In the past week, the Nordic impact stocks made another small comeback in a challenging year. Every sector delivered a positive return except for one, with the Waste Mangement sector on top. We take a look at the Power2X & Fuel Cells sector and investments worth a closer look. The best stock rose almost 200% while announcing a new CEO.

We have launched a brand new newsletter that dives deep into impact stocks in the Nordics. The newsletter can help you invest more sustainably in the businesses of tomorrow. We track the development of more than 100 ompanies within multiple impact sectors including energy production, waste management, and carbon capture. We follow over 100 large and small companies

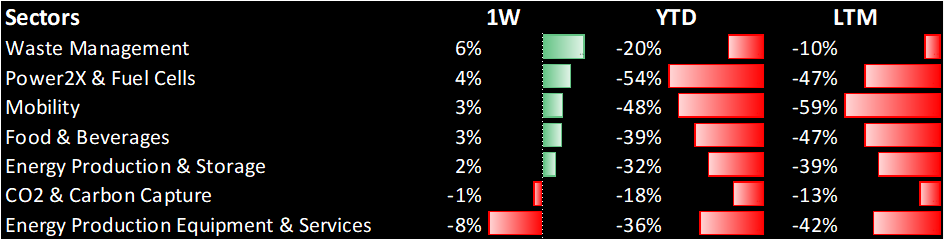

The Waste Management sector performed the best in the past week with a 6% increase helped by strong performance from Recyctec AB and Pryme NV. On the other hand, Energy Production Equipment & Services came out as only sector with a negative return in the past week. The worst performing stocks where Absolicon Solar Collector AB, Midsummer AB, and Climeon AB which fell 21-50% after annuncing rights issues.

Overview of the performance of each sector the past week

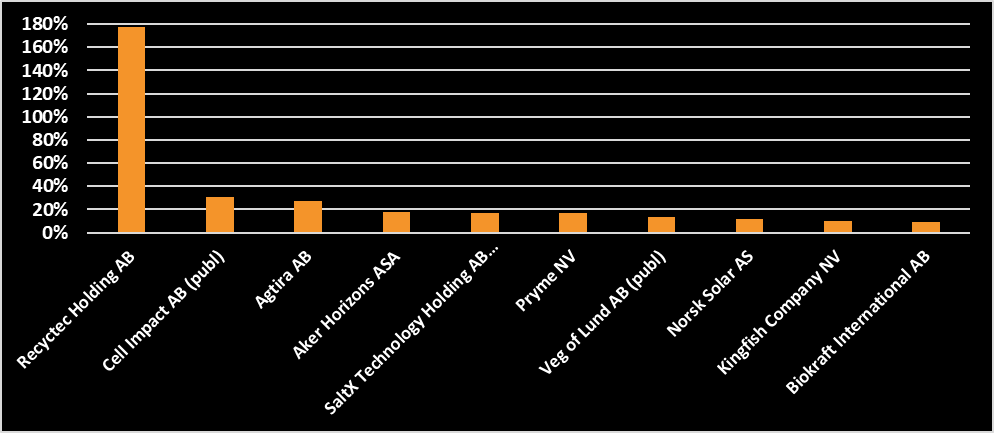

Top 10 best performing impact stocks of the week

In the past week, Recyctec AB, a company that restores used glycol so that it can be reused, became the best-performing stock rising 178% in a week, where the company announced a new CEO. Recyctec AB has a market cap. of only 8.4 MEUR. Cell Impact AB, a global supplier of advanced flow plates to fuel cell and electrolyzer manufacturers, rose 31% in a week, announcing a 152 MSEK rights issue. The 10 best stocks rose 33% on average. Agtira AB, a food tech company that delivers and operates facilities for sustainable and profitable food production, rose 27% following a letter of intent with ICA Maxi Hälla that covers a production facility in Västerås, where Agtira builds and operates the facility over a longer period. The 27% rise for Agtira AB comes after they fell 23% in the week prior to this.

