Nexcom maintains a revenue in the level of DKK 11-15 million and EBITDA in the level of (2) – 1.5 million for 2023 after a first quarter of 2023 that had lower revenue but better earnings compared to last year. The investment case is therefore still based on a relatively low pricing relative to the customer potential, including momentum in sales of the AI products.

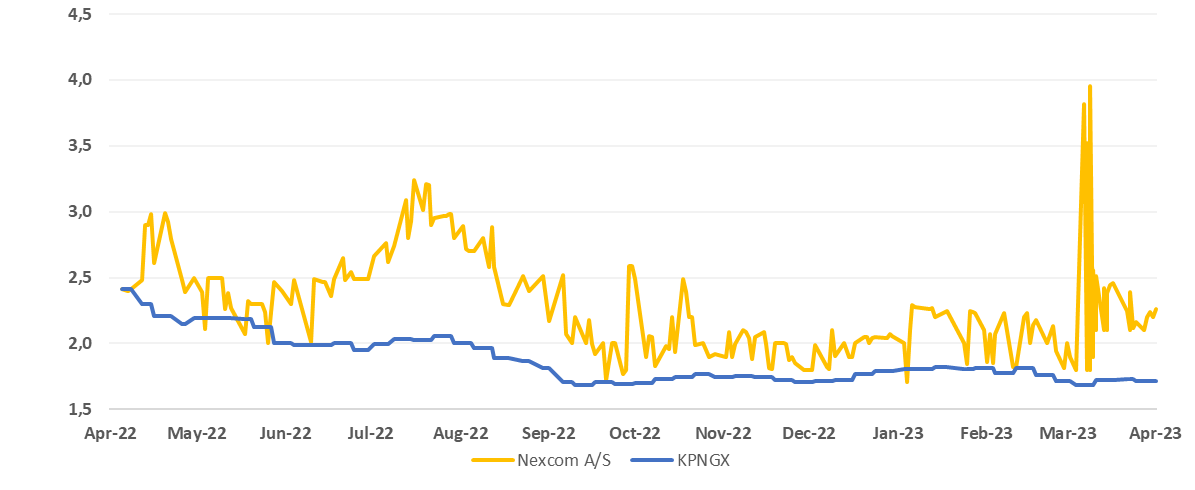

Nexcom: Ticker: NEXCOM | Price: DKK 