NORDIC | BIOTECH & HEALTHCARE Your insights into listed Danish & Nordic biotech & healthcare stocks.

In the past week, the Danish biotech and healthcare sector rose 1.5%. Most notably, FluoGuide announced a partnership with Olympus to be used in combination with FG001, Pila Pharma raised MSEK 20 before costs from a recent rights issue, while Gubra and Zealand Pharma got new price targets by Goldman Sachs and Wells Fargo being set considerably higher than thier current stock prices.

Latest news for the Danish biotech companies

Acarix AB has developed a technology to identify heart diseases. Moving forward, product sales are the main driver for the stock.

No news in the past week

Ascendis Pharma develops so-called prodrugs, which are medications that start in an inactive form and become active once inside the body. The main stock price driver going forward is the development and commercialization of its TransCon technology.

No news in the past week

Biosergen is developing BSG005 to treat serious and life-threatening fungal infections safely and with limited side effects, contrary to current drugs. The main price triggers are centered around product development and the ongoing clinical trials

Biosergen announced Mark Beveridge as their new Chief Financial Officer

Cessatech develops pain treatments for children. The company is finalizing its phase 3 study for its lead candidate, and the main price driver will be the commercialization for this product.

No news in the past week

Curasight is focused on diagnosing (uTRACE) and treating cancer (uTREAT) through targeted radionuclide therapy. The benefit is treating cancer at the cellular level without harming healthy cells. The main driver of the stock moving forward is the financing of the portfolio as well as pipeline and partnership development. You can read our full investment case here (in Danish).

No news in the past week

DanCann Pharma focuses on discovering, developing, and producing medical cannabis for pain and neurological conditions. The stock price drivers are regulatory progress and sales development.

No news in the past week

Evaxion Biotech develops personalized immunotherapies and vaccines, with recent advancements in their cancer vaccine candidate EVX-01. Clinical trial outcomes and technological innovations currently drive the stock price.

Evaxion will be presenting two-year clinical efficacy data from its phase 2 trial with lead compound EVX-01 at the European Society for Medical Oncology (ESMO) Congress 2025 to be held in Berlin, Germany, from October 17-21, 2025.

ExpreS2ion provides protein production technologies for vaccine development and has its own pipeline. Key stock drivers include pipeline progression and licensing agreements.

No news in the past week

Fluoguide develops tumor-targeted products that make cancer visible on imaging solutions to improve cancer surgery outcomes, especially within brain and head & neck cancer surgery. The main stock driver is the clinical validation of their imaging technology and additional partnerships.

Fluoguide announced a collaboration with Olympus, a medical technology company. The focus of the current agreement is to support the clinical phase and to gather a body of evidence on Olympus’s technology platforms used in combination with FG001. The agreement has no initial payment and is non-exclusive. The terms of this agreement are not disclosed, and the agreement will not have an impact on the Company’s financial results in 2025.

Genmab focuses on creating differentiated antibody therapeutics for the treatment of lymphatic leukemia and solid tumors. Genmab has developed Darzalex, with sales of nearly USD 12 billion in 2024. The stock performance is primarily driven by product sales and pipeline developments.

No news in the past week

Gubra offers preclinical contract research services and develops treatments for metabolic diseases. Key stock drivers are partnerships and progress in their internal drug pipeline

Goldman Sachs initiated coverage on Gubra with a price target of DKK 520 in comparison to the current stock price of around DKK 410.

Initiator Pharma develops treatments for erectile dysfunction and neuropathic pain. The main stock catalyst is the outcome of clinical trials.

No news in the past week

IO Biotech is developing immune-modulating therapies for cancer, with a focus on conditions like melanoma. Stock performance is driven by clinical trial advancements.

No news in the past week

Pila Pharma is working on TRPV1 antagonists aimed at treating type 2 diabetes. Early clinical data and funding developments are key stock drivers.

Pila Pharma announced the outcome of the rights issue being subscribed to approx. 79%, and raising MSEK 20 before costs.

Saniona focuses on ion channel-targeted therapies, including rare eating disorders. The main stock driver is the progression of their clinical pipeline and the approval of the weight loss drug Tesofensine in Mexico.

No news in the past week

SynAct Pharma develops drugs targeting inflammatory diseases through melanocortin pathways. Clinical milestones significantly influence stock performance

No news in the past week

ViroGates provides prognostic products for acute care settings to improve patient triage. Stock drivers include hospital adoption rates and revenue growth.

No news in the past week

Y-mAbs Therapeutics develops antibody-based therapies for pediatric cancers. Stock performance is driven by regulatory approvals and commercialization efforts.

No news in the past week

Zealand Pharma specializes in peptide-based treatments for metabolic and gastrointestinal diseases. The stock has seen increased awareness following the obesity hype, and advancements in its late-stage pipeline and partnerships are key stock price influencers.

Wells Fargo initiated coverage on Zealand Pharma with a price target of DKK 650.

2cureX offers the IndiTreat platform for individualized cancer treatment testing. The main stock driver is the adoption of their technology by hospitals and subsequent sales growth.

No news in the past week

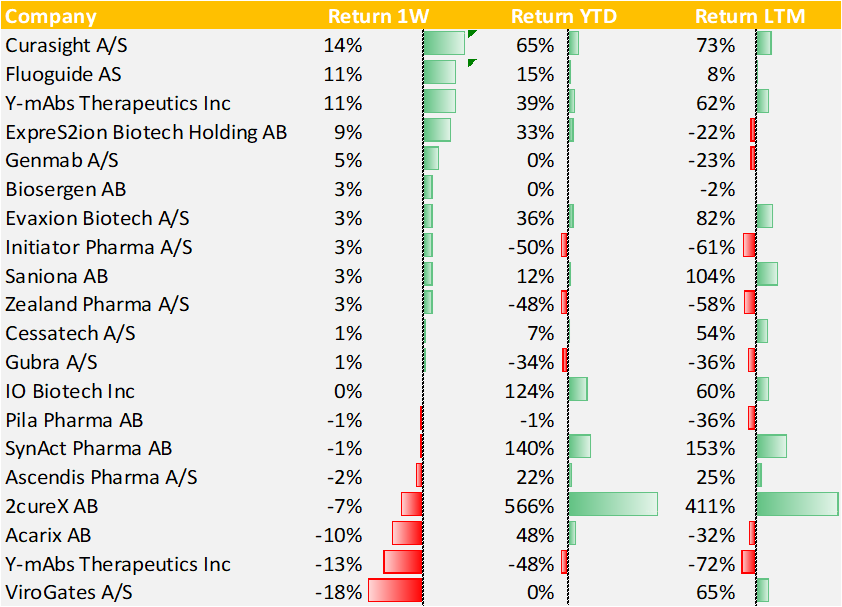

The latest share price developments for the Danish biotech stocks

On average, the Danish biotech and healthcare stocks delivered a return of 1.5%. Most notably, FluoGuide announced a new partnership with Olympus to be used in combination with FG001. Furthermore, Biosergen announced a new CFO, Pila Pharma announced the results of their rights issue raising MSEK 20. Finally, Gubra and Zealand received new price targets after coverage was initiated by Goldman Sachs and Wells Fargo respectively. Both price targets were set considerably higher than their current stock prices indicating a positive outlook for the stocks.

Overview of share price development in the past week, year-to-date, and the last twelve months

DanCann Pharma does not appear on the list due to data issues.