The Nordic impact stocks delivered a negative return of 1.3% in the past week. The top 3 stocks rose 19-36%. The Energy Production Equipment & Services and the Power2X and Fuel Cells sectors continue to be down 9-12% year-to-date respectively. A Swedish recycling company released positive earnings and targets 15% annual revenue growth going forward.

NORDIC | IMPACT Helps you to invest more sustainably in the businesses of tomorrow. We track the development of more than 100 Nordic impact companies within multiple impact sectors from small to large cap.

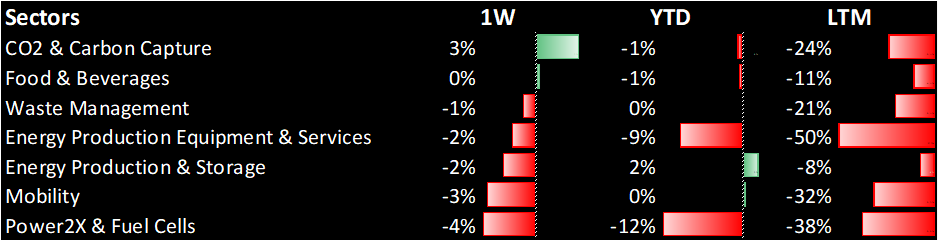

CO2 & Carbon Capture rising the most – P2X down double-digit YTD

In the past week, the CO2 & Carbon Capture rose 3% driven by Bergen Carbon Solutions and Aker Carbon Capture rising 8-9%. The Food & Beverage sector was also in slightly positive territory fueled by Biofish Holding rising 9%. On the flip side, the majority of the sectors declined, and the Energy Production & Storage and Power2X & Fuel Cells specifically are down 9-12% year-to-date as Norsk Renewables have declined 43% and Cell Impact 21%.

Overall, the average return for impact stocks over the past week was -1.3% and -2.9% year-to-date.

The impact sectors the past week, year-to-date, and last twelve months

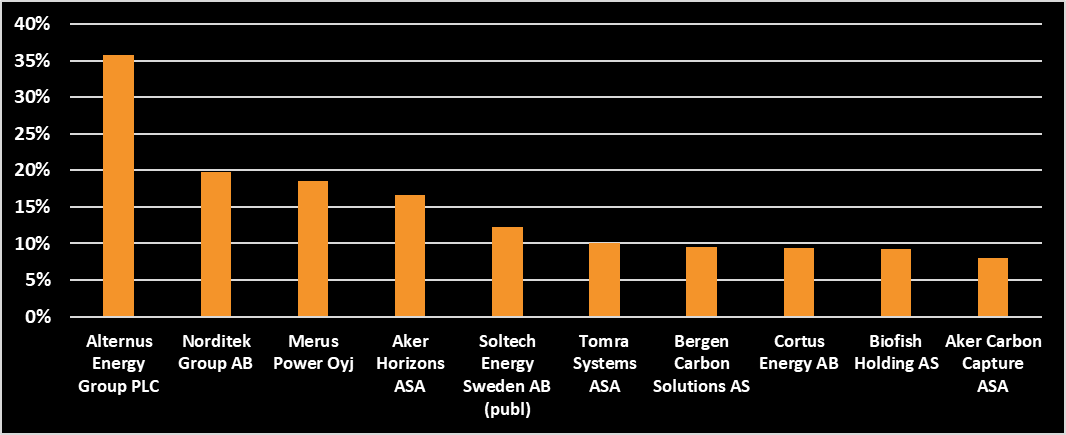

Top 10 impact stocks of the week

Alternus Energy Group (36%) owns, develops, and manages solar cell parks. The company collaborates with both local and international development partners who provide pipelines of new projects for the acquisition and construction of new solar parks.

Norditek Group AB (20%) is an environmental technology company with a focus on mobile and flexible recycling facilities in the Waste, Gravel, Rock, and Biomass segments. The company develops, sells, and rents out facilities and offers self-produced products and modular solutions that can be combined with other producers. Norditek rose following its quarterly earnings release with EBITA at 6.7 MSEK. The company’s financial targets are 15% annual organic revenue growth, EBITA margin above 17%, and net debt under 3x EBITDA.