The 10 best performing stocks the past week

Power2X and Fuel Cells in focus

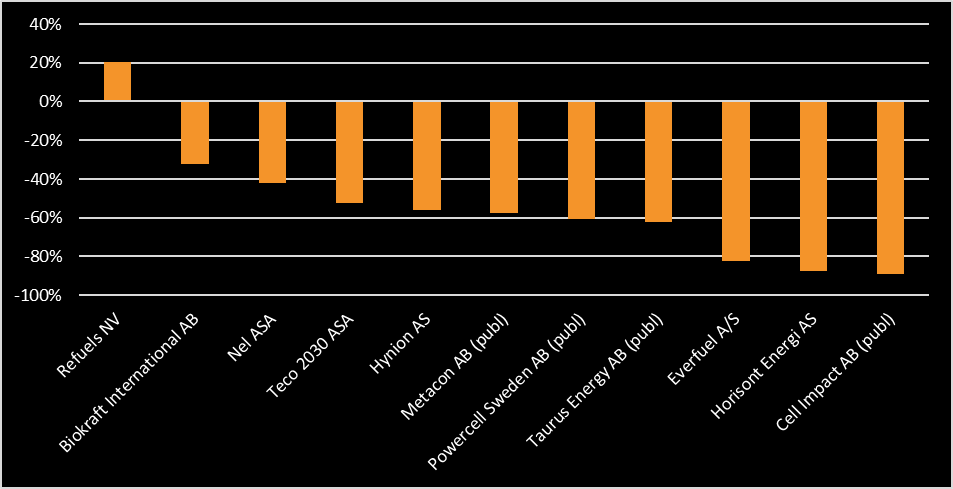

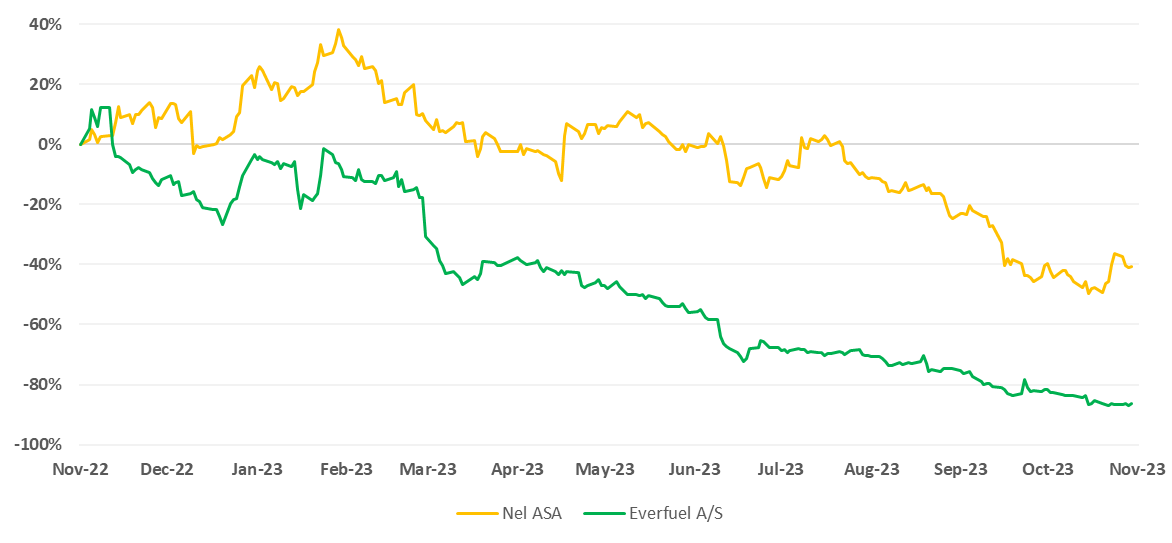

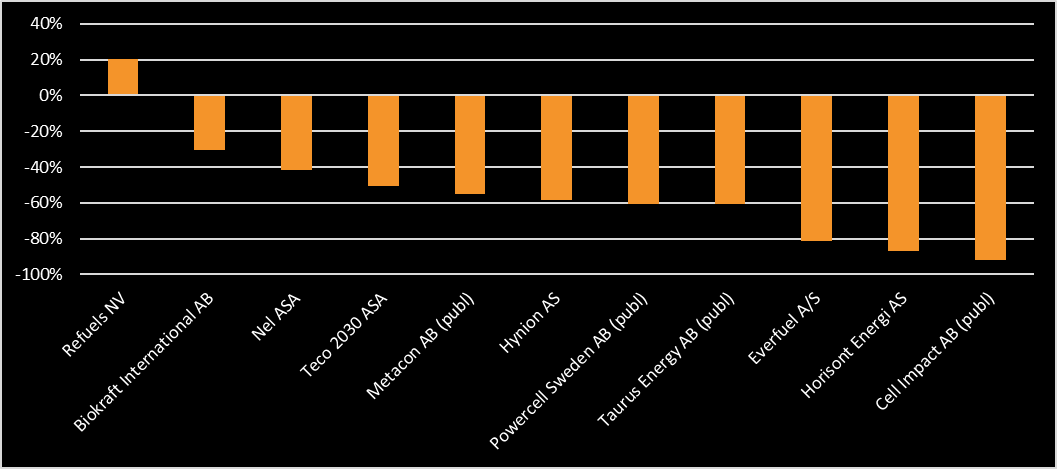

The Power2X and Fuel Cells sector includes companies involved in creating the energy systems of tomorrow. The companies in the sector, focus on harnessing clean energy technologies to convert surplus electricity into various forms of energy such as hydrogen or synthetic fuels, thereby facilitating the transition to a more sustainable energy system. The sector is integral to reducing carbon emissions and advancing energy storage solutions. It is worth highlighting that the Power2X and Fuel Cells sector are still in its infancy, and it requires substantial investments and scaling efforts to achieve profitability. It should be seen as high risk and high reward compared to more traditional areas of impact investing such as solar and wind farms. The sector includes 11 companies which are listed below. Year-to-date the sector has delivered a return of -54%, in line with other high-risk sectors and companies.

Year-to-Date retrun for Power2X and fuel cell stocks

Nel ASA is a leading player in the field of clean hydrogen production and distribution based in Norway. The company specializes in electrolyzer technology and hydrogen fueling equipment. Nel is well-positioned to benefit from the growing global interest in Power2X solutions. Nel’s extensive experience, innovative technology, and strategic partnerships can potentially make it a compelling long-term investment opportunity in the clean energy space. The increasing adoption of hydrogen as a clean energy source and Nel’s position as an industry pioneer suggest a promising future for the company.

