In May, the current CEO of Ekobot resigned from his position, causing turmoil and a falling share price. The company has now found its new CEO and can once again look forward in pursuit of its strategic goals for 2023 and beyond.

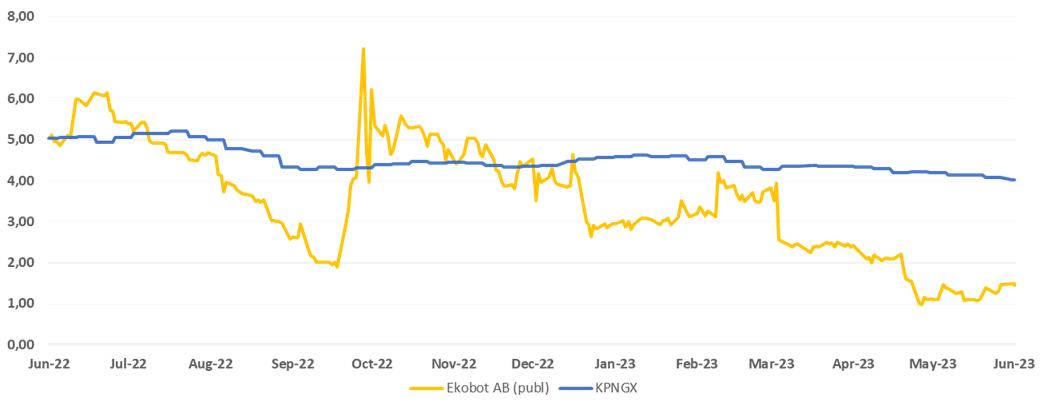

EKOBOT: Ticker: EKOBOT | Price: SEK 1.45 | Market Cap: SEK 23 million | YTD price development: -72%

EKOBOT has developed an agricultural robot that both removes weeds and collects crop data, allowing farmers to reduce their costs by up to 20%. EKOBOT focuses on crops that are difficult/costly to grow in terms of weed control, and thus the segment of agriculture that has the greatest economic benefit from using robots. Organic farms in particular benefit from robots for weed removal as they do not use pesticides, but conventional farms also benefit financially. EKOBOT has begun commercialization, with Denmark, Sweden and the Netherlands being the main markets.

New CEO brings valuable experience

In May, the current CEO of EKOBOT, Erik Jonuks, resigned from his position. His replacement has been found in the form of Jonas Eklind, who will take over on September 1. Eklind has, among other things, been CEO of the listed energy storage company Azelio AB from 2015-2022, chairman of the board of the international measurement company Shapeline AB 2015-2020 and most recently business consultant at Konkret VD Stöd. Ekobot now has a CEO with valuable experience from a listed company and companies with industrial solutions that can prove useful when Ekobot takes the next step. In addition, Eklind has a particular focus on pulling companies from the development phase into the commercial phase, which is exactly where Ekobot is.

The investment case is hit

We have previously mentioned how the resignation of Erik Jonuks has probably led to a standstill for the company in terms of attracting new capital and sales of robot units. Since the resignation of Erik Jonuks, the share price has dropped 34%, but with the hiring of Jonas Eklind, the company can once again look forward to achieving its strategic goals for 2023, including signing contracts for 25 robot units and an agreement with a pilot customer for Ekobot Plus (AI-based robot solution). Achieving the strategic goals for 2023 is crucial for the investment case as it can bring back confidence and subsequently boost the share price. In other words, new agreements with customers act as price triggers.

Read more: The investment case for Ekobot

The share price of Ekobot vs. Kapital Partner Nordic Growth Index over the past year