Merus Power (19%) specializes in electrical engineering where the company designs technology for energy efficiency and operational and environmental performance. The company delivers dynamic compensation solutions, power electronics, software technology, and services in electrical engineering. The customer base consists of customers in the industry, power production, and renewable energy sector.

The average return for the top 10 stocks in the past week was 14.9%.

The 10 best-performing stocks in the past week

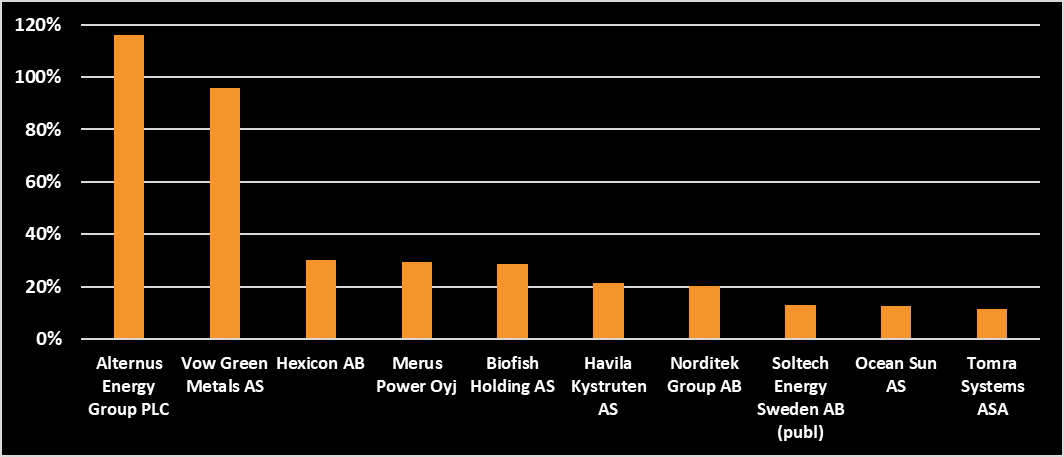

Top 10 impact stocks of the year

Vow Green Metals has come off to a very good start with a 96% return, but in the past week Alternus Energy Group, an independent solar power producer, became the best stock year-to-date with a return of 116%. The rest of the stocks in the top 10 have delivered returns of 11-30% year-to-date.

The average return for the top 10 stocks in the past week was 37.9%:

The return for the top 10 impact stocks year-to-date

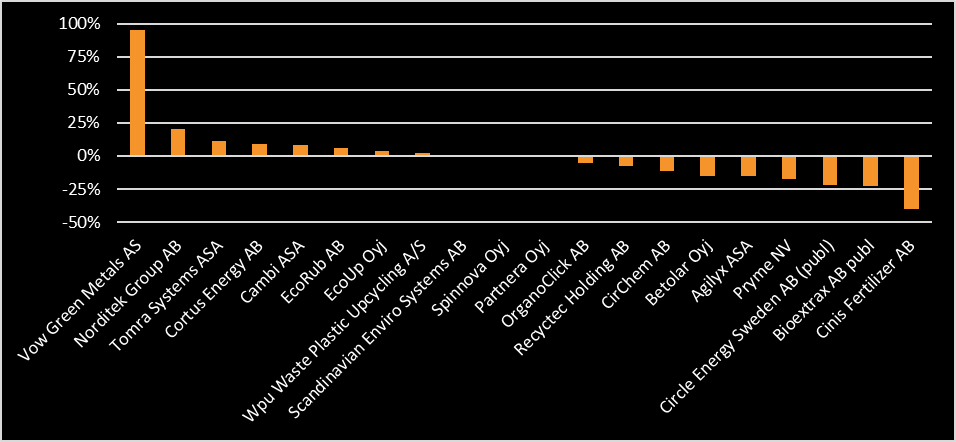

Waste Management

The waste management sector, characterized by its essential and non-cyclical nature, should present a stable investment opportunity with long-term potential, driven by increasing environmental awareness, regulatory demands, and the growing need for efficient waste disposal and recycling solutions. Despite this, the majority of the stocks have performed negatively this year. Vow Green Metals stands out from everyone else in the sector that seems otherwise balanced although Cinis Fertilizer AB is down 40%.

