NORDIC | BIOTECH & HEALTHCARE Your insights into listed Danish & Nordic biotech & healthcare stocks.

In the past week, the Nordic biotech and healthcare stocks rose 3.4%. Curasight announced the subscription price of its MDKK 100 rights issue, multiple companies reported positive clinical progress, HSBC recommends buy of a Danish giant, and SynAct Pharma saw positive patent development. Year-to-date, SynAct Pharma is the best-performing stock with a return of 123%.

Latest news for the Danish biotech companies

Acarix AB has developed a technology to identify heart diseases. Moving forward, product sales are the main driver for the stock.

No news the past week

Ascendis Pharma develops so-called prodrugs, which are medications that start in an inactive form and become active once inside the body. The main stock price driver going forward is the development and commercialization of its TransCon technology.

Ascendis Pharma will report its Q1 earnings on May 1.

Biosergen is developing BSG005 to treat serious and life-threatening fungal infections safely and with limited side effects, contrary to current drugs. The main price triggers are centered around product development and the ongoing clinical trials

No news in the past week

Cessatech develops pain treatments for children. The company is finalizing its phase 3 study for its lead candidate, and the main price driver will be the commercialization for this product.

No news in the past week

Curasight is focused on diagnosing (uTRACE) and treating cancer (uTREAT) through targeted radionuclide therapy. The benefit is treating cancer at the cellular level without harming healthy cells. The main driver of the stock moving forward is the financing of the portfolio as well as pipeline and partnership development. You can read our full investment case here (in Danish).

Curasight announced the final details of its rights issue of MDKK 100. The subscription price is set to DKK 1.98 per share, while it is currently trading at DKK 5.7. It starts on May 2. Furthermore, the company released its Q1 earnings as well as its annual report for 2024. The main focus is their financial development and potential big pharma deals. Read more in Danish here.

DanCann Pharma focuses on discovering, developing, and producing medical cannabis for pain and neurological conditions. The stock price drivers are regulatory progress and sales development.

Permanent medical cannabis legislation in Denmark has been completed.

Evaxion Biotech develops personalized immunotherapies and vaccines, with recent advancements in their cancer vaccine candidate EVX-01. Clinical trial outcomes and technological innovations currently drive the stock price.

No news the past week

ExpreS2ion provides protein production technologies for vaccine development and has its own pipeline. Key stock drivers include pipeline progression and licensing agreements.

No news the past week

Fluoguide develops tumor-targeted products that make cancer visible on imaging solutions to improve cancer surgery outcomes, especially within brain and head & neck cancer surgery. The main stock driver is the clinical validation of their imaging technology and additional partnerships.

No news the past week

Genmab focuses on creating differentiated antibody therapeutics for the treatment of lymphatic leukemia and solid tumors. Genmab has developed Darzalex, with sales of nearly USD 12 billion in 2024. The stock performance is primarily driven by product sales and pipeline developments.

HSBC lowered their price target from DKK 2970 to DKK 1990 and recommends buying.

Gubra offers preclinical contract research services and develops treatments for metabolic diseases. Key stock drivers are partnerships and progress in their internal drug pipeline.

No news the past week

Initiator Pharma develops treatments for erectile dysfunction and neuropathic pain. The main stock catalyst is the outcome of clinical trials.

No news the past week

IO Biotech is developing immune-modulating therapies for cancer, with a focus on conditions like melanoma. Stock performance is driven by clinical trial advancements.

IO Biotech presented new data at the AACR 2025 conference supporting multiple cancer vaccines (read more)

Pila Pharma is working on TRPV1 antagonists aimed at treating type 2 diabetes. Early clinical data and funding developments are key stock drivers.

No news the past week

Saniona focuses on ion channel-targeted therapies, including rare eating disorders. The main stock driver is the progression of their clinical pipeline and the approval of the weight loss drug Tesofensine in Mexico.

No news the past week

Scandion Oncology is developing treatments to overcome chemotherapy resistance in cancer patients. The company has recently faced significant financial challenges, thus, financial stability is the main driver for the stock price.

No news in the past week

SynAct Pharma develops drugs targeting inflammatory diseases through melanocortin pathways. Clinical milestones significantly influence stock performance

SynAct Pharma announced getting a Notice of Allowance for their patent application for their candidate, AP1189, in combination with metotrexat, giving them protection until at least 2040, when granted.

ViroGates provides prognostic products for acute care settings to improve patient triage. Stock drivers include hospital adoption rates and revenue growth.

No news the past week

Y-mAbs Therapeutics develops antibody-based therapies for pediatric cancers. Stock performance is driven by regulatory approvals and commercialization efforts.

Y-mAbs announced dosing of the first patient in a phase 1 clinical trial evaluating CD38-SADA pre-targeted radioimmunotherapy in relapsed/refractory mon-Hodgkin Lymphoma. The company also presented new data of the candidate at the AACR annual meeting.

Zealand Pharma specializes in peptide-based treatments for metabolic and gastrointestinal diseases. The stock has seen increased awareness following the obesity hype, and advancements in their late-stage pipeline and partnerships are key stock price influencers.

Zealand Pharma announced enrollment of its first patient in the phase IIb ZUPREME trial with Petrelintide in people with obesity and type 2 diabetes. The trial will enroll approximately 200 patients.

2cureX offers the IndiTreat platform for individualized cancer treatment testing. The main stock driver is the adoption of their technology by hospitals and subsequent sales growth.

No news the past week

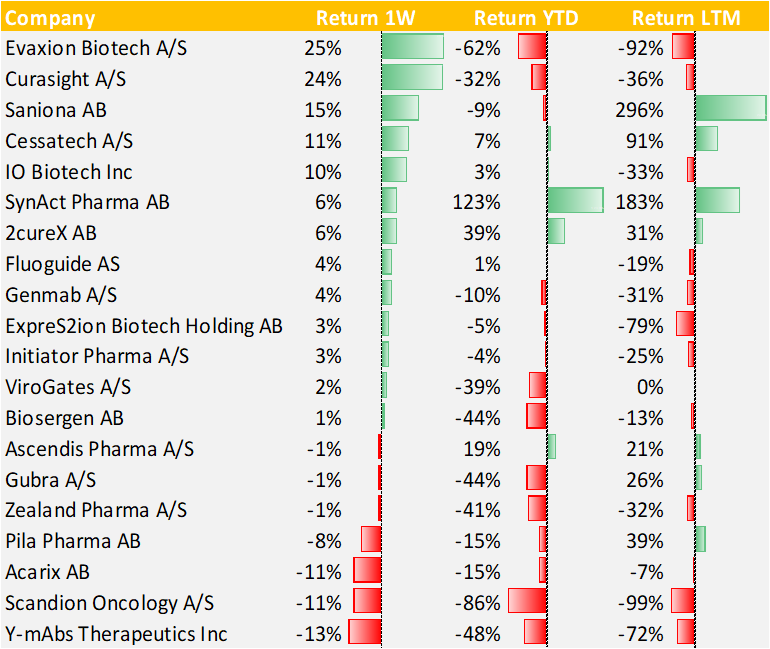

The latest share price developments for the Danish biotech stocks

On average, the Danish biotech and healthcare stocks rose 3.4%. Evaxion Biotech and Curasight stood out with returns of 24-25%. Evaxion did not release any news, and Curasight’s share price increase came following news of its ongoing rights issue, but it based on a low trading volume. On the other hand, Zealand Pharma and Y-mAbs Therapeutics declined 1-13%, respectively, although both announced clinical progress by enrolling patients into their trials. Genmab also received a new price target with a buy recommendation, and the average price target for the stock is now 55% higher than the current stock price. For 2025, the average return is -13.1%, and SynAct Pharma is the only stock with a +100% return.

Overview of share price development in the past week, year-to-date, and the last twelve months

DanCann Pharma does not appear on the list due to data issues.

AcouSort and Alzinova are raising capital, and you can participate!

AcouSort AB is a Danish-led medtech company that develops automated solutions for handling biological samples, such as blood samples for diagnostics and patient treatment. AcouSort has already developed several research instruments and is raising 34.1 MSEK to establish an OEM partnership. 73% of the issue is secured, and the subscription period runs until May 5, 2025. You can read more about AcouSort and other rights issues at Nyemission.dk (in Danish)

Alzinova AB is a Swedish biopharmaceutical company in clinical development specializing in the treatment of Alzheimer’s. Alzheimer’s is one of the most common and devastating neurological diseases, affecting around 40 million people worldwide. The main purpose of the issue is to raise capital to finalize preparations of the company’s lead vaccine candidate, ALZ-101, ahead of an upcoming clinical study while ongoing partnership discussions with large pharmaceutical companies are ongoing. The company will raise MSEK 35.7 before issue costs, and the last day of subscription is May 6, 2025.