Developments during the week at the Nordic growth exchanges

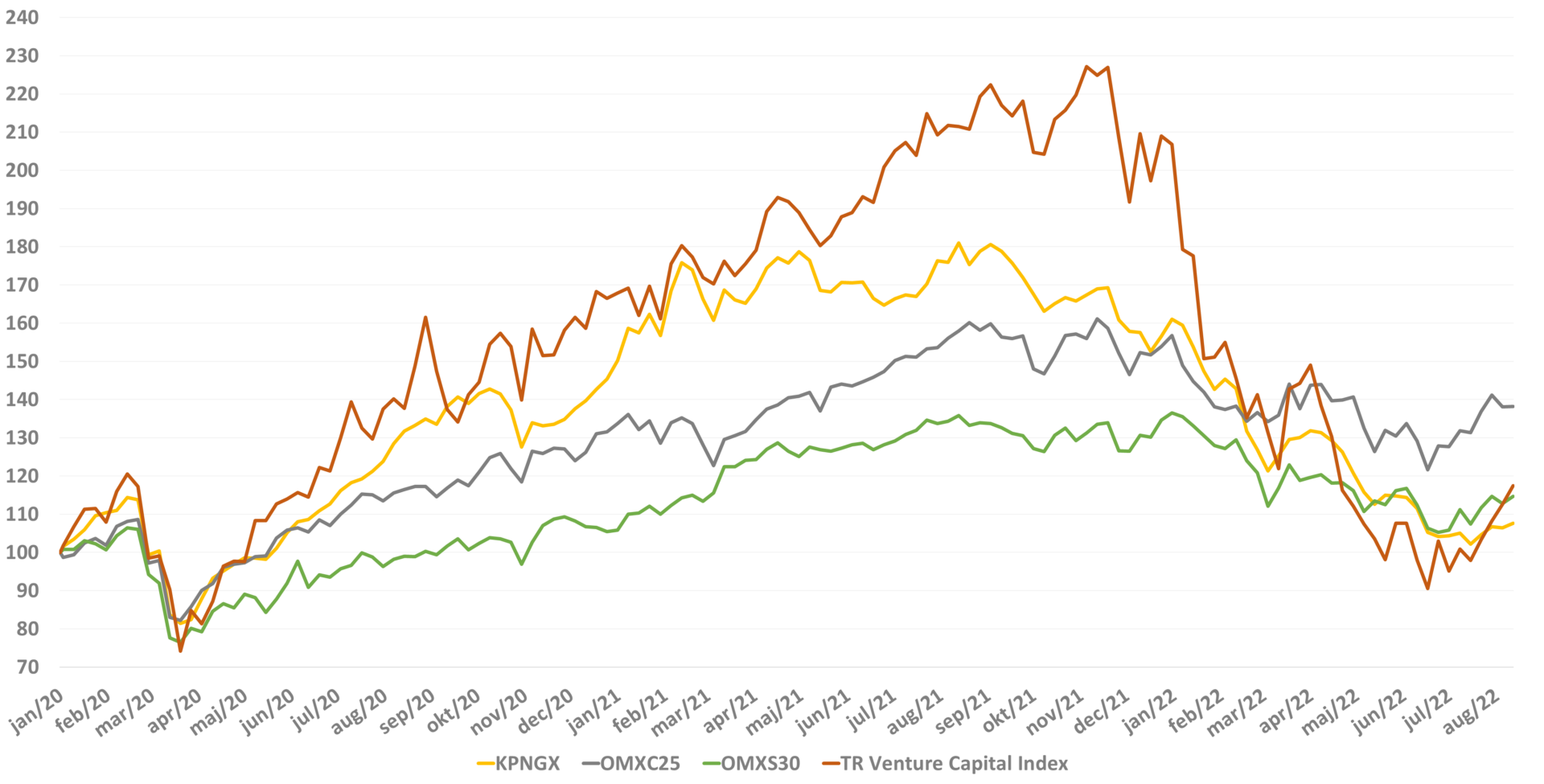

The Kapital Partner Nordic Growth Exchanges (KPNGX) index rose 1.1% last week. The Swedish S30 index rose 1.7%, while the Danish C25 index went to zero. 421 out of 917 companies in the KPNGX index delivered a positive return last week. The 3 best performing stocks on the Nordic growth exchanges were Nexar Group AB (+92%), Lyckegård Group AB (+59%) and GNP Energy AS (+53%). The worst performer of the week was Clinical Laserthermia Systems AB, down 53%.