Waste Management – YTD

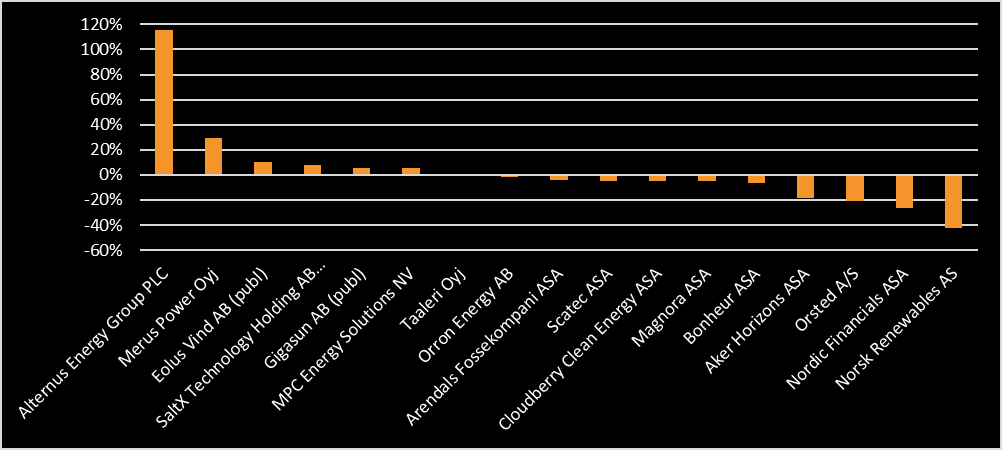

Energy Production & Storage

The Energy Production and Storage sector offers substantial investment opportunities, as it stands at the forefront of the transition towards renewable energy sources, driven by climate concerns and technological advancements. Year-to-date, 6 stocks have delivered a positive return.

Energy Production & Storage – YTD

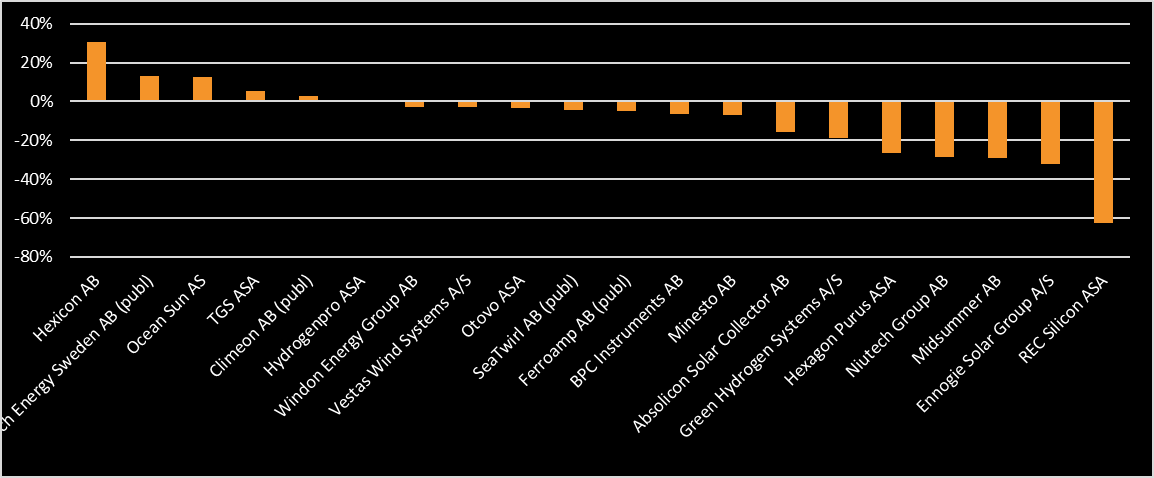

Energy Production Equipment & Services

The Energy Production Equipment & Services provides technical equipment and machines to other energy-producing companies such as Ørsted. The sector is to some extent influenced by oil and gas price fluctuations and industry trends. Year-to-date, there is already quite a spread between Hexicon at 30% and REC Silicon at -63%.

Energy Production Equipment & Services – YTD

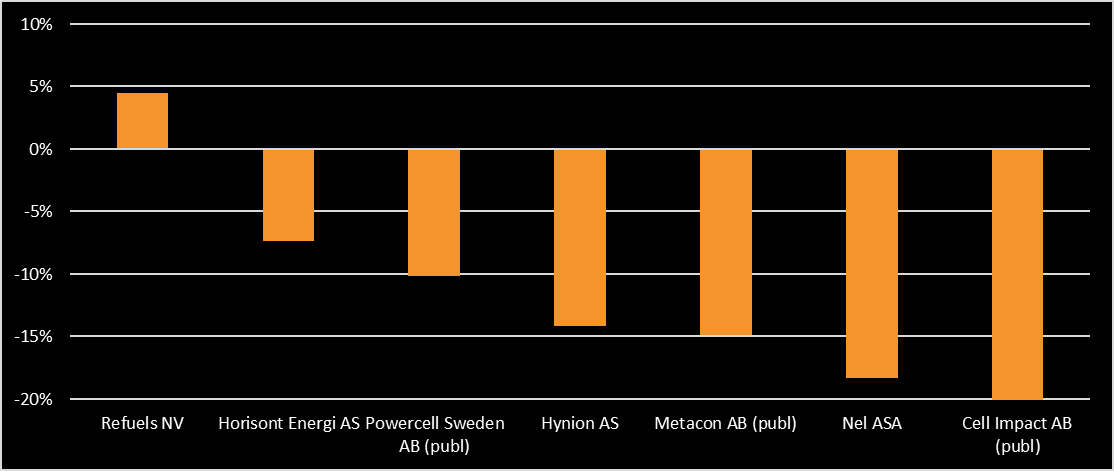

Power2X & Fuel Cells

The Power-to-X and Fuel Cells sector offers exciting investment opportunities in the evolving landscape of clean and sustainable energy technologies, but investors should also be mindful of the evolving regulatory and competitive landscape in this rapidly advancing field. Every stock in the sector has declined except for Refuels NV.

Power2X & Fuel Cells – YTD

Food & Beverages

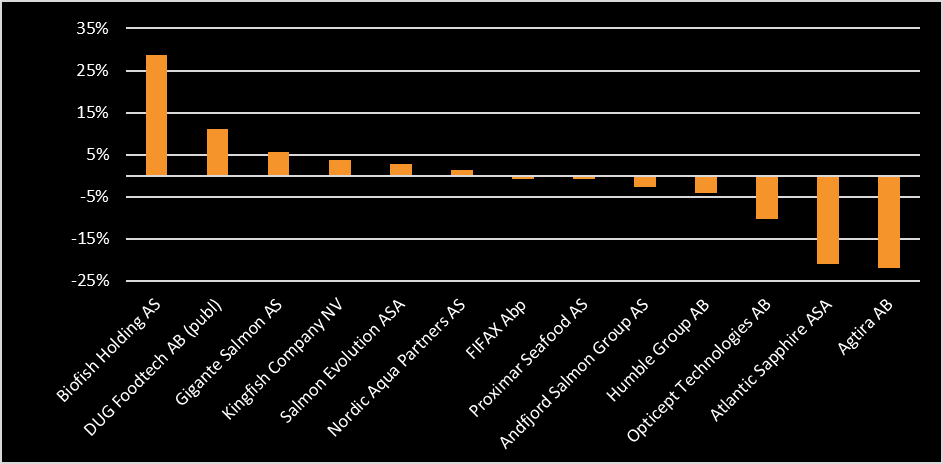

The food and beverages sector is heavily driven by consumer demand and having strong brands is a major advantage. Investors should consider factors such as changing consumer preferences, health and sustainability trends, and global supply chain dynamics to identify promising opportunities. Year-to-date, the Food & Beverage sector dominated by fish companies has two stocks at -22%, and Biofish Holding at 29%.

Food & Beverages – YTD

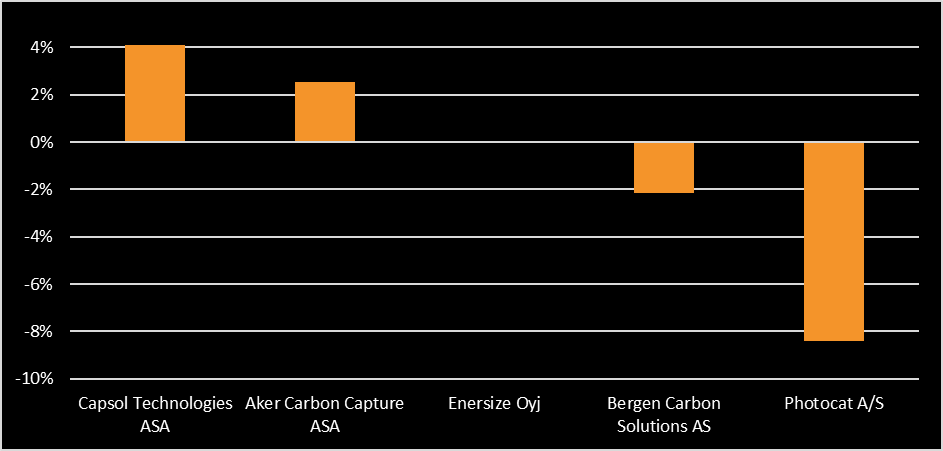

CO2 & Carbon Capture

The CO2 and Carbon Capture sector presents compelling investment opportunities for companies capturing and removing carbon dioxide from the atmosphere. It is a small sector comprising only 5 stocks, and every stock within 5% and -10%.

CO2 & Carbon Capture sector YTD

Mobility

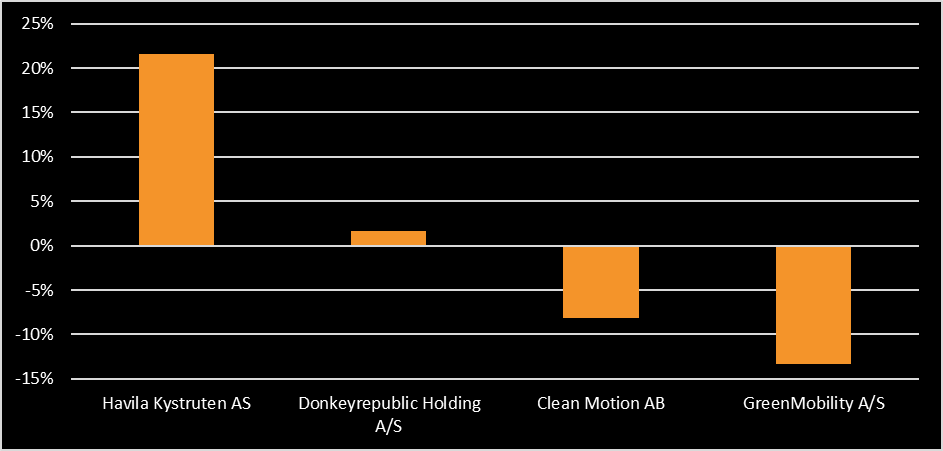

The mobility sector includes among others ride-sharing platforms and the development of electric vehicles to lower emissions and costs for consumers while increasing flexibility. Mobility is the smallest sector we track totaling only 4 stocks. Havila Kystruten is the stock with the highest return at 22%.

Mobility YTD