Last week, the Danish recycling company Combineering A/S was sold to the UK-based Reconomy Group for approximately DKK 1.5 billion. Combineering is part of the circular economy, where residual waste from one industry is recycled in another, such as converting residual waste from the pharmaceutical industry into fuel in the biogas industry. This creates win-win situations for companies that have to get rid of waste and those who buy the new products. Waste is in many ways the new gold, so we take a closer look at the sector and interesting investment cases with billion-dollar sales potential.

A megatrend with high multiples

The market for waste recycling and the whole ESG trend of better use of resources is developing rapidly. The global market for recycling services was USD 60 billion in 2022 and is estimated to grow to USD 88 billion in 2030, with an annual growth rate of 4.8%. The sector is enjoying public and political tailwinds, while creating real economic value for companies. The sale price of Combineering was approximately DKK 1.5 billion and the company had a turnover in 2022 of 310 MDKK with 19 MDKK on the bottom line. This corresponds to a P/S value of 4.8 and a P/E value of 78.9.

3 companies with interesting solutions for the recycling and circular economy market

Recycling of plastics

Waste Plastic Upcycling (WPU) is a Danish company listed in Norway. The company has developed a technology to recycle plastic. It works by pouring plastic waste into a reactor that uses pyrolysis to heat the plastic to very high temperatures, which melts the plastic. When the melted plastic comes out of the reactor, it consists of 65-85% plastic oil. The majority is used to make new plastics, while the remainder can be used in the transportation sector.

The company is currently constructing three factories in Fårevejle, Naksov and Esbjerg. Production in Fårevejle is scheduled to begin in Q1 2023, while the factories in Naksov and Esbjerg are under construction and will be ready in 2024/2025. The company has no revenue at this time, and it is therefore a significant price trigger if/when the company successfully launches production and revenue.

The company has entered into an agreement with Vitol, where two additional plants will be constructed abroad before the end of 2026. Waste Plastic Upcycling has a target of 88 MEUR in revenue and EBITDA of 79 MEUR for the Danish plants, at full capacity utilization. The two foreign plants are expected to increase revenue by 55-70 MEUR and EBITDA by 45-60 MEUR. The company has a market capitalization of 1,462 MNOK (135 MEUR).

However, a major obstacle on the road is financing. The Danish plants cost 339 MDKK to construct, while the foreign ones cost 372 MDKK. This requires massive investments and financing. At the end of H1 2022, the company had 43 MNOK in capital, and they raised an additional 10.5 MNOK in August. There is therefore a need to raise capital in the short term.

Share price development for Waste Plastic Upcycling A/S year-to-date

Recycling end-of-life tires

Every year, more than 1 billion car tires are worn out globally, leaving them unusable for vehicles. Subsequently, the end-of-life tires are not sufficiently recycled. Scandinavian Enviro Systems AB has developed and patented a pyrolysis technology to convert end-of-life tires into oil, steel and carbon black for industries around the world. An interesting detail is that the company has partnered with Michelin, which has bought 20% of the shares.

The company is at about the same stage as Waste Plastic Upcycling. They have a limited turnover and are in the process of building their first full-scale production plant, which will be ready in 2023/2024. The first phase of the plant can handle 30,000 tons of car tires annually, while the second phase will increase capacity by 30,000 tons. Initially, the company is investing 398 MSEK in phase 1, and they estimate an annual turnover of 243 MSEK and EBITDA of 149 MSEK when the plant is completed, with a payback time of only 2.7 years.

The company’s solution is scalable and they expect to have more than 30 plants by 2030 with a turnover of 7 billion SEK and EBITDA of 4.5 billion SEK. SEK 7 billion and EBITDA of 4.5 billion. SEK. Scandinavian Enviro Systems has a market capitalization of 998 MSEK. The interesting question is whether the company can scale the business. Current production figures, potential customer agreements and sales figures therefore act as important price drivers. On the risk side is the lack of financing. The company had a cash balance of 30 MSEK at the end of 2022 with a deficit of 83.6 MSEK in 2022. Financing for continued operations and construction of new plants is therefore considered necessary in the short term.

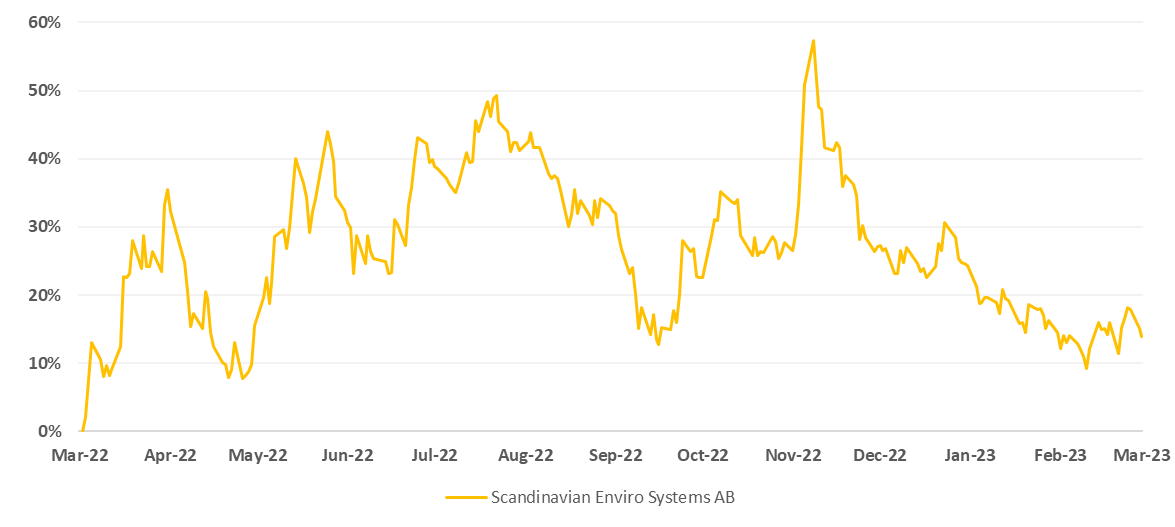

Share price development for Scandinavian Enviro Systems AB year-to-date

Sale of systems for recycling

Cambi ASA has developed technological systems to degrade different types of waste and sludge. The technology is primarily used for wastewater treatment and food waste management, which is later decomposed into biogas. Cambi primarily sells their plants as a system supplier, where they usually do not have ownership. To date, Cambi has sold 83 plants located in 25 countries.

Cambi’s business model is similar to companies in the elevator industry, where companies like Otis and Kone first install elevator systems and then service them. As a rule, the service part gives higher margins than the actual sale of the systems, but to make the service part a core part of the business, it also requires steadily increasing sales of systems to support the service business.

The company’s turnover in 2022 was 341 MNOK, of which the service part accounted for 73 MNOK, corresponding to 21% of the turnover. In comparison, the company’s market value is 1,159 MNOK. The result after tax was -14 MNOK, while the order backlog was 974 MNOK at the end of 2022. The order backlog itself and new sales agreements are a significant factor for future growth and earnings – also to support the service part. New sales agreements therefore act as price triggers.

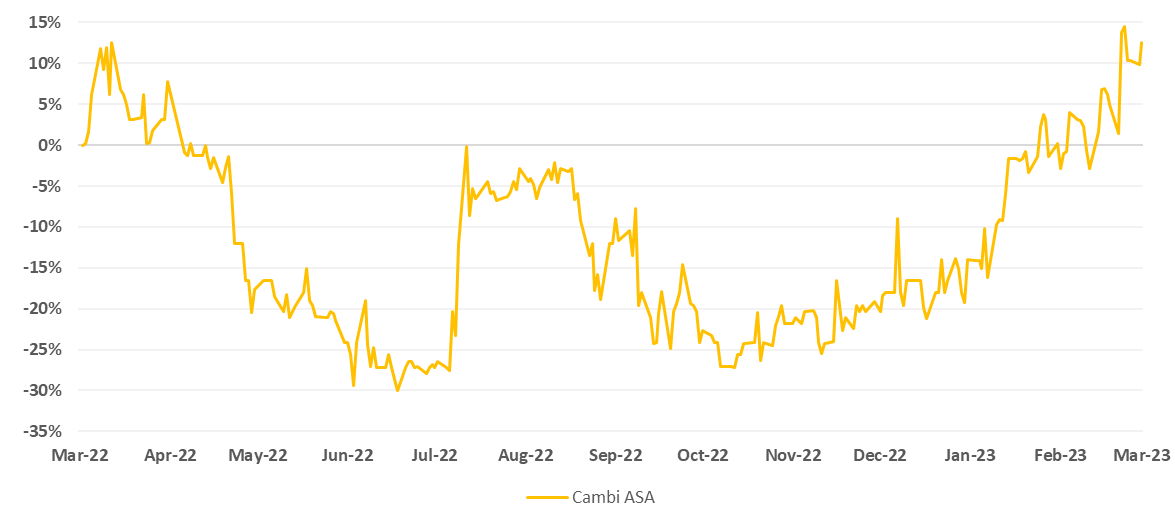

Price development for Cambi ASA year-to-date