Ekobot’s Q1 2023 report was as expected and the investment case with focus on further sales and commercialization of the agricultural robots is therefore intact and strengthens the opportunities for positive price development.

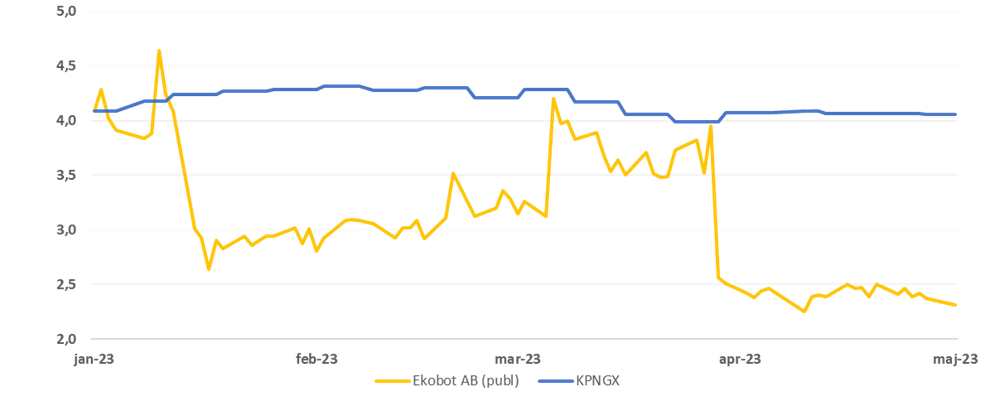

Ekobot: Ticker: EKOBOT | Price: SEK 2.33 | Market Cap: SEK 36 million | YTD price performance: -54%

EKOBOT has developed an agricultural robot that both removes weeds and collects data on crops, enabling farmers to reduce their costs by up to 20%. EKOBOT focuses on crops that are difficult/costly to grow in terms of weed control, and thus also the segment of agriculture that has the greatest economic benefit from using robots. Organic farms in particular benefit from robots for weed removal, as they do not use pesticides, but conventional farms also benefit economically.

EKOBOT has started commercialization, with Denmark, Sweden and the Netherlands as the main markets.

Important events in the quarter

During the quarter, Ekobot completed a share issue that raised SEK 26.8 million, of which SEK 2.6 million was set aside to pay a bridge loan. Ekobot also signed its first agreement with a Swedish vegetable grower and demonstrated further benefits of the robotic system. Management also participated in discussions with Missouri Governor Michael Parson, which may help open the door for Ekobot to the US market.

Strategic goals for 2023

During the quarter, Ekobot also set a number of strategic goals for 2023 with a focus on commercialization. The strategic goals include:

- Sign contracts for 25 robot units with delivery in 2024

- Sign agreement with distributor in Denmark

- Sign agreement with pilot customers for Ekobot PLUS

- Prototyping of the next generation of robots

The future of agriculture is on its way – Ekobot with a good market positio

Artificial intelligence is affecting more and more industries and agriculture is also on its way, where satellite images are used to optimize crop growth. Ekobot has developed Ekobot PLUS, which is a cloud-based software service (SaaS) that collects field data via the robotic system in real time, which is subsequently analyzed via artificial intelligence (AI). The analysis then serves as decision support for farmers in terms of inputs for fertilization, irrigation, harvesting, etc. Throughout the transition to increased use of data and artificial intelligence, Ekobot is in a strong position, as they partly own and have know-how about robotic systems on the ground that collect a lot of data to feed artificial intelligence.

Read more about the future of agriculture: The global food market is growing – 4 companies are ready with solutions that can also benefit investors

Ekobot ended Q1 with a cash balance of 23,5 MSEK, but the board is still looking at possible financing solutions to have sufficient liquidity to run the business for the next 12 months.

Read more: The investment case for Ekobot

Price development of Ekobot vs. KPNGX index year-to-date