Mdundo is guiding for strong growth for the 2023/24 financial year and remains on course for its long-term goals in 2025. Will this also put the share price on the growth track?

Mdundo: Ticker MDUNDO | Price: 7 DKK | Market Cap.: 72 MDKK | YTD price development: 6%

Mdundo is a music service similar to Spotify, but with a sole focus on the sub-Saharan African market. Mdundo is Danish-led with operational headquarters in Kenya, but developed 100% according to African consumer wants and needs. Mdundo’s streaming product consists of a music service optimized for unstable internet connections and low-end smartphones, which can be accessed online via the website www.mdundo.com and via an Android app for mobile phones. Mdundo has over 26 million active users on both the web and the app.

See the investment case and upcoming price triggers for Mdundo here

Guidance with strong growth – and on track in terms of earnings

Mdundo has issued guidance for the financial year 2023/24 from July 2023 to June 2024. Many growth companies have changed their focus from growth to positive earnings in the past year, but Mdundo, which has good liquidity, continues to keep its foot on the accelerator with guidance of strong growth while expecting an improvement in earnings.

For 2023/24, the company expects a growth in monthly active users (MAU) from currently 26 million to 35 million, corresponding to 35% growth compared to the last financial year. Similarly, the company expects revenue to end up in the range of 17-21 MDKK, corresponding to a growth of 31%. Finally, Mdundo expects an improvement in EBITDA of -6.5 to -7.5 MDKK compared to -7 to -8.5 MDKK in the current financial year. The company remains a growth company and is still on course for its long-term goals of 50 million monthly users and positive EBITDA in 2025, which would make Mdundo a very obvious acquisition candidate.

The share price has fallen since the IPO, even though key figures have improved

The company’s share price has been steadily declining since the company went public in 2020. The closing price on the first day of trading on September 4, 2020, was DKK 9.55, and the share price is now DKK 7. This is despite the fact that the company has had a solid development in the company’s key figures. Guidance for the financial year 2023/2024 reflects a 7x growth in monthly active users (MAU) and 11-13x growth in revenue since the company went public. However, the company still has a negative EBITDA, which has likely depressed the share price. As mentioned, the company has a target of positive EBITDA for 2025, and progress in the financial key figures, including positive EBITDA, are crucial price drivers that can lift the share price and interest in the share.

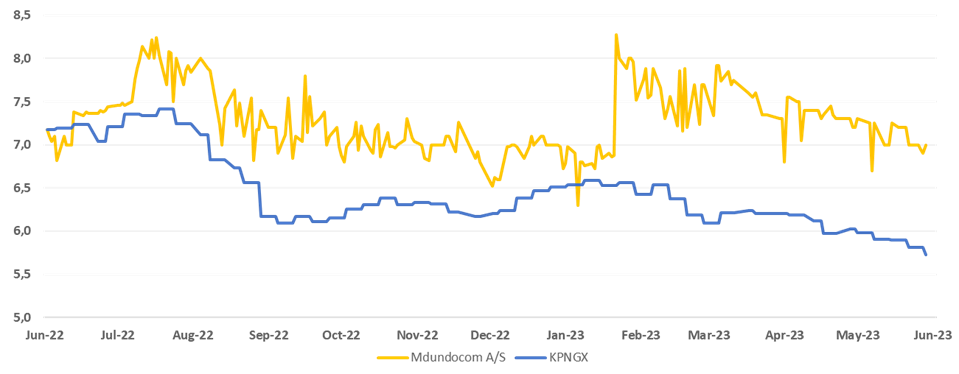

Share price for Mdundo vs. Kapital Partner Nordic Growth Index over the past year