NORDIC | BIOTECH & HEALTHCARE Your insights into listed Danish & Nordic biotech & healthcare stocks.

In the past week, the Nordic biotech and healthcare stocks rebounded slightly with a 2.3% return. The most notable news includes Synact Pharma’s initiation of a phase II study and one Danish biotech stock received a new price target from Goldman Sachs at more than twice their current stock price.

Latest news for the Danish biotech companies

Acarix AB has developed a technology to identify heart diseases. Moving forward, product sales are the main driver for the stock.

No news in the past week

Ascendis Pharma develops so-called prodrugs, which are medications that start in an inactive form and become active once inside the body. The main stock price driver going forward is the development and commercialization of its TransCon technology.

No news the past week

Biosergen is developing BSG005 to treat serious and life-threatening fungal infections safely and with limited side effects – contrary to current drugs. The main price triggers are centered around product development and the ongoing clinical trials

No news in the past week

Cessatech develops pain treatments for children. The company is finalizing its phase 3 study for its lead candidate, and the main price driver will be the commercialization for this product.

No news in the past week

Curasight is focused on diagnosing (uTRACE) and treating cancer (uTREAT) through targeted radionuclide therapy. The benefit is treating cancer at the cellular level without harming healthy cells. The main driver of the stock moving forward is the financing of the portfolio as well as pipeline and partnership development. You can read our full investment case here (in Danish).

Curasight is in the process of an MDKK 100 capital raise. 47% of the rights issue is secured through pre-subscriptions and guarantee commitments. The subscription price will be set at 65% of the theoretical share price (based on 10-day volume-weighted average price) from the time of the board’s formal decision to carry out the issue. Therefore, the subscription price is not known yet. However, the price will not be lower than the nominal value per share or higher than DKK 10.24. At the time of writing, the share is trading at 6.10. The subscription period runs from May 2 through May 16. You can read more in Danish here.

DanCann Pharma focuses on discovering, developing, and producing medical cannabis for pain and neurological conditions. The stock price drivers are regulatory progress and sales development.

No news the past week

Evaxion Biotech develops personalized immunotherapies and vaccines, with recent advancements in their cancer vaccine candidate EVX-01. Clinical trial outcomes and technological innovations currently drive the stock price.

Evaxion will present at the World Vaccine Congress from April 21 to April 24.

ExpreS2ion provides protein production technologies for vaccine development and has its pipeline. Key stock drivers include pipeline progression and licensing agreements.

No news the past week

Fluoguide develops tumor-targeted products that make cancer visible on imaging solutions to improve cancer surgery outcomes, especially within brain and head & neck cancer surgery. The main stock driver is cthe linical validation of their imaging technology and additional partnerships.

No news in the past week

Genmab focuses on creating differentiated antibody therapeutics for the treatment of lymphatic leukemia and solid tumors. Genmab has developed Darzalex, with sales of nearly USD 12 billion in 2024. The stock performance is primarily driven by product sales and pipeline developments.

No news the past week

Gubra offers preclinical contract research services and develops treatments for metabolic diseases. Key stock drivers are partnerships and progress in their internal drug pipeline.

No news the past week

Initiator Pharma develops treatments for erectile dysfunction and neuropathic pain. The main stock catalyst is the outcome of clinical trials.

No news the past week

IO Biotech is developing immune-modulating therapies for cancer, with a focus on conditions like melanoma. Stock performance is driven by clinical trial advancements.

No news the past week

Pila Pharma is working on TRPV1 antagonists aimed at treating type 2 diabetes. Early clinical data and funding developments are key stock drivers.

No news the past week

Saniona focuses on ion channel-targeted therapies, including rare eating disorders. The main stock driver is the progression of their clinical pipeline and the approval of the weight loss drug Tesofensine in Mexico.

No news the past week

Scandion Oncology is developing treatments to overcome chemotherapy resistance in cancer patients. The company has recently faced significant financial challenges, thus, financial stability is the main driver for the stock price.

No news in the past week

SynAct Pharma develops drugs targeting inflammatory diseases through melanocortin pathways. Clinical milestones significantly influence stock performance

Synact Pharma released its annual report for 2024, and the company also announced the initiation of its phase II study with resomelagon for the treatment of patients with dengue, which is a viral infection that spreads from mosquitoes to people and 100-400 million people are at risk each year.

ViroGates provides prognostic products for acute care settings to improve patient triage. Stock drivers include hospital adoption rates and revenue growth.

No news the past week

Y-mAbs Therapeutics develops antibody-based therapies for pediatric cancers. Stock performance is driven by regulatory approvals and commercialization efforts.

No news the past week

Zealand Pharma specializes in peptide-based treatments for metabolic and gastrointestinal diseases. The stock has seen increased awareness following the obesity hype, and advancements in their late-stage pipeline and partnerships are key stock price influencers.

Goldman Sachs increased the price target from 977 DKK to DKK 980 and recommends buying

2cureX offers the IndiTreat platform for individualized cancer treatment testing. The main stock driver is the adoption of their technology by hospitals and subsequent sales growth.

No news the past week

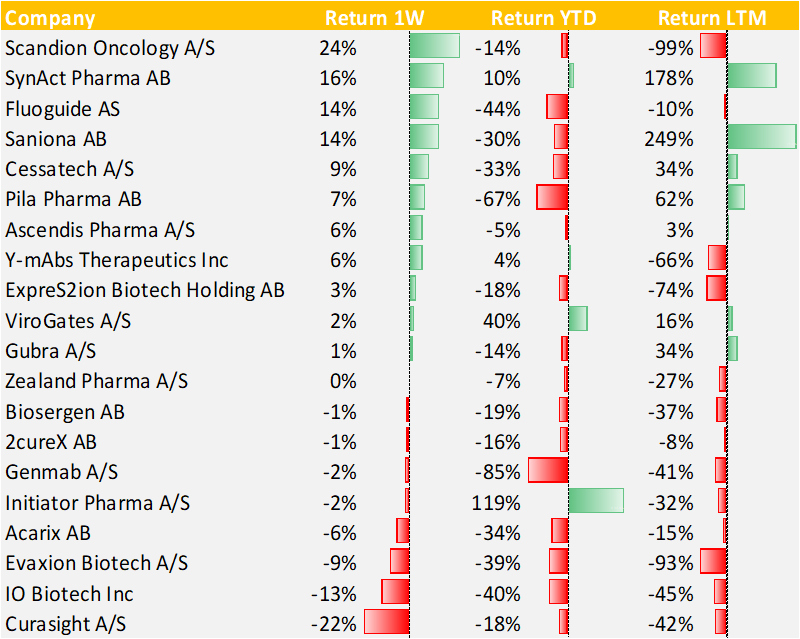

The latest share price developments for the Danish biotech stocks

On average, the Danish biotech and healthcare stocks increased 2.3%. Four stocks, including Scandion Oncology, SynAct, Fluoguide, and Saniona, delivered double-digit returns. SynAct Pharma released positive news with its initiation of the phase II study with resomelagon in patients with Dengue, but the stock rose well before the release of the clinical news. On the other hand, IO Biotech and Curasight declined by a double-digit percentage. The latter was driven by the news of its rights issue, but the final terms are still not determined as they rely on the stock price these trading days. Moreover, Zealand Pharma received a new price target by Goldman Sachs at more than twice their current stock price, but the stock price was unchanged last week. Finally, Saniona continues to be the best performer in the past year at 249%, followed by SynAct Pharma.

Overview of share price development the past week, year-to-date, and the last twelve months

DanCann Pharma does not appear on the list due to data issues.

Multiple Nordic biotech stocks are raising capital right now, and you can get involved

1. Odinwell is a Swedish medical technology company specializing in the development of medical devices for wound care. The company has a platform with associated technological tools to analyze and facilitate the process of wound care. The company wants to raise approximately MSEK 17.5 before issue costs. The subscription period runs from April 1 to April 15.

2. The subscription period of AcouSort’s rights issue starts tomorrow! More information will follow on Nyemission.dk in Danish.