NORDIC | BIOTECH & HEALTHCARE Your insights into listed Danish & Nordic biotech & healthcare stocks.

In the past week, the Nordic biotech and healthcare stocks declined 1.5%, while the Danish fell 1%. Most notably, Biosergen announced positive results from the second part of their trial with BSG005 against invasive fungal infections. Further, Acarix entered a new partnership, and IO Biotech announced preclinical data. Finally, the top 3 healthcare stocks in the Nordics only rose 23-33% during the week.

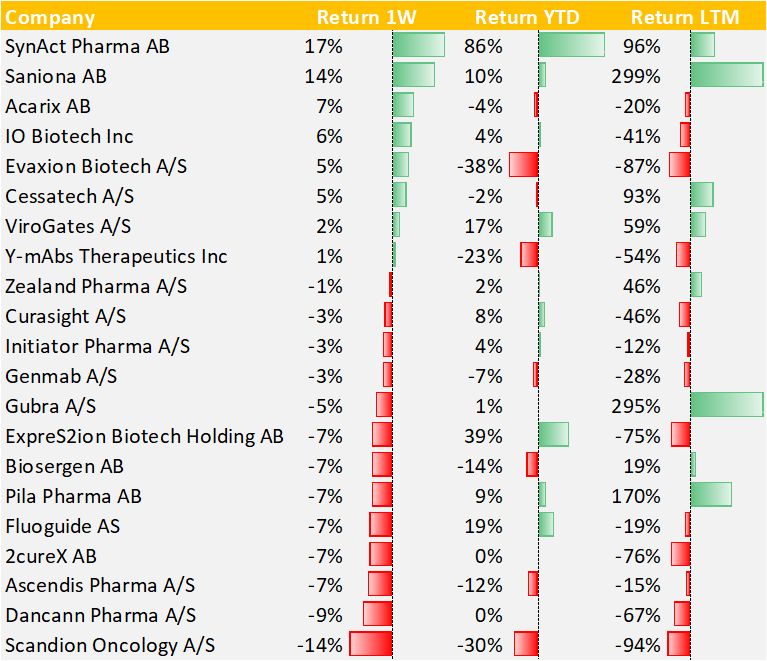

8 of the 21 Danish biotech companies had a positive share price development in the past week and 11 companies had a positive share price performance over the past 12 months. Obesity continues to drive the best performances with Gubra, Zealand Pharma, and Pila Pharma having strong LTM performances Saniona is the best performer with 299% over the last twelve months.

Danish company news

Acarix Partners with Geo-Med to Extend the Availability of the CADScor System for Veterans (Link)

Ascendis Pharma to Report Full Year 2024 Financial Results and Provide Business Update on February 12, 2025

Biosergen Successfully Completes Second Cohort of BSG005 Clinical Trial, Gaining Conclusive Proof-of-Concept Data, and Confirms 2025 Objectives (Link)

Cessatech receives positive Notified Body opinion under MDR for CT001 (Link)

Curasight announces an updated financial calendar 2025 (Link)

No news in the past week

No news in the past week

ExpreS2ion announces financial results for the fourth quarter of 2024 (Link)

No news in the past week

No news in the past week

No news in the past week

No news the past week

IO Biotech Announces Publication of Preclinical Data Investigating Immune-Modulatory Effects of IO112, an Arginase 1-Targeting Therapeutic Cancer Vaccine Candidate (Link)

No news the past week

No news in the past week

No news in the past week

No news the past week

No news the past week

No news the past week

Y-mAbs to Present at the Oppenheimer 35ᵗʰ Annual Life Sciences Conference (Link)

No news the past week

Share price development – Danish stocks

On average, the Danish biotech and healthcare stocks delivered a negative return of 1%. The two best stocks, SynAct Pharma and Saniona, did not present any news explaining their rise of 14-17%. The most notable news was Acarix partnering with Geo-Med to extend the availability of the CADScor system. Furthermore, Biosergen completed the second cohort of the clinical trial with BSG005 with a positive outcome. 5 patients with life-threatening fungal infections. One patient recovered, three showed significant improvements, and one withdrew from the trial due to discomfort. The study evaluates BSG005 as a potential rescue therapy for patients who have either failed previous standard-of-care antifungal treatments due to lack of efficacy or safety, or patients with mild to moderate kidney impairment. IO Biotech also announced preclinical data investigating the effects of IO112 indicating further development. Finally, Scandion Oncology declined 14% without any news.

Pila Pharma, Gubra, and Saniona are the best performers in the last twelve months with +100% returns each. This comes following a very positive investment environment for companies involved in drug development targeting diabetes and obesity. Saniona is the best performer with a 299% return over the last twelve months. Year-to-date, the average return is 21% with SynAct Pharma having a very strong start to the year.

Further reading: The Curasight investment case

Overview of share price development the past week, year-to-date, and the last twelve month

Nordic Biotech & Healthcare Developments

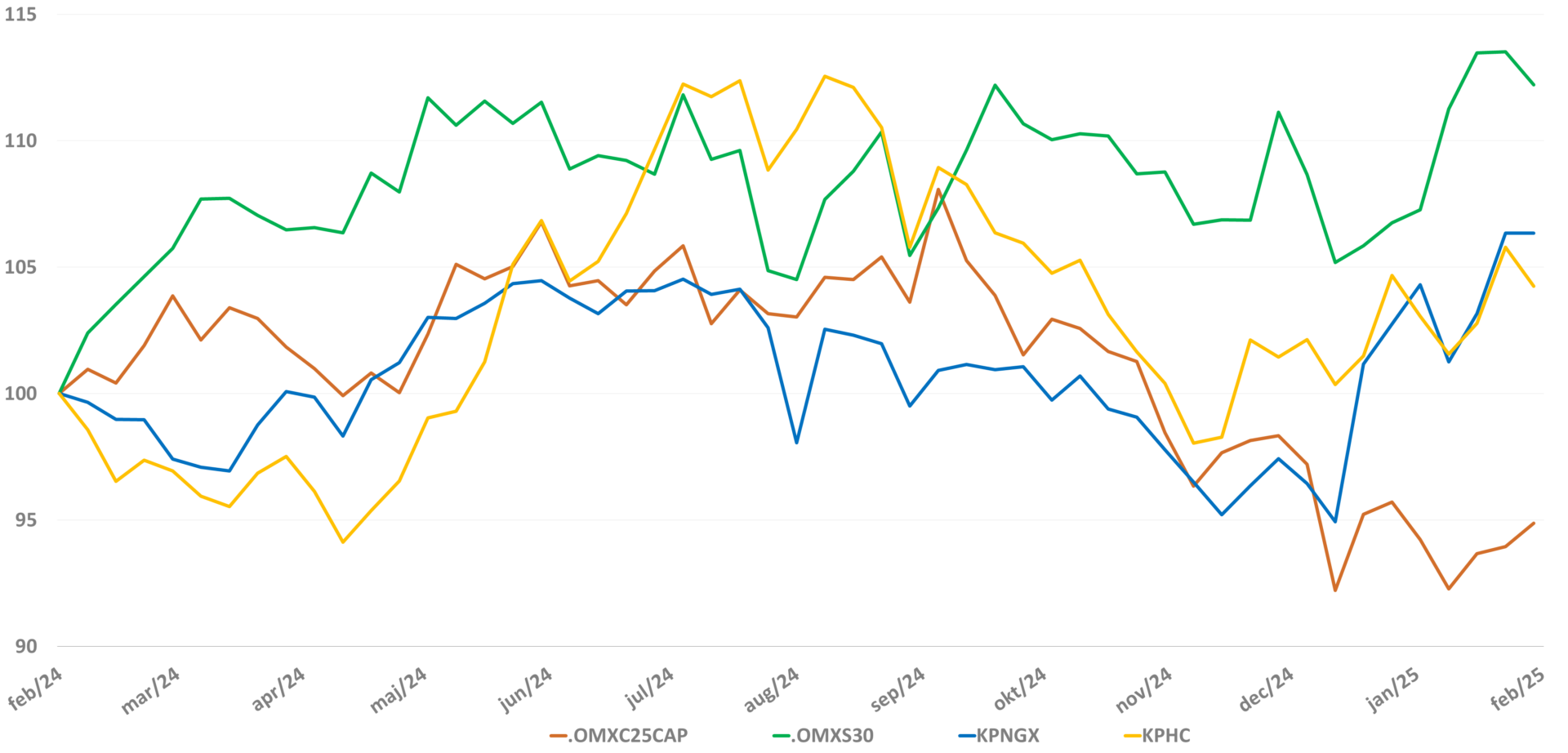

The Kapital Partner Nordic Healthcare Index (KPHC) declined 1.5% to 65.78 in the past week. The index had a rough start over the past 12 months, then made a comeback followed by another drawback, and now it seems to be on an upward trend in the past few months. The index has performed better than the C25 Index over the past year, and the return is almost 5%.

The Nordic healthcare stocks (KPHC) vs. the C25, S30, and KPNGX index the past year

The top three best-performing stocks in the past week

The top 3 healthcare stocks showed among the lowest seen in a while at just 23-33% returns for the top 3 stocks.

Lidds AB (33%) is a pharmaceutical company. The company develops pharmaceutical products based on a proprietary and clinically tested drug delivery technology. The properties of the products form the basis of the LIDDS technology platform for the development of injectable drug products. LIDDS is the abbreviation for Local Intelligent Drug Delivery System and the company is headquartered in Uppsala.

Physitrack (33%) is active in the healthcare sector. The company specializes in physiotherapy. Its product portfolio includes digital healthcare offerings to businesses via SaaS solutions. In addition to its core business, it also offers personalized services and related ancillary services. The business operates globally with the largest presence in Europe and North America. In the past week, the company announced a deal for its employee wellness platform, with deal value SEK 1.1 million over three years.

Nextcell Pharma (23%) is active in the healthcare sector. Today, the company develops stem cell products that are mainly used in the treatment of autoimmune diabetes and in kidney transplantation. A large part of the work consists of stem cell research where the company develops drug candidates that will facilitate and increase acceptance in organ transplantation. In addition, the company owns a stem cell bank.

Resources: Refinitiv Eikon, Cision, Nordnet & company websites