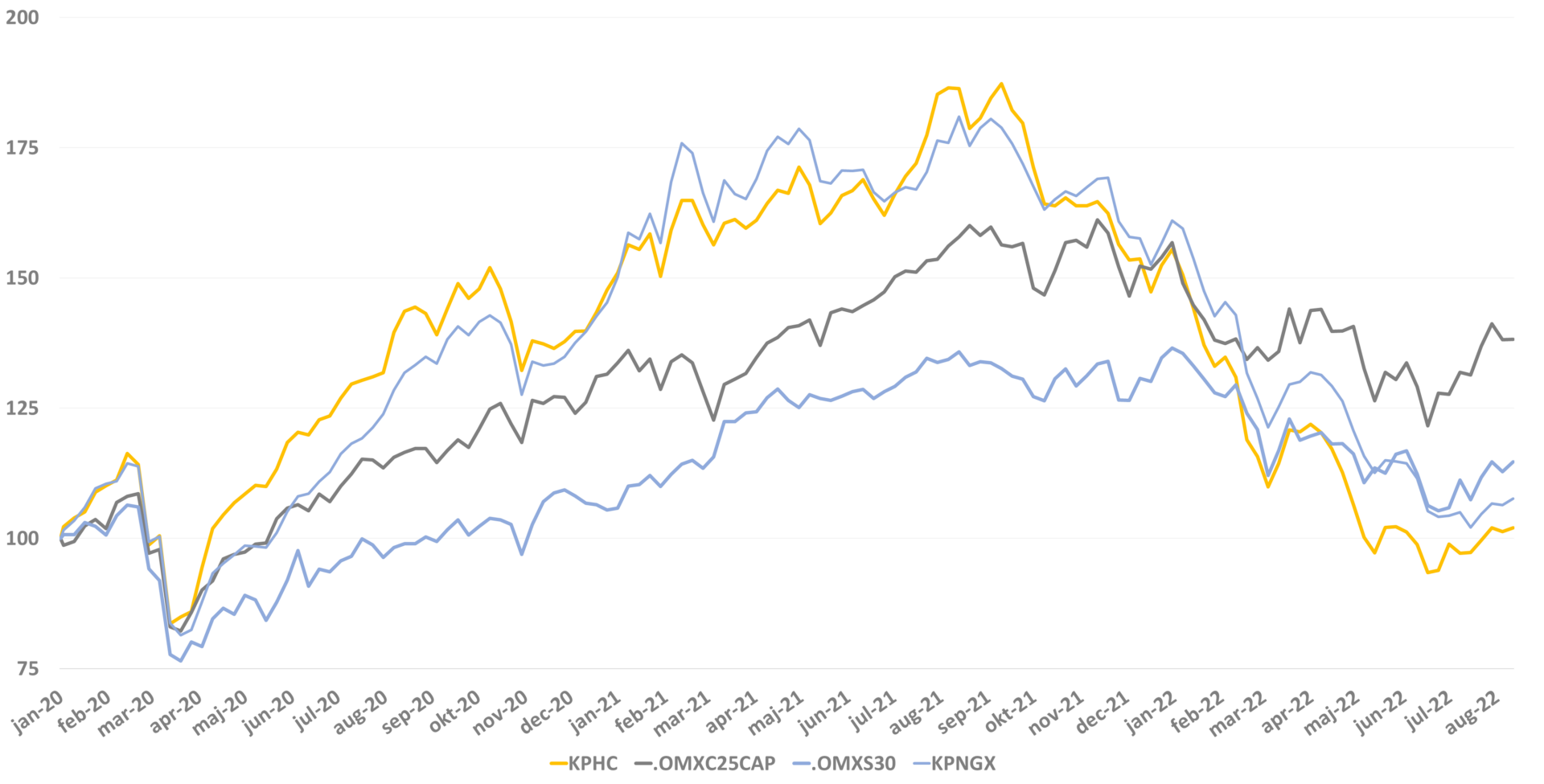

KPNGX index development since 01.01.2020

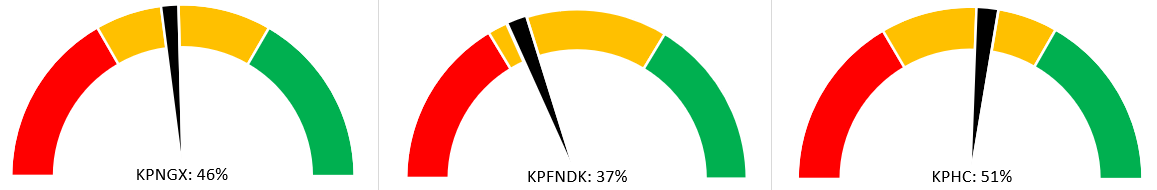

The sentiment on the Kapital Partners index last week:

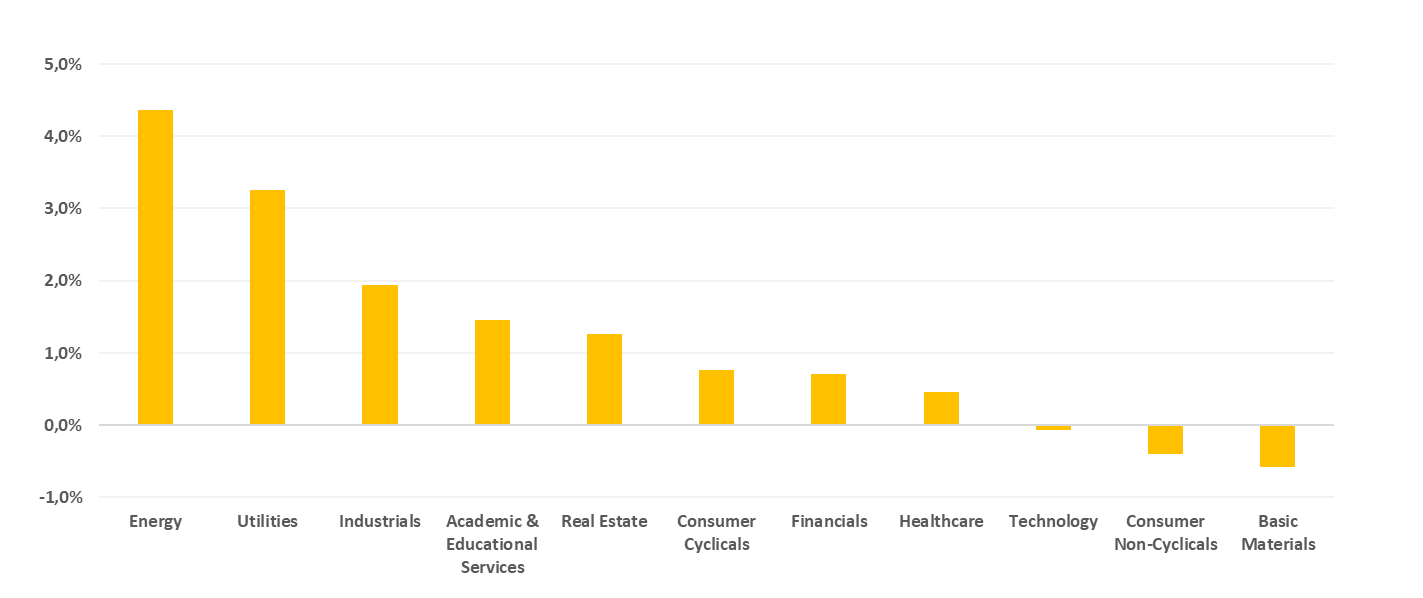

Developments at sector level on the Nordic growth exchanges

The majority of sectors performed well. Energy performed best with a 4.4% increase, while utilities followed with a 3.2% rise. Industrials, academic & educational services and real estate all outperformed the KPNGX index. Basic materials was the worst performing sector last week after falling 0.6%.

