Nexcom’s half-year results offered little news to the market that had not already been communicated in connection with the company’s capital increase in Q2. The company has secured a total of 9.5 mDKK to execute its recently communicated strategy of profitable growth.

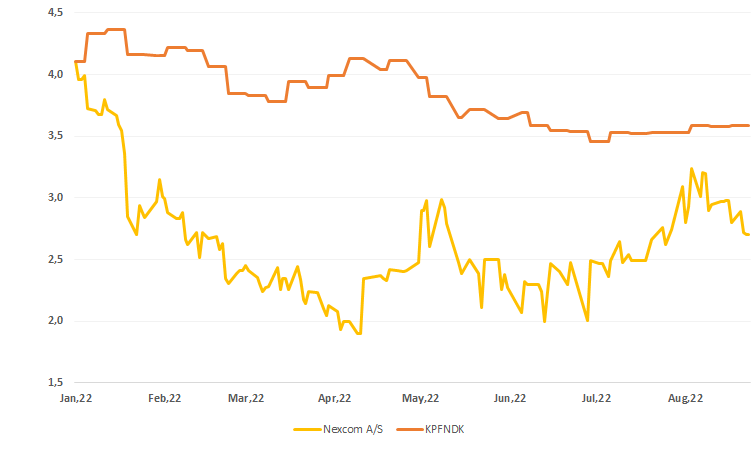

Nexcom: Ticker: NEXCOM | Price: DKK 2,7 | Market Cap.: DKK 35 mio. | YTD share price development: -29%

Nexcom reported revenue of DKK 4.3m for H1 2022, compared to DKK 5.2m in H1 2021. The company’s revenue in H1 2022 has been impacted by the geopolitical crisis in Ukraine, which has led to the postponement of system deployments at customers. In addition, revenue in H1 2021 was exceptionally high due to a one-time amount related to the development of the company’s AI product.

Read the full investment case of Nexcom here

As the news flow in the H1 report was known in advance, the upcoming Q3 announcement is awaited with great interest. Here it will be clarified whether the company is well on its way in implementing the new strategy. In addition, it will also be clarified how much the revenue/ARR will be affected by the changes. Nexcom will issue a Q3 announcement on 24 November.

Share price development of Nexcom vs. Kapital Partners First North Denmark index YTD

Short about Nexcom:

For large companies with several thousand or hundreds of thousands of customers, automated systems are needed to handle customer enquiries by telephone or e-mail, for example – from the actual contact with customers to the execution of customer wishes and orders. Nexcom provides such IT systems to B2C companies in particular, in the fields of telephony, insurance, energy and property management. Nexcom’s customers are from Scandinavia, Europe and North America and include among others Telenor in Denmark and the USA, Telia in Denmark, Norway and Lithuania, and Groupon, RealPage and Lash in the USA.