Global demand for food is growing as the global population increases year on year combined with increased consumption. Increased production is needed to meet this growing demand, creating opportunities for companies that can provide modern and efficient solutions. We take a closer look at 4 companies on the Nordic growth exchanges that have the potential to take part in global developments and can therefore also be very interesting to invest in.

Agriculture is a secular growth market in the coming years. This is due in part to population growth, with the world’s population estimated to exceed 10 billion by 2050. Similarly, large populations are moving from low to middle income, with consumption rising and with it the demand for food. Thus, the global agricultural market is expected to grow from USD 12,245 billion in 2022 to USD 19,007 billion in 2027 with an annual growth rate of about 9%. This is where emerging market companies come in, as they help provide the solutions that the market is demanding, including the demand for organic food or sustainable food with a lower impact.

1. Agricultural Robots

Ekobot AB has developed and sells an agricultural robot that both removes weeds and collects crop data, enabling farmers to reduce their costs by up to 20%. Ekobot focuses on crops that are difficult/costly to grow in terms of weed control, and thus the segment of agriculture that benefits most economically from using robots. Especially, but not only, organic farms benefit from robots for weed removal as they do not use pesticides. The focus markets are Sweden, the Netherlands and Denmark. The company brought in a venture fund as an investor late last year and is about to launch a rights issue, which has lowered the share price. However, with a market capitalisation of only SEK 15 million, the company has become an obvious acquisition candidate.

Commercial scale-up in 2023

In 2023, Ekobot enters the commercial phase in earnest, with a target of 25 robotic units sold by 2023 and the signing of an agreement with a distributor in Denmark. In addition, the company is looking to sign an agreement for Ekobot PLUS, which is a software-based service (SaaS) that collects field data via the robotic system in real time and is then analysed using artificial intelligence (AI). The analysis can then advise the farmer on agricultural inputs such as fertilisation, irrigation and harvesting. The interesting thing for Ekobot in 2023 is therefore whether it manages to execute on its commercial goals, and new sales deals are in that respect curveballs for the company.

Rights issue underway

Ekobot is underway with a rights issue, where existing shareholders as of 21 February have the opportunity to subscribe for shares during the period 23 February to 9 March. The issue comprises a maximum of 8,564,728 new shares. Upon full subscription, Ekobot will receive SEK 21.4 million before issue costs. In addition, there is an over-allotment option of a further SEK 5.4 million if the rights issue is fully subscribed. 85% of the issue is secured through pre subscriptions, including from Navus, and guarantees. Half of the proceeds will be used to pay loans, while the other half will be used to develop the robot.

2. Land-based fish farming

The Kingfish Company operates land-based fish farming. The advantage of land-based fish farming compared to conventional fish farming/dam farming is that optimal conditions for growth and health of the fish can be created, where, among other things, unwanted lice that can destroy an entire production can be avoided, without the use of chemicals etc. Also, there are a limited number of locations at sea where it is possible to obtain a licence to operate fish farms. Kingfish’s system mimics seasonal light and temperature conditions that fish experience in the wild. This includes turning the lights on for longer periods, raising the water temperature, etc. so that the fish think it is spring and thus spawn eggs. This means that Kingfish are not dependent on the natural seasons. In other words, the whole essence of Kingfish land-based fish farming is that production can be significantly optimised. The company is Dutch, but it is listed in Norway. In 2022, the company achieved a turnover of approximately 207 MNOK, and the company has a market capitalization of 1,264 MNOK by comparison.

Upgrading of production facilities

Kingfish produced approximately, 1.4 tonnes of fish in 2022. The company is in the process of expanding production capacity to increase to 3.5 tonnes of fish in Q1 2023. In addition, investments are being made to further expand production capacity by an additional 2.5 tonnes. The company is awaiting approval. In other words, there are major expansions of production capacity underway that will create the basis for further growth and earnings for Kingsfish in the coming years.