Sector returns for the KPNGX index last week

The 3 best performing stocks on the Nordic growth exchanges last week

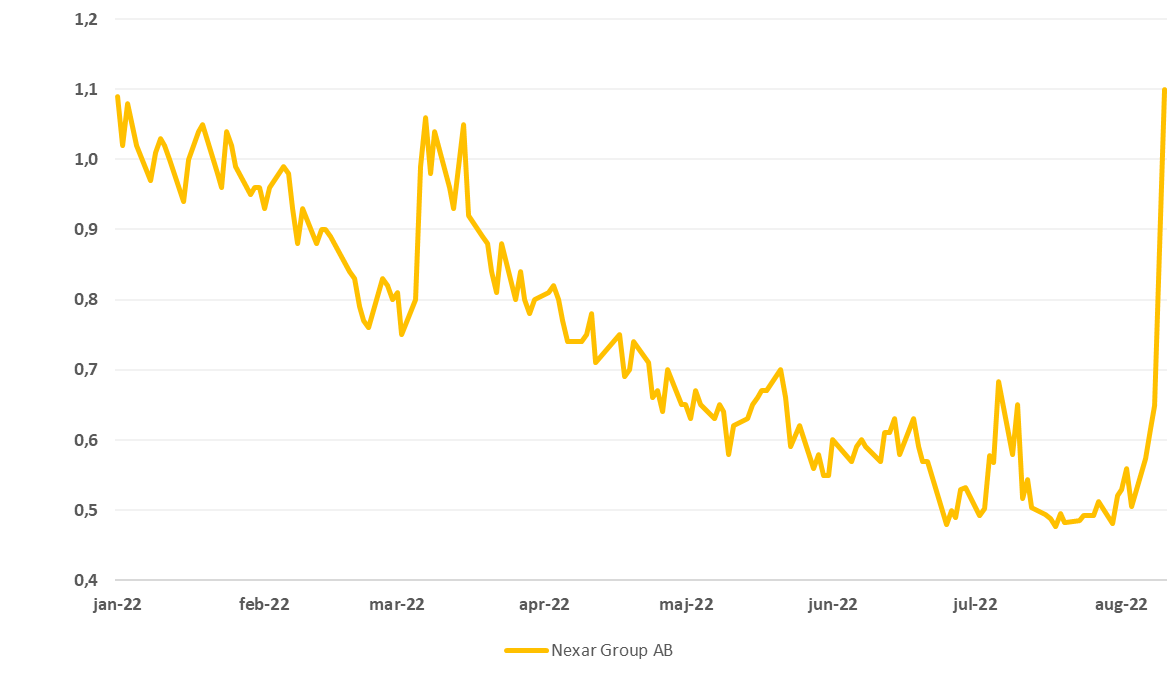

Nexar Group AB (+92%) is a Swedish company with TV formats in football, sports and player management with offices in Sweden. The company has created a number of commercial entertainment formats, both for digital TV, TV and radio.

Nexar Group AB announced last week that Nexar Football, part of Nexar Group AB, has signed a five-year agreement with a Nigerian state to film a football programme worth MUSD 10. The company has a market capitalisation of SEK 28 million and had revenues of SEK 3 million in 2021. After the last week’s price rise, the share price has not changed year to date.