The company has a market value of NOK 13.5 billion. The company presented its Q3 results in October, with revenues of 405 MNOK, net income of -226 MNOK, an order backlog of 2,854 MNOK as well as a cash balance of NOK 3.8 billion. In other words, the company does not make a profit yet. However, they have substantial revenue as well as an order backlog that indicates a significant interest in the solutions they offer. Following its Q3 results announced in October, there have been insider buys by the CFO, CPO, and a board member indicating that they believe the stock is trading at an attractive level. 20 analysts are covering the company with an average price target of 11.28 NOK compared to the existing share price of 8.086 NOK indicating a 40% difference between the current price and where analysts believe it should be trading at.

Everfuel A/S is based in Denmark and is a smaller player in the field of hydrogen compared to NEL ASA. The company owns and operates green hydrogen infrastructure and partner with industry and vehicle OEMs to connect the entire hydrogen value chain and seamlessly provide hydrogen fuel to enterprise customers under long-term contracts. The company has a market value of 549 MNOK. In the first half of 2023, the company had revenues of 33.3 MNOK and a negative net income of 130.5 MNOK with 324 MNOK in cash on hand. This is also a case with some uptake in revenues but with continued negative results. In September, the company announced a 200 MEUR joint venture with Hy24 for green hydrogen infrastructure in the Nordics. Everfuel A/S owns 51% of the joint venture. Interestingly, the joint venture between the two companies just won a Danish Power-to-X tender for the production and supply of green hydrogen. You can read more about the announcement here.

Share price development for NEL ASA and Everfuel A/S the past year

Overview of each sector year-to-date

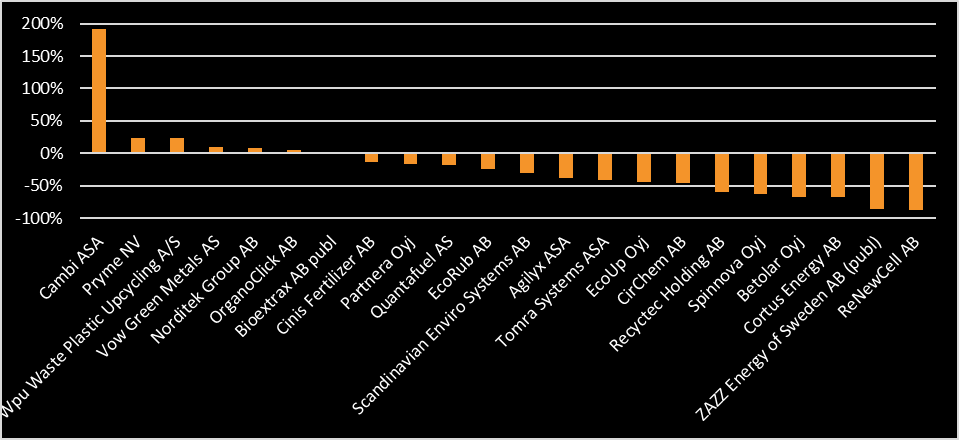

Waste Management

The waste management sector, characterized by its essential and non-cyclical nature, often presents a stable investment opportunity with long-term potential, driven by increasing environmental awareness, regulatory demands, and the growing need for efficient waste disposal and recycling solutions. Year-to-date, Cambi ASA has significantly outperformed the rest of the sector with a 191% increase.

Read more: Combineering sold for more than a billion – more companies may follow

Overview of the return year-to-date for the stocks in the Waste Management sector

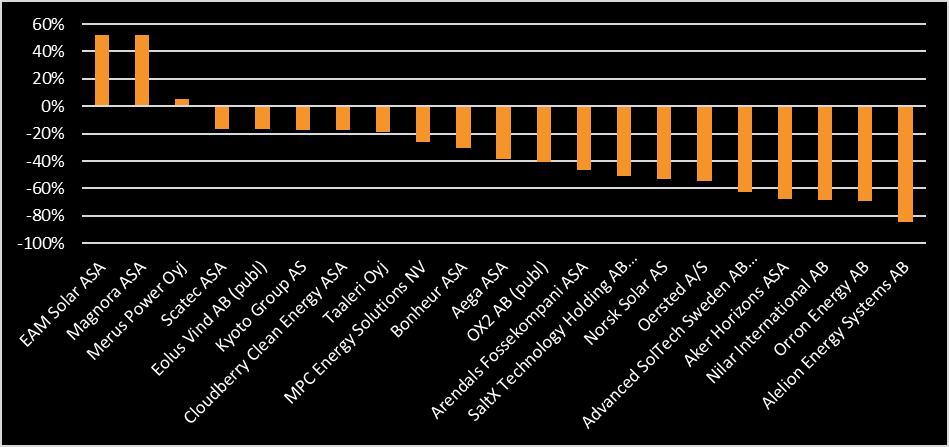

Energy Production & Storage

The Energy Production and Storage sector offers substantial investment opportunities, as it stands at the forefront of the transition towards renewable energy sources, driven by climate concerns and technological advancements. Year-to-date, only 3 stocks have delivered a postive return.

Overview of the return year-to-date for the stocks in the Energy Production & Storage sector

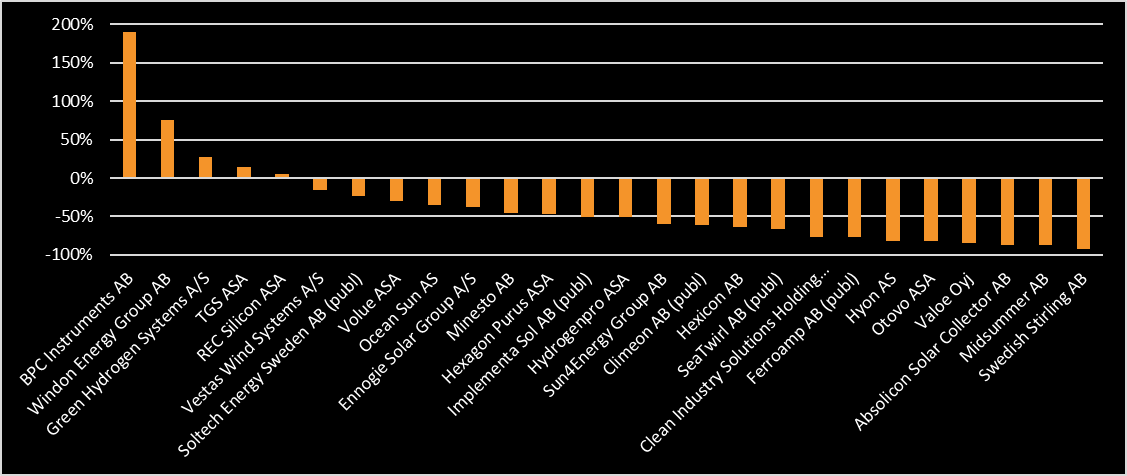

Energy Production Equipment & Services

The Energy Production Equipment & Services is providing technical equipment and machines among other energy producing companies such as Ørsted. The sector is to some extent influenced by oil and gas price fluctuations and industry trends. Year to date, BPC Instruments AB has performed best with an 190% increase.

Overview of the return year-to-date for the stocks in the Energy Production Equipment & Services sector

Power2X & Fuel Cells

The Power-to-X and Fuel Cells sector offers exciting investment opportunities in the evolving landscape of clean and sustainable energy technologies, but investors should also be mindful of the evolving regulatory and competitive landscape in this rapidly advancing field. Refuels NV remains only stock year-to-date with a postive return.

Overview of the return year-to-date for the stocks in the Power2X & Fuel Cells sector

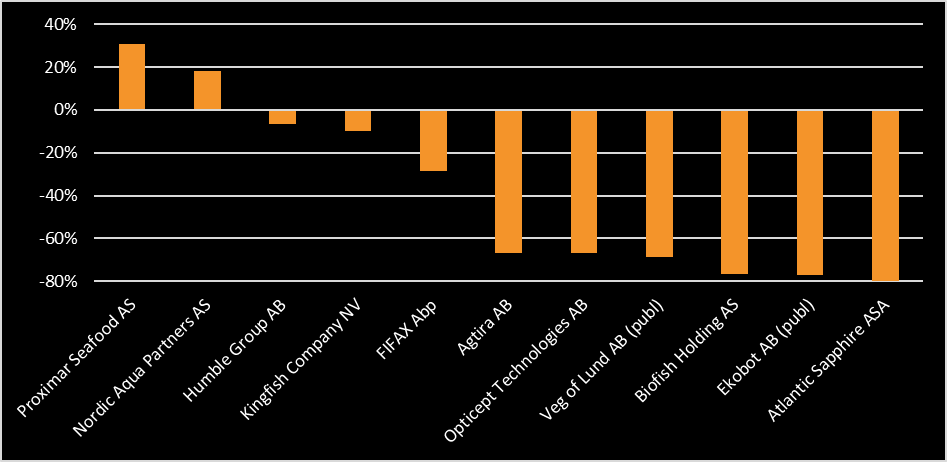

Food & Beverages

The food and beverages sector is heavily driven by consumer demand and having strong brands is a major advantage. Investors should focus consider factors such as changing consumer preferences, health and sustainability trends, and global supply chain dynamics to identify promising opportunities. Proximar Seafood AS and Nordic Aqua Partners AS within the fish industry is have delivered returns of 31% and 18% each.

Overview of the return year-to-date for the stocks in the Food & Beverages sector

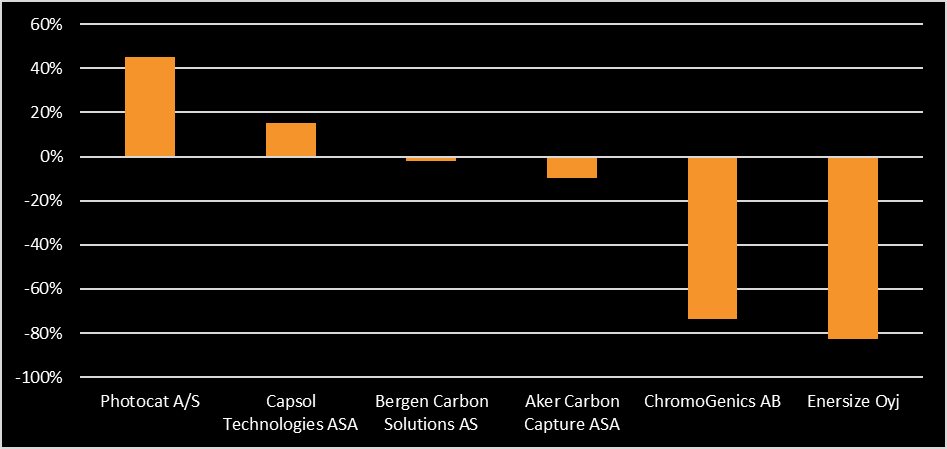

CO2 & Carbon Capture

The CO2 and Carbon Capture sector presents compelling investment opportunities into companies involved in capturing and removing carbon dioxide from the atmosphere. It is a small sector consisting of only 6 stocks, with Photocat A/S as the best performing year-to-date.

Overview of the return year-to-date for the stocks in the CO2 & Carbon Capture sector

Mobility

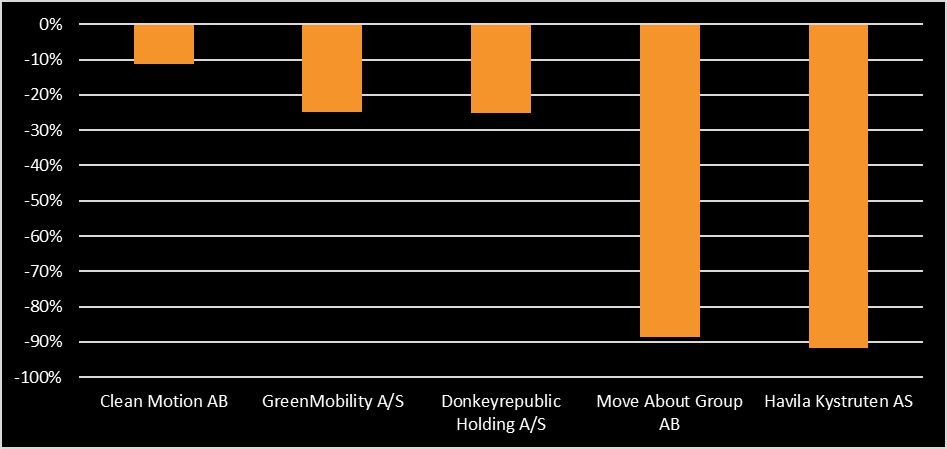

The mobility sector includes among others ride-sharing platforms and development of electric veichles with the purpose of lowering emissions and costs for consumers, while increasing flexibility. The mobility is the smallest sector we track with totalling 5 stocks. None of the companies have delivered a postive return year-to-date.

Overview of the return year-to-date for the stocks in the Mobility sector