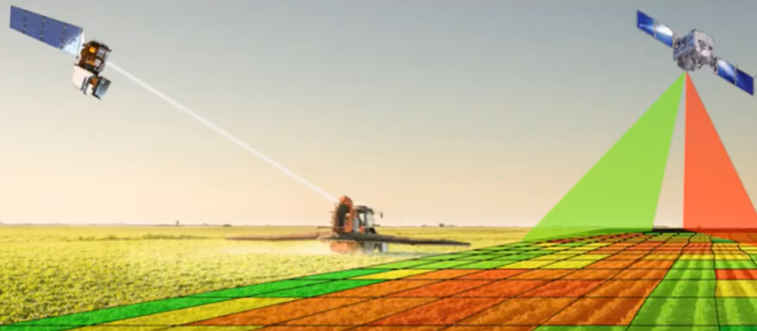

3. Monitoring of agricultural soils via satellite imagery

Vultus AB is a Swedish company that has developed an analysis platform that continuously monitors farmland conditions via satellite images, helping farmers to estimate the right amount of fertiliser, crop irrigation needs, condition, etc. This allows production to be optimised so that more is produced for fewer resources. Vultus has conducted a study in sugar cane that demonstrated a 9% increase in production yield and a 42% reduction in nitrogen input. Vultus’ analytical platform is constantly evolving, and most recently they have launched a solution together with TKS Agri that allows predicting protein and dry matter content in grass, which is useful for dairy and meat producers. The company has a market capitalisation of SEK 11 million.

From product development to commercial phase

Vultus AB has entered the commercial phase, where it intends, among other things, to increase its sales team by three people. The company has already secured an agreement in Brazil that will bring Vultus SEK 1-3 million annually. In 2023, it is crucial for the investment phase that they manage to scale the business with more customers, and new sales agreements therefore act as positive curve triggers

4. UV light for vertical farming

LED iBond International A/S has developed LED lighting based on the internet of things (IoT). The solutions are primarily used for large lighting solutions, such as indoor lighting of plants in both large greenhouses and so-called vertical farming. Vertical farming is a fast-growing area of agriculture where growing plants vertically in multiple storeys can increase production per square metre, so to speak. This is where LED iBond International’s solutions come into play. The company’s lighting solutions, via digital control and sensors, can emit the optimal amount of UV radiation as well as heat to provide the plants with optimal growing conditions.

The company has a number of pilot projects underway and is receiving small orders, but due to increased energy prices, the company does not expect large-scale revenue in 2023 for indoor farming. The company expects 6-12 MDKK in revenue in 2023 and a positive cash flow in 2024. For comparison, the company has a market capitalization of 22 MDKK.

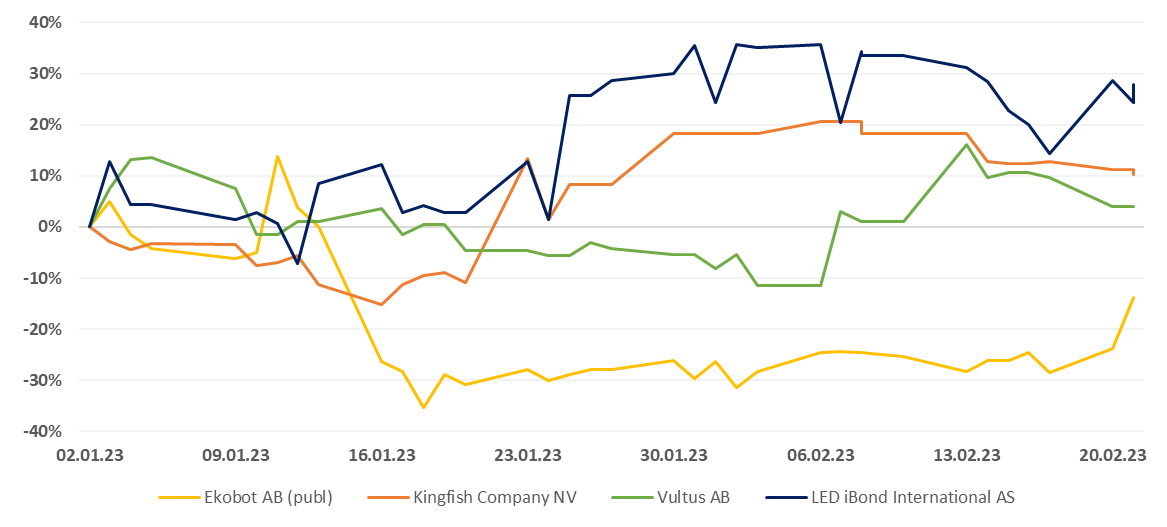

Share price development of Ekobot AB, The Kingfish Company NV, Vultus AB and LED iBOND International A/S since the beginning of the year