Share price development of Nexar Group AB year to date

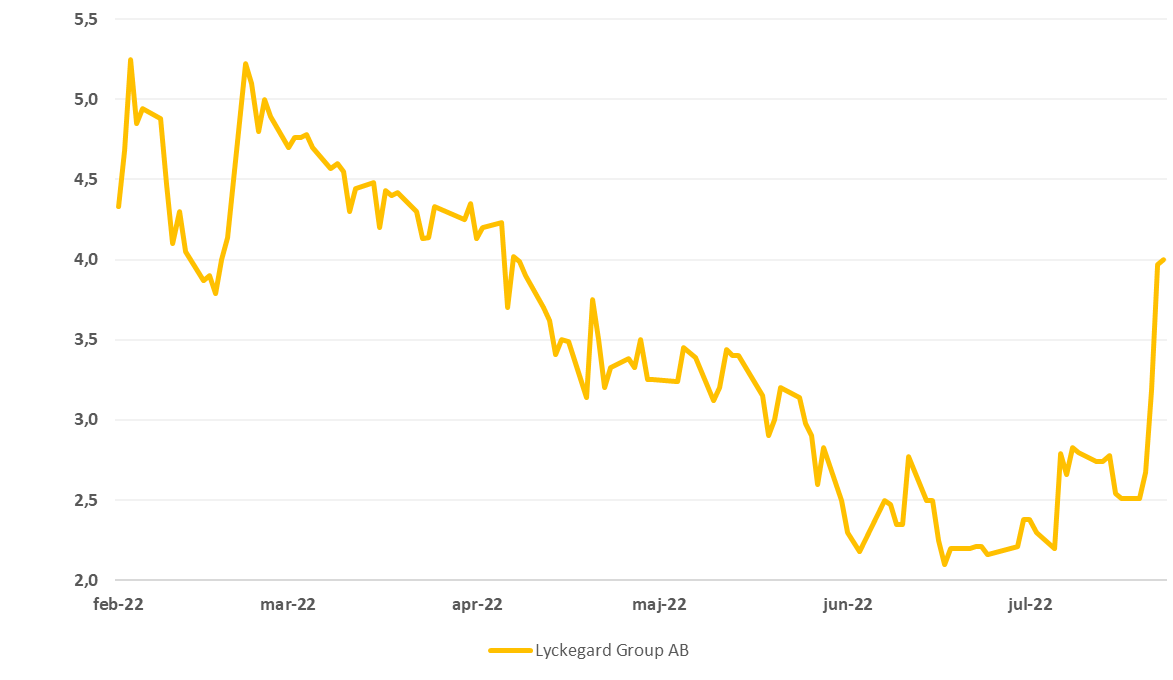

Lyckegård Group AB (+59%) offers a product portfolio of tools for organic farming. The tools work mechanically for weed control and tillage without chemicals and apply cultivation strategies for organic farming. Customers are mainly farmers. The company operates in the Nordic region and Europe.

The company has a market capitalisation of SEK 63 million and the share price has fallen 33% since the company was listed in February.

Share price development of Lyckegård Group AB year to date

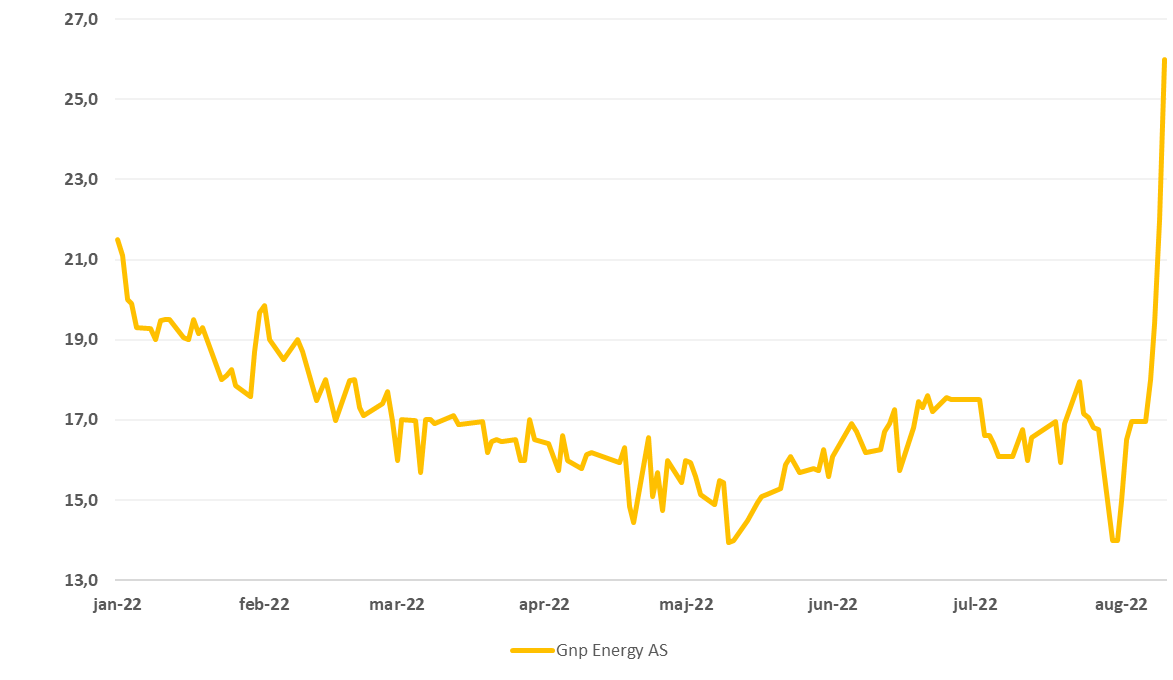

GNP Energy AS (+53%) is a Norwegian-based energy company. It is active in electricity trading, makes investments in the electricity market in Europe and owns other companies involved in the electricity industry.

The company has a market capitalisation of MNOK 263, turnover in 2021 of MNOK 630 and the share price has increased 16% year to date.

Share price development of GNP Energy AS year to date

Developments during the week on First North Denmark

The Kapital Partner First North Danmark (KPFNDK) index fell 0.4% last week. The KPFNDK index is one of the best performing stock indices in the Nordic region relative to the other indices year to date. However, since 1 January 2020, the index has delivered a negative return, which is worse than both the KPNGX index, the C25 index and the S30 index, which have all delivered positive returns since 1 January 2020.

Read more: Nexcom secures funding for continued growth

KPFNDK index development since 01.01.2020

Developments during the week on First North Denmark at company level

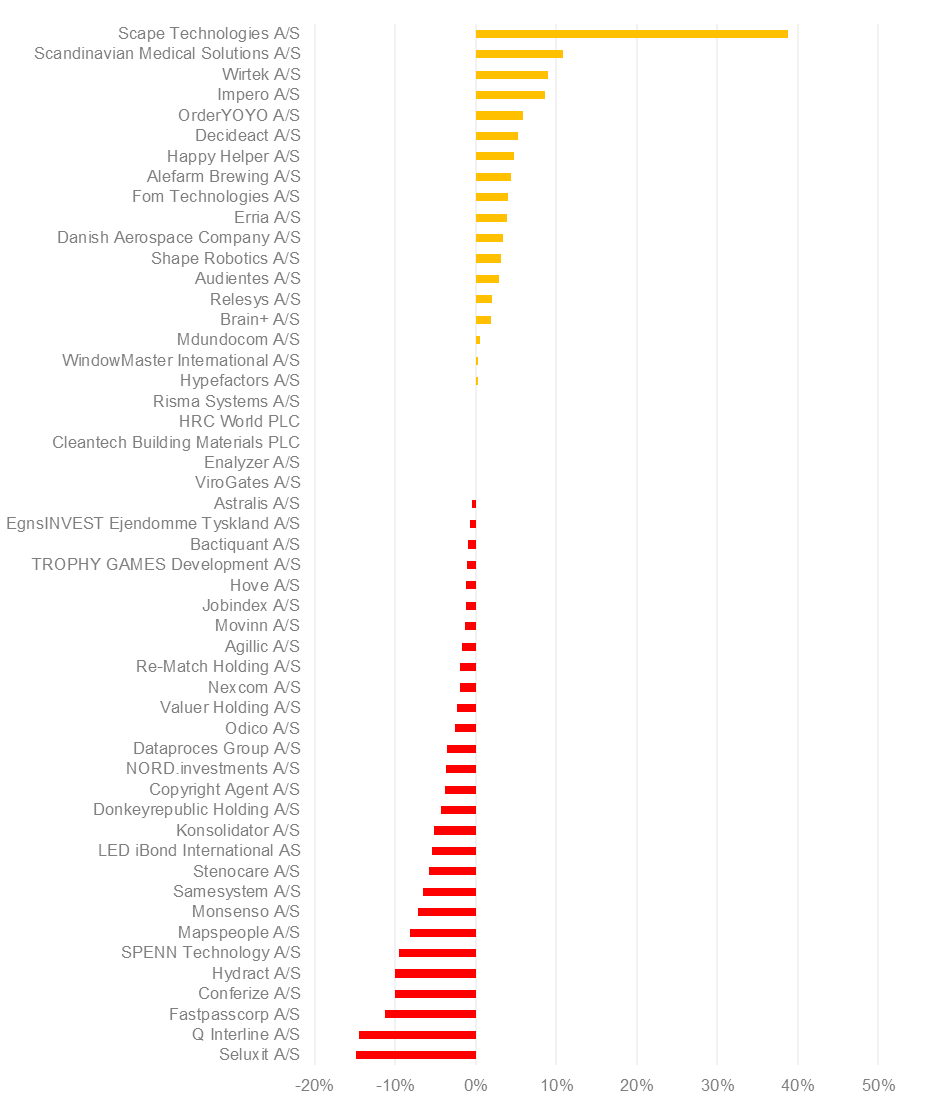

19 out of 51 companies in the KPFNDK index delivered a positive return. Scape Technologies A/S was the superior winner of the week with an increase of 39%. Scandinavian Medical Solutions A/S followed well with an increase of 11%. Seluxit A/S was the worst performer of the week after a fall of 15%.

Development on First North Denmark last week

Winner of the week on First North Denmark: Scape Technologies A/S

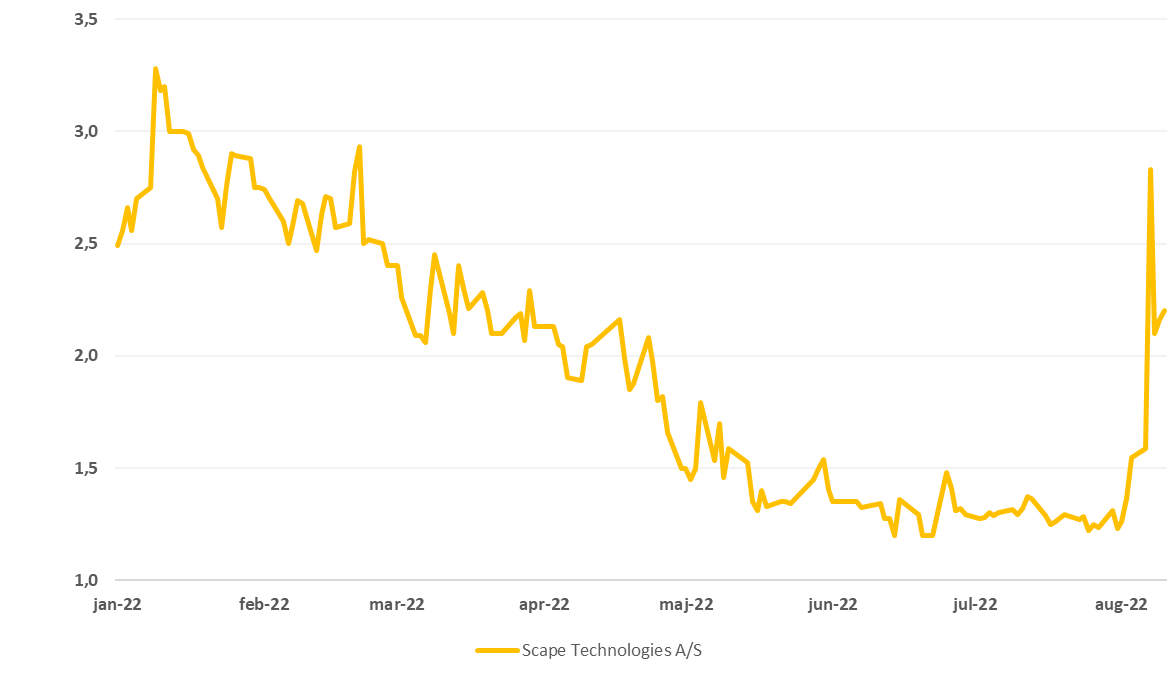

Scape Technologies A/S (+39%) is active in the IT sector. The company specialises in the development of technical tools for the industrial sector. The software is proprietary and used mainly for scanning, testing and control systems in large processes.

The company has a market capitalisation of MDKK 65 and the share price has fallen 9% year to date.

Share price development of Scape Technologies A/S year to date

Developments during the week for the Nordic healthcare stocks

The Kapital Partner Healthcare (KPHC) index fell 0.7% during the week. 150 out of 293 companies in the index rose during the week. Oncozenge AB (+31%) was the winner for the week, while Clinical Laserthermia Systems AB was the worst performer, falling 53%.

Development of the KPHC index since 01.01.2020

Winner of the week among Nordic healthcare stocks: Oncozenge AB

Oncozenge AB (+31%) is a Swedish pharmaceutical company developing treatment for pain relief in patients suffering from oral pain caused by radiotherapy and chemotherapy for cancer. Having completed Phase 2 studies, the company’s product candidate is undergoing further development as a basis for seeking market approval and commercialisation.

The company has a market capitalisation of SEK 43 million and the share price has fallen 67% year to date.

Share price development of Oncozenge AB year to date