Curasight and Curium of France have entered into a partnership agreement for uTRACE for prostate cancer. This has triggered a significant price trigger, and Curasight will receive up to USD 70 million in milestone payments and royalties on the sale. We see this as a validation of Curasight’s platform and a strengthening of the investment case.

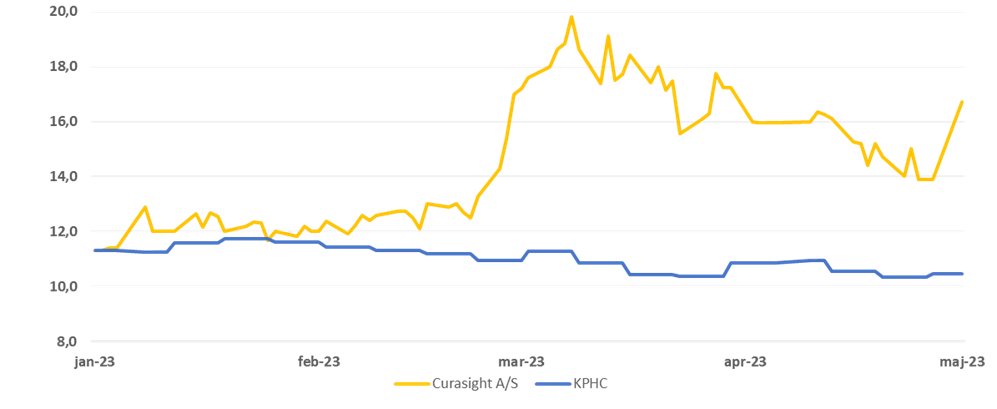

Curasight: Ticker: CURAS | Price: DKK 16.7 | Market Cap: DKK 332m | YTD price performance: 54% | YTD price development: 54

Curasight A/S, a phase 2 biotech company, has developed two products that can identify cancer cells (uTRACE) and target radiation therapy (uTREAT) to cancer cells. The advantage of Curasight’s products is that they avoid irradiating healthy tissue, which is a major side effect of traditional radiotherapy. Curasight avoids this by having uTREAT bind to receptors that are only found in cancer cells and thereby only emit radiation against cancer cells, leaving healthy tissue unaffected.

Major financial deal for Curasight

The partnership agreement with Curium PET France includes uTRACE against prostate cancer, where Curasight’s responsibility is to further develop the product until approval in the EU and the US, after which Curium is responsible for production and commercialization. Curasight will receive up to USD 70 million in development and commercial milestone payments and double-digit royalties on sales. The percentage is not disclosed, but typically 10-20% royalties are involved in similar agreements. Curium is a world leader in radioactive medicine with a presence in more than 60 countries and over 2000 employees worldwide. We consider it a validation of Curasight’s platform that Curium chooses to enter into a partnership with Curasight.

Curasight retains valuable rights

The partnership with Curium is exclusively for uTRACE in prostate cancer. Curasight continues to own the rights to uTRACE in all indications other than prostate cancer and also all rights to uTREAT. Curasight can thus enter into new agreements with other indications and thereby realize additional value. Curasight has previously conducted Phase II studies with uTRACE in brain cancer, neuroendocrine tumors and head and neck cancer, where new partnerships may be entered into.

Strengthening the investment case

The partner agreement has triggered a significant price trigger in relation to entering into a partnership with a large pharmaceutical company. We consider it a significant strengthening of the investment case on several fronts, as the company’s platform is partly validated by a large and recognized partner, and the company receives funding over time, which reduces the risk of further capital injections. In addition, it adds real economic value to the company’s pipeline. As mentioned above, the agreement only covers uTRACE against a single indication. The company still owns the rights to all other indications for uTRACE, as well as all rights to uTREAT, which has greater long-term potential than uTRACE. The rest of the company’s pipeline is thus worth significantly more than the value of yesterday’s partnership agreement with Curium.

At the end of last year, Curasight had a cash balance of approximately DKK 50 million and with today’s partner agreement, the company does not need a capital injection this year.

Read more: The investment case of Curasight

Price development for Curasight vs. KPHC-indekset year-to-date