There are 900 companies on the growth exchanges in the Nordic countries, which represent some of the best equity investments, including this year’s hottest stock with 7,865% return. But until now, there has been no way to keep up with market developments and thus not an entrance to investing in the Nordic growth exchanges. With Kapital Partner’s Nordic Growth Exchanges Index (KPNGX), investors now get a unique – and much-needed – overview of the Nordic trends, and with the KPFNDK index, an overview of developments in First North Denmark is now also available.

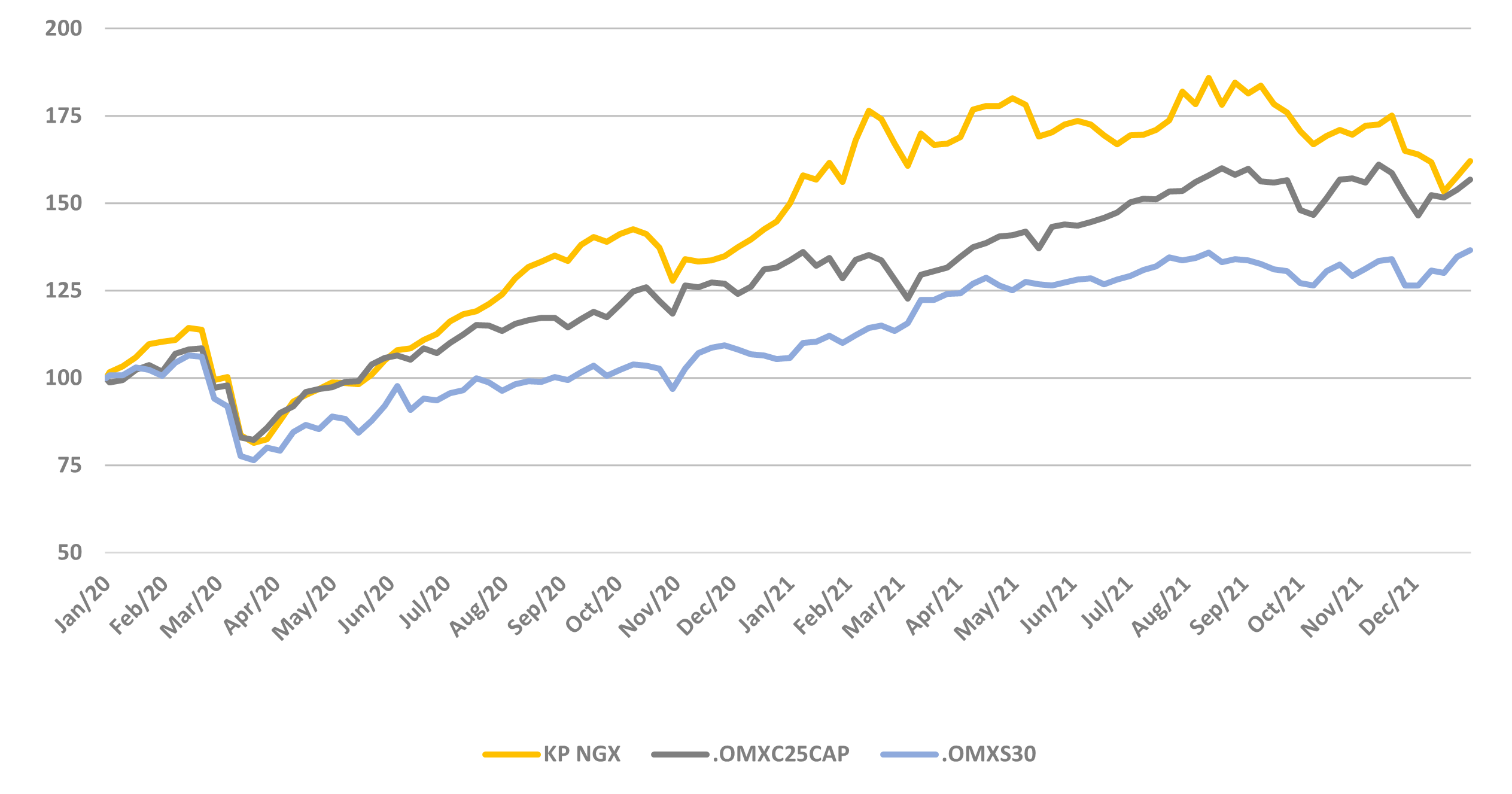

Based on the average price return, KPNGX provides a picture of how a portfolio of the Nordic growth exchange shares is developing. Starting 1 January 2020 with a value of 100, KPNGX contains all shares on the Nordic growth exchanges, consisting of: Nasdaq First North Growth Market in Sweden, Denmark, Finland and Iceland, Spotlight Stock Market in Sweden, Nordic Growth Market SME in Sweden and Euronext Growth Oslo.

The indices are updated regularly and can be followed on www.kapitalpartner.dk/aktieindeks, so that everyone can follow the trends in the Nordic market.

Jesper Ilsøe, CEO of Kapital Partner: “With the KPNGX index, everyone, and thus also the private investors, can now follow the crucial “market mood” that governs the overall price development of stocks. The stocks on the growth exchanges are primarily the domain of private investors, but as the market sizes are smaller and liquidity lower than large caps, the trend on the growth exchanges does not slavishly follow the large indices, as we can now clearly show. With the KPNGX index investors no longer have to invest blindfolded to the trend which particularly applies to the shares on the growth exchanges.”

KPNGX beats C25 and S30

Since the start on 1 January 2020, KPNGX has risen from a price of 100 to 162, corresponding to a growth of 62%, after peaking in August 2021 at a price of 186. In 2020, KPNGX beat both the Swedish S30 and Danish C25 indices, with a growth of 49.9% against 5.8% for S30 and 33.7% for C25. In 2021, however, the growth stocks have had a negative second half year and therefore end the year with a growth of only 8.1% compared to 29.1% for S30 and 17.2% for C25.

The development is thus in line with the typical trend; that investors steer towards safe havens (large cap and high liquidity) in periods of greater uncertainty.

This year’s Nordic share rocket with 7,865% is …

With a return of 7,865% in 2021, Vestum is the supreme winner of the year. It is a share traded on Nasdaq First North Sweden and is therefore a share that few investors in Denmark and Norway have discovered. Like the second best performing stock, Doxa, the sharp price increase is due to the fact that the activity in the company changed identity from health care to being an investment firm.

Nasdaq in Denmark usually does not allow companies to change activity (“reverse mergers”) on First North. These potential high return stocks must therefore primarily be searched for in Sweden in 2022.

Of the 10 best investments on the Nordic growth exchanges in 2021, all were listed in Sweden, which also represents the largest share of the shares in the KPNGX index. On the top ten list, however, is the best Danish stock of 2021, Freetrailer, with a return of 371%. Freetrailer is listed on the Swedish stock exchange Spotlight Stock Market, and therefore appears as a Swedish share.

First North Denmark index from top to bottom

Kapital Partner also launches the First North Denmark index (KPFNDK), which traces the companies on the Danish Nasdaq First North stock exchange. Until the summer of 2021, the Danish First North companies outperformed the KPNGX index and clearly the C25 companies. Thereafter, the KPFNDK index hit the wall hard – initially over the summer, when the index fell from 189 to the level of 150 and then from September to the end of the year falling further to 107 and thus almost back to the 100 inaugural level of 1 January 2020.

One of the reasons for the KPFNDK index’s poorer development in relation to KPNGX is that First North in Denmark is very tech-heavy and has few / no shares in the sectors that have performed the best on a Nordic level in 2021, such as real estate and industry – sectors that typically perform best when there is market turmoil.

The sector return shows flight to safety

In 2021, the financial sector has been the best performing sector with an average return of 197%. In general, the more “safe” sectors have performed best during the second half of the year, while investors have fallen from the hyped shares and sectors. With continued uncertainty in the stock markets, this indicates that financial and industrial equities will be best for the country in 2022.

Jesper Ilsøe, CEO of Kapital Partner: “There is and has been a lot of discussion about the companies on First North Denmark. Now we can show that the companies’ price development can largely be explained by the Nordic market trends, including the sector distribution of the companies on First North Denmark. ”

Anyone can join

During 2022, Kapital Partner will launch a mutual fund with an investment strategy focusing on equities on the Nordic growth exchanges. This gives all investors easy access to invest in a stock universe with great potential. Interested parties can already sign up for Kapital Partners’ newsletter and thus be informed when the subscription starts. In addition, Kapital Partner regularly publishes ideas for investments on the Nordic growth exchanges.

Kapital Partner A/S

Kapital Partner is a corporate finance company, founded and run by experienced investment bankers, who as a financial advisor, helps companies with among others: capital injection, stock exchange listing (IPO), M&A, Market Relations and Investor Relations, as well as assisting as Nasdaq Certified Adviser and NGM Mentor. In addition, Kapital Partner publishes Nordic investment cases and provides information on IPOs and issues in Scandinavia. Kapital Partner was instrumental in the revitalization of Nasdaq First North Denmark and continuously develops innovative, financial products and services.