return of 1.7%. Ascendis Pharma rose nearly 20% after posting its results for 2024 with revenues rising 36% from 267 MUSD to 364 MUSD. The company announced several milestones for 2025 including the launch of YORVIPATH in 5 European countries. Genmab also posted its annual results for 2024. The company had revenues of MUSD 3,124 and an operating profit of MUSD 973 million. For 2025, the company expects revenues of MUSD 3,340 – 3,660 corresponding to a growth of 31% for the midpoint of the guidance. The company also expects gross profit to rise to MUSD 895–1,365 corresponding to 26% (Link). Following the release of the 2024 numbers, Cowen lowered their price target from DKK 1,806 to DKK 1,431. Saniona‘s partner Medix will finally submit the final version of its application for tesofensine, a drug for weight loss, following discussions with Mexico’s Ministry of Health. If successful, it will lead to royalties to Saniona. The stock declined 9% during the week, but it is important to note the stock is already up 190% in the past 3 months.

Not surprisingly, Pila Pharma, Gubra, and Saniona continue to be the best performers in the last twelve months with +100% returns each. This comes following a very positive investment environment for companies involved in drug development targeting diabetes and obesity. Gubra is the best performer with a 328% return over the last twelve months. In the last twelve months, the average return is 19%. Year-to-date with SynAct Pharma is having the best to the year with a return of 76%.

Further reading: The Curasight investment case

Overview of share price development the past week, year-to-date, and the last twelve month

Nordic Biotech & Healthcare Developments

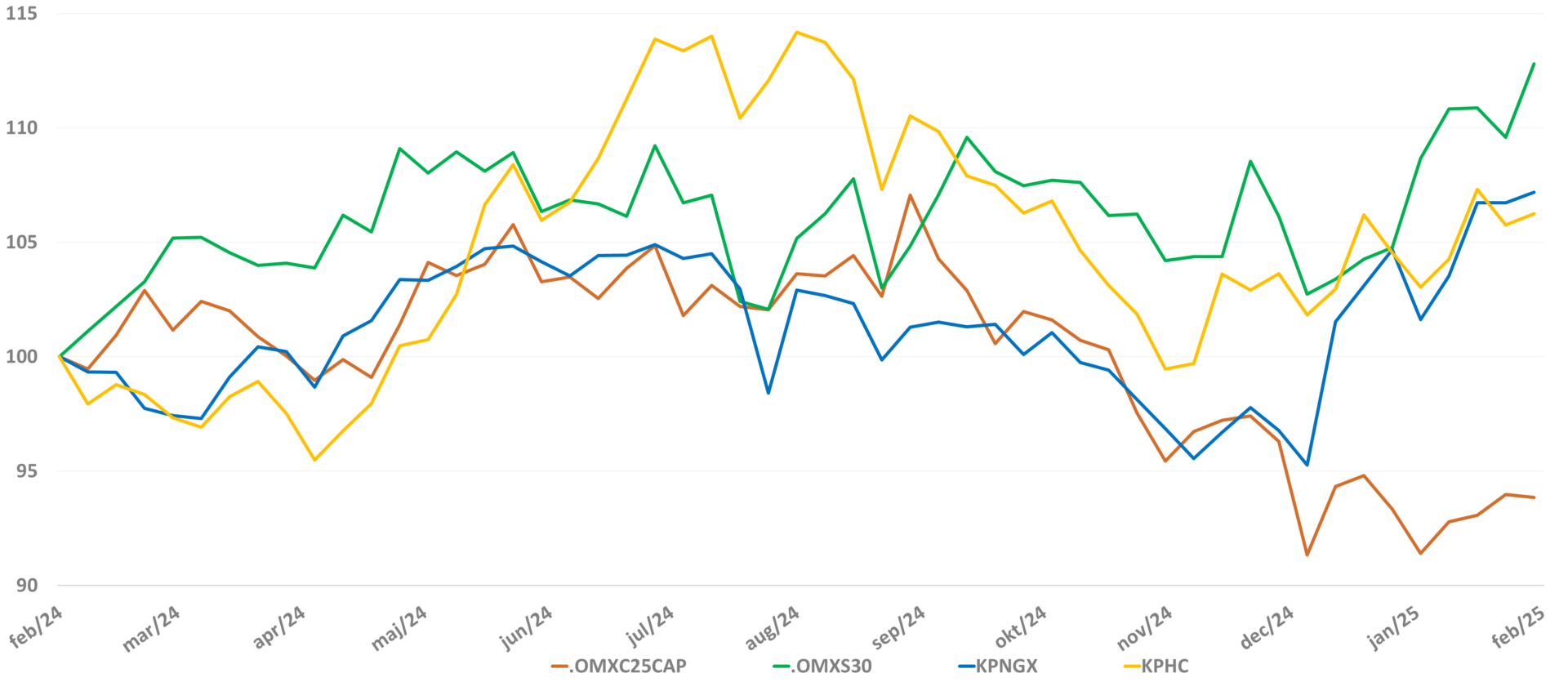

The Kapital Partner Nordic Healthcare Index (KPHC) increased 0.5% to 66.08 in the past week. The index had a poor start over the past 12 months, then made a comeback followed by another drawback, and now it seems to be on an upward trend in the past few months. The index has performed better than the C25 Index over the past year, and the return is above 5%.

The Nordic healthcare stocks (KPHC) vs. the C25, S30, and KPNGX index the past year

The top three best-performing stocks in the past week

Magnasense AB (381%) specializes in the research and development of various drug candidates. The product portfolio is broad and mainly includes drugs for the treatment of multiple sclerosis. In addition to the main business, associated ancillary services are offered. The company did not report any news that can explain the massive share price increase. On February 14 the stock rose 226% based on a turnover of 5.48 MSEK.

Evolear (33%) offers a range of digital services, mainly consisting of digital applications specially adapted for children. The solutions are used by several preschools where the apps are adapted to different development levels for learning and personal development. The apps go by different names and touch, for example, simple mathematics and cognitive games. This stock also rose without any company specific news, and the company even commente that they are not aware of undisclosed price-sensitive information that can explain it (Link).

Gabather (54%) is a business focus on developing drug candidates for the treatment of nerve diseases. Particular focus is on the stimulation of gamma-aminobutyric acid, which is the main inhibitory neurotransmitter in the brain. The drug candidates are today patented on a global level. During the week, the company announced that the Danish Medicines Agency hasgranted final approval for the TOTEMS Phase 2 clinical trial of GT-002 at the Center for Neuropsychiatric Schizophrenia Research (CNSR) in Denmark. The approval covers both the ethical and operational aspects of the trial. The study is funded by the Danish Innovation Fund and involves 30 volunteers/healthy volunteers and 20 patients. The study is expected to last two years and will investigate how EEG values and cognitive tests are affected by GT-002 in a cross-over design (Link in Swedish).

Resources: Refinitiv Eikon, Cision, Nordnet & company websites