Developments during the week at the Nordic growth exchanges

Shares on the Nordic growth exchanges (Kapital Partner Nordic Growth Exchanges Index/ KPNGX) rose 1.2% last week. In comparison, the Swedish S30 index rose by 0.7% while the Danish C25 index rose by 1.1%. The Nordic winning stock of the week was once again a biotech stock with a return of 85%.

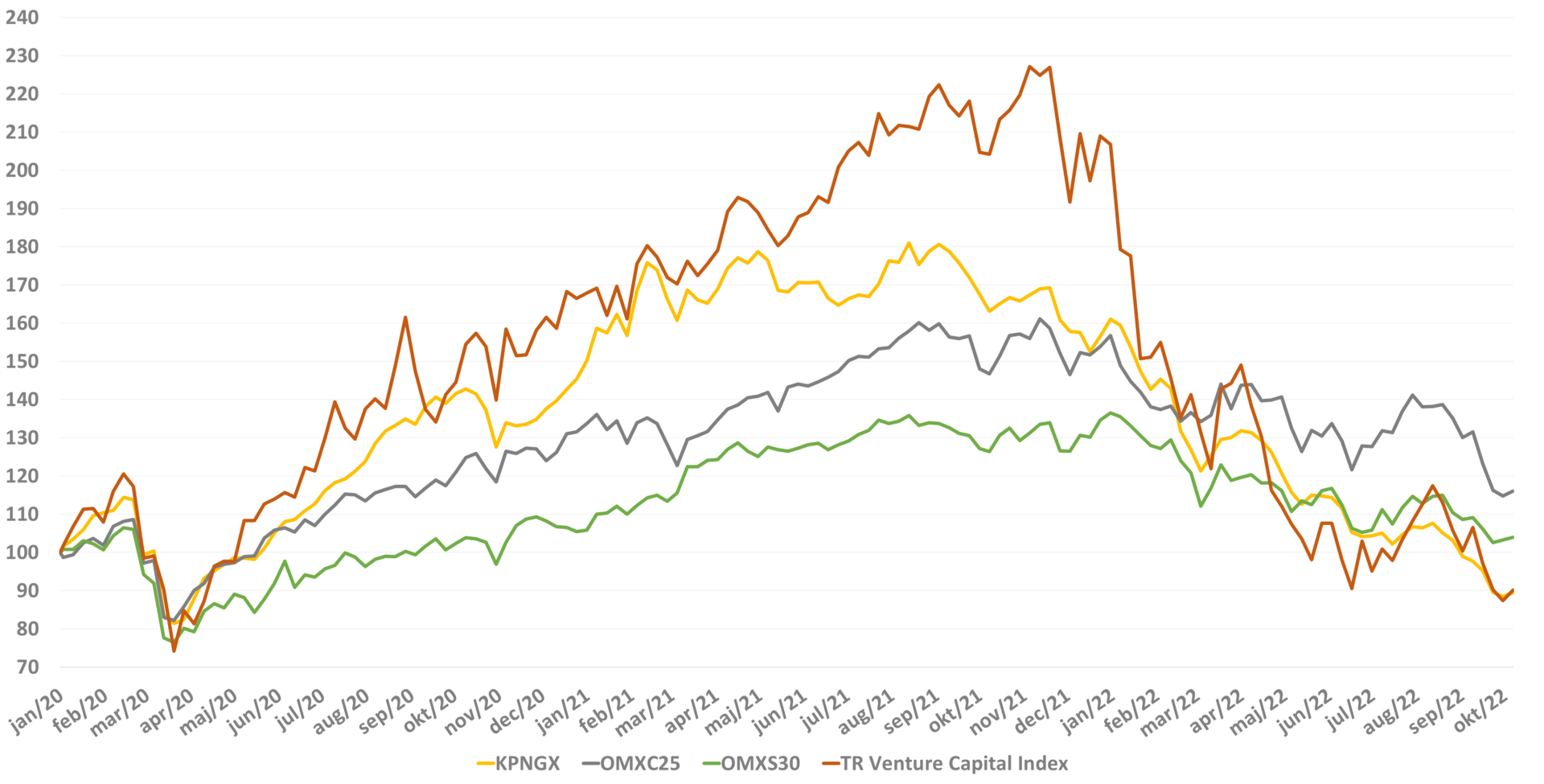

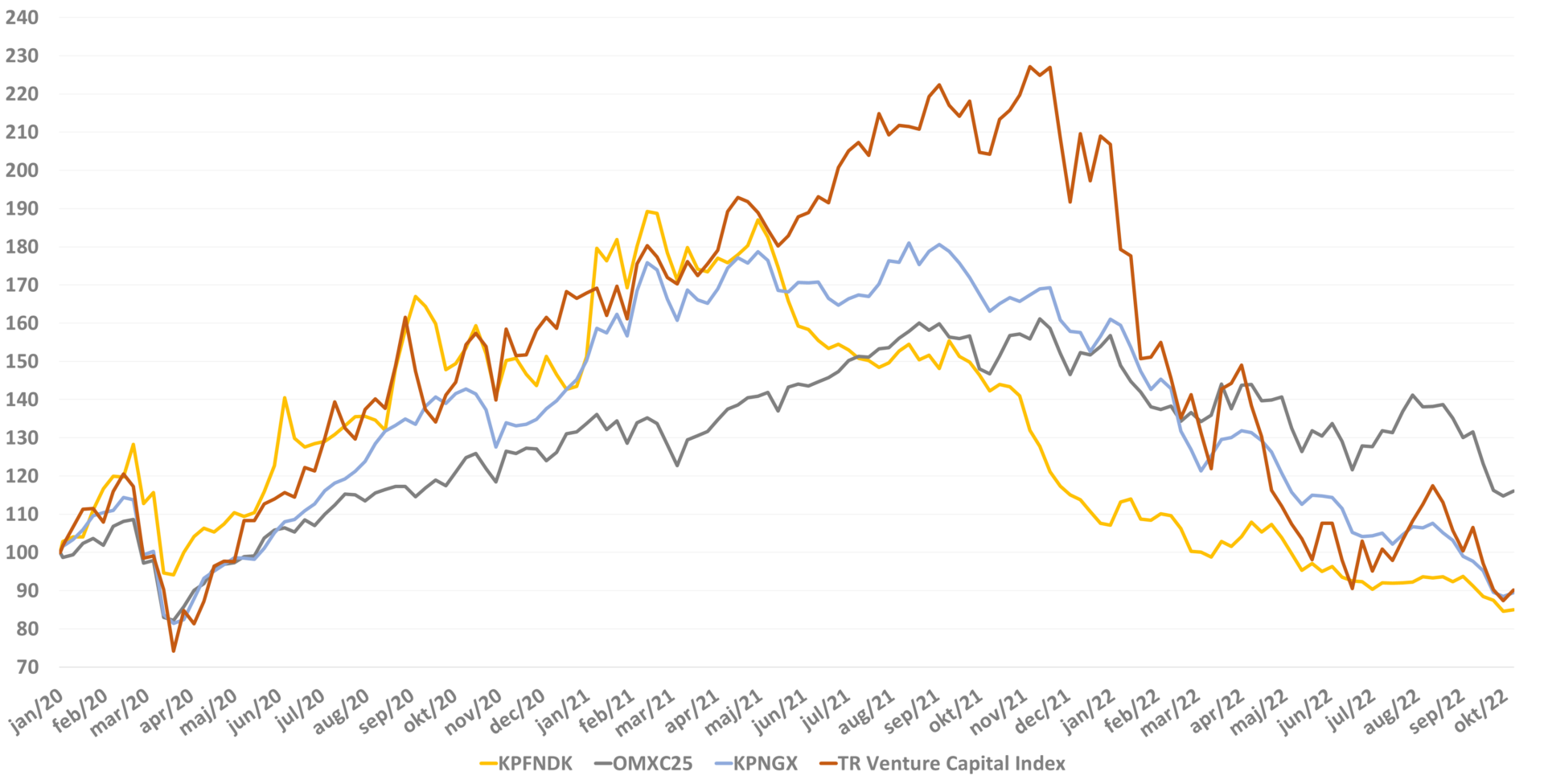

Since January 1, 2020, both the KPNGX index and the Thomson Reuters Venture Capital Index have fallen approximately 10%. The development of Nordic growth stock markets thus corresponds to the development of the venture sector. Year to date, the KPNGX index has fallen 45%, while the Thomson Reuters Venture Capital Index has fallen 56%.

KPNGX index development since 01.01.2020

The sentiment on the Kapital Partners index last week

The trend for Nordic growth stocks was balanced last week. On the Nordic growth exchanges as a whole, 454 out of 908 stocks rose (50%), while the figure was 21 out of 51 stocks on First North Denmark (41%) and 156 out of 293 (53%) for Nordic healthcare stocks. Thus, there was a balanced development.

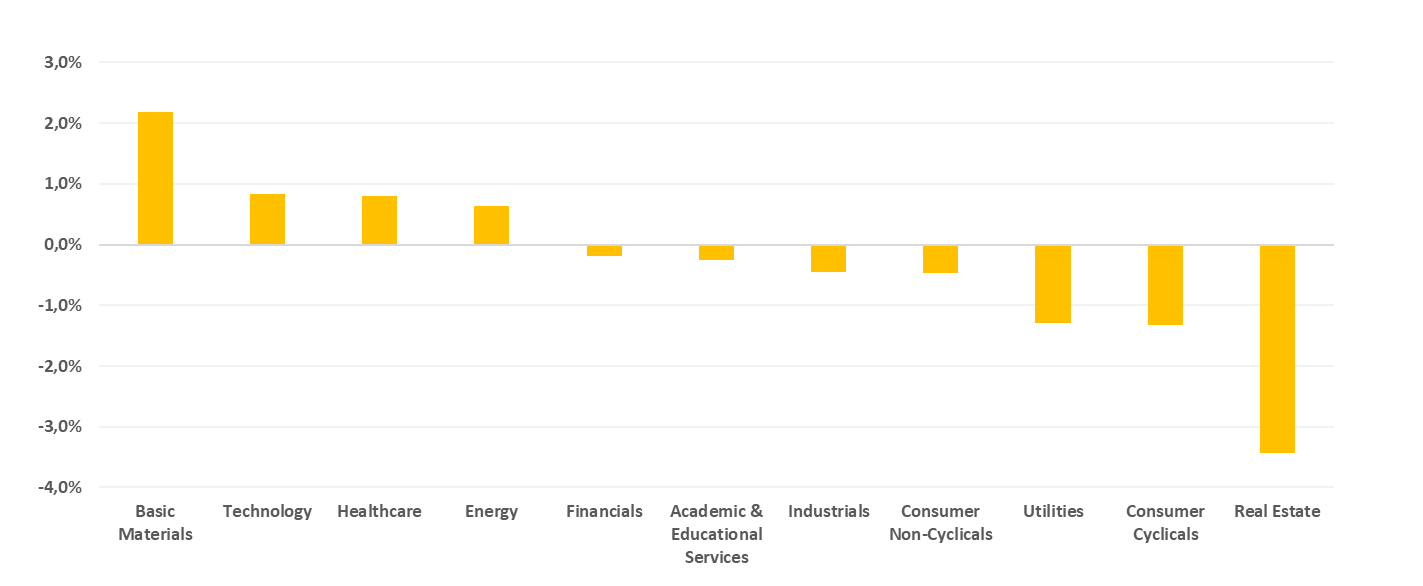

Sector development the past week

Basic Materials fared best during the week, rising 2.2%, while Technology, Healthcare and Energy followed with fine gains. Real estate fared worst with a fall of 3.4%. Year-to-date, the Energy sector has fared best in the wake of the energy crisis with a fall of 8.4%, while Healthcare has fallen the most with -46.5%.

The 3 best performing stocks on the Nordic growth exchanges last week

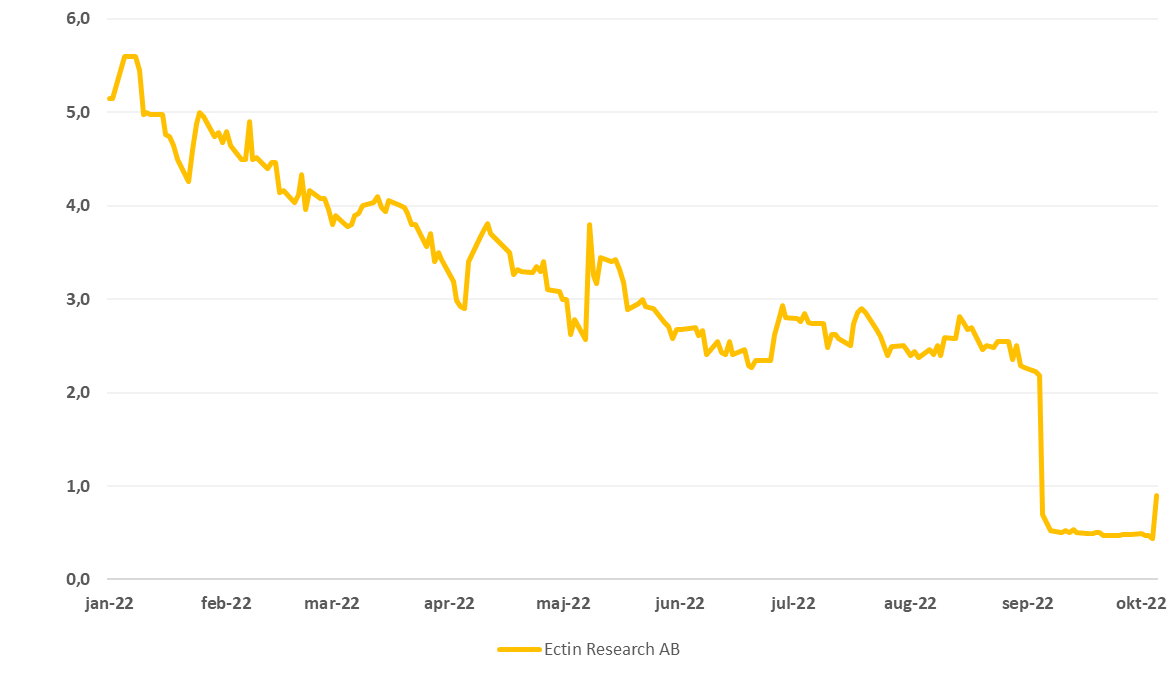

Ectin Research AB (+85%) specialises in the research and development of drug candidates aimed at eliminating cancerous tumours in patients, with a primary focus on the treatment of bladder cancer. In addition, the company intends to develop drugs for the treatment of breast, colorectal and prostate cancers.

The share price rose after the company decided to cancel its planned rights issue and instead seek alternative financing solutions in light of the fact that the company’s share price has fallen over 80% year to date. This was based on a trading volume of SEK 0.7M and Ectin Research AB has a market capitalisation of approximately SEK 11M.

Share price development of Ectin Research AB year to date

FluoGuide A/S (+74%) focuses on the treatment of cancer, where the company’s products can illuminate cancer cells in order to remove harmful tumors with greater precision in the patient’s tissue.

The company announced on 3 October that it had presented results from phase 1/2a studies in patients with brain cancer at the World Molecular Imaging Congress, held 28 September – 1 October 2022. FluoGuide A/S is a Danish company but is listed in Sweden. The company has a market capitalisation of 792MSEK.

Share price development of FluoGuide A/S year to date

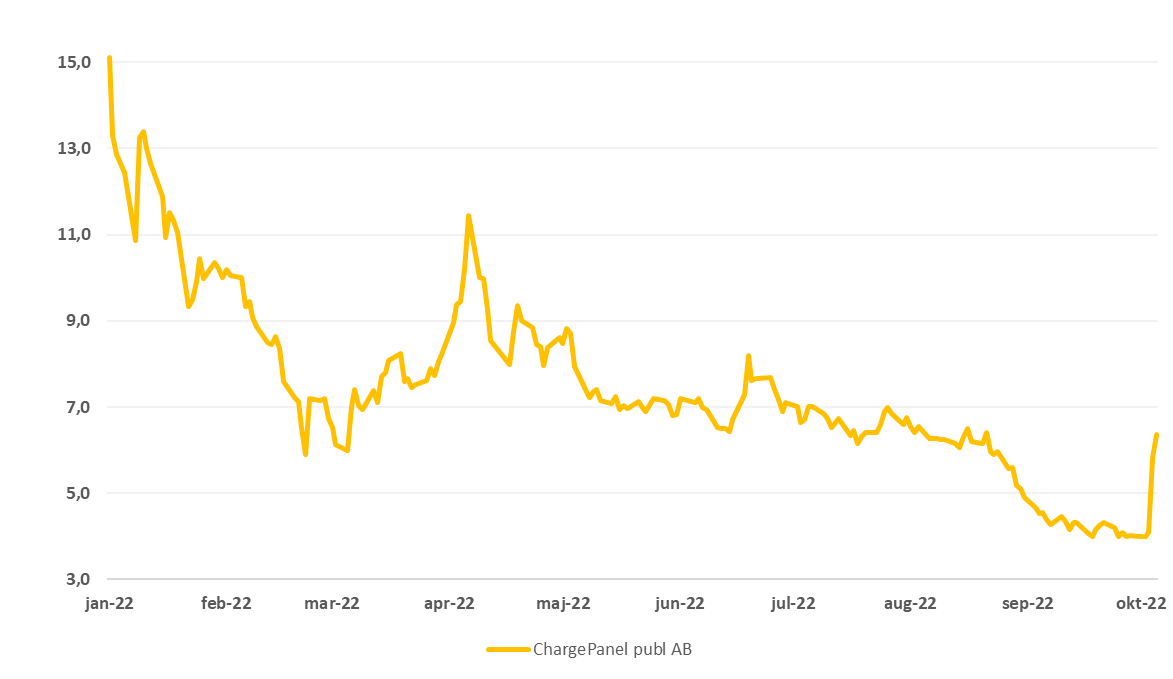

ChargePanel AB (+58%) owns and operates a SaaS platform for B2B customers within electric vehicle charging. ChargePanel also has a mobile app where electric car owners can find charging stations and arrange payments. ChargePanel AB entered into a cooperation agreement with Bumblebee during the week for approximately 200 charging stations to be connected to ChargePanel’s solutions. The company has a market capitalisation of SEK 104 million and its share price has fallen 35% since the start of the year.

Share price development of ChargePanel AB year to date

Developments during the week on First North Denmark

The Kapital Partner First North Danmark (KPFNDK) index rose 0.4% last week. The KPFNDK index is one of the best performing stock indices in the Nordic region year to date with -21% compared to KPNGX (-45%) and C25 (-26%). As it can be seen from the graph, the performance of First North Denmark, the Nordic growth stock exchanges and the venture index is broadly similar since 1 January 2020 – albeit negative in the 11-15% range.

Read more: “Strategic review” after the company has risen 13%

KPFNDK index development since 01.01.2020

Developments during the week on First North Denmark at company level

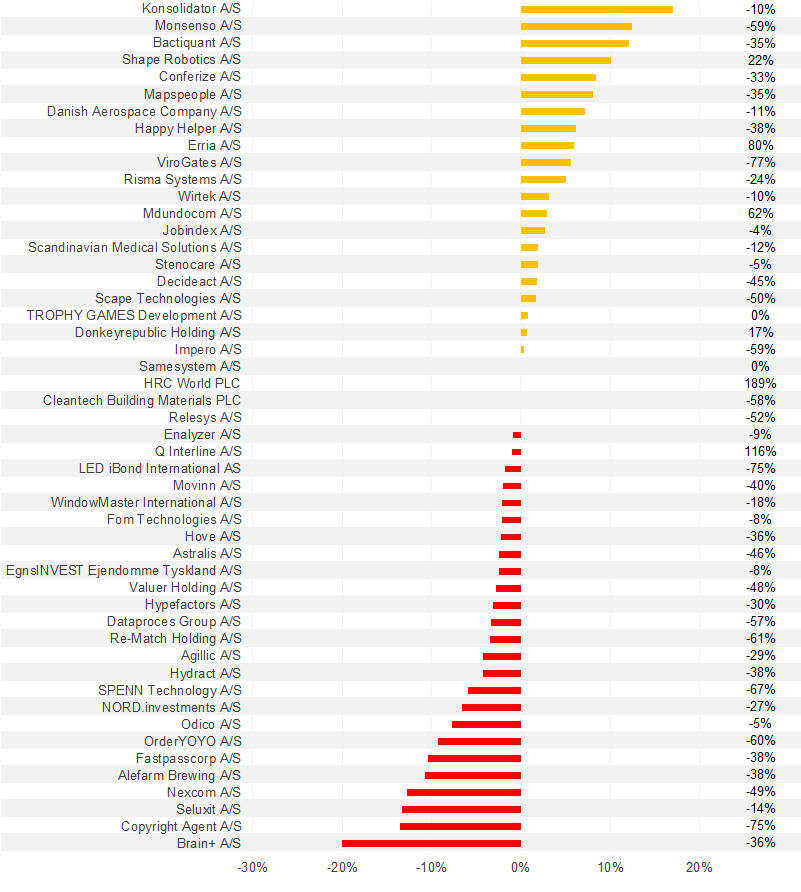

Konsolidator A/S was the winner of the week with an increase of 17%. Monsenso A/S and Bactiquant A/S followed with increases of around 12%. Of the three companies, Konsolidator A/S has come through the year quite nicely with -10% in returns compared to the general development on First North Denmark. Brain+ A/S, on the other hand, was the worst performing stock of the week with -20%.

Development on First North Denmark last week and year to date

Best performing stock of the week on First North Denmark: Konsolidator A/S

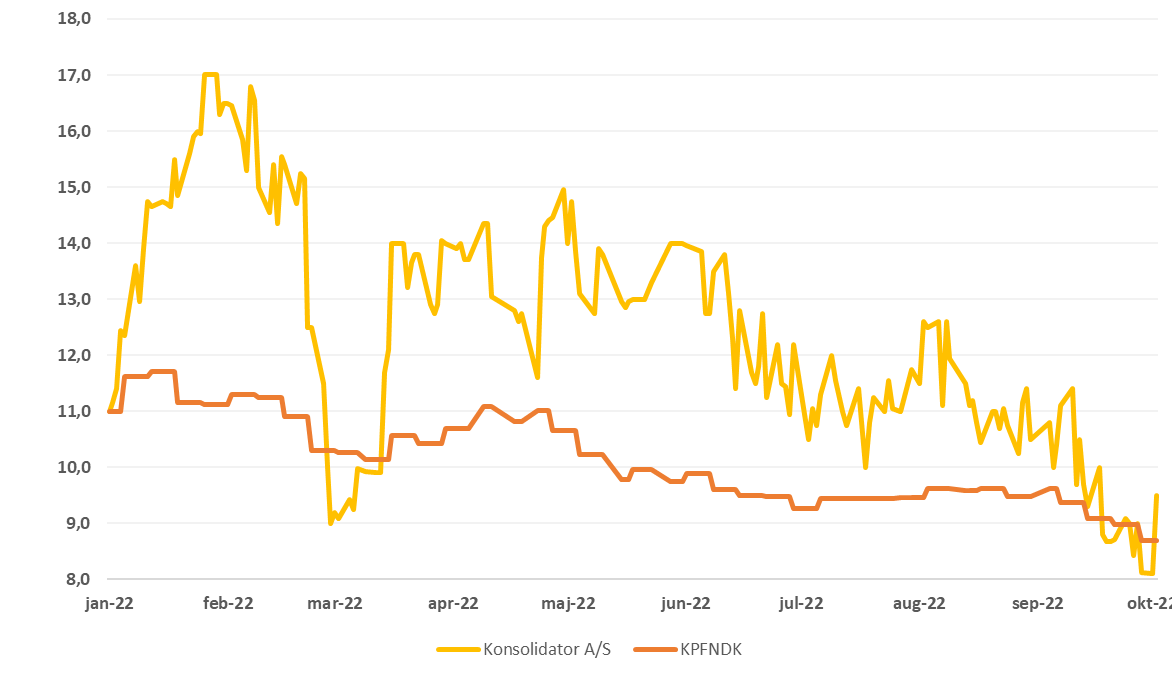

Konsolidator A/S (17%) develops IT solutions for reporting consolidation programmes. The products are, for example, focused on budgeting and forecasting, cash flow analysis, currency conversion and other accounting applications. The programmes are used among small and medium-sized corporate customers, mainly CFOs and accounting departments.

The company has a market capitalisation of 150MDKK and the share price has fallen 10% year to date.

Price chart of Konsolidator A/S year to date

Developments during the week for the Nordic healthcare stocks

Nordic healthcare stocks (Kapital Partner Healthcare Index/KPHC) have really taken a beating in 2022, falling around 49%. Last week, however, the KPHC index rose 2.1%, with the aforementioned Ectin Research AB (85%) and Fluoguide A/S (74%) making up the top 3 along with Egetis Therapeutics AB (42%). Learning 2 Sleep L2S AB, which made up the top 3 last week, fared worst with a 33% fall.

KPHC index development since 01.01.2020

Read more: Success leads to launch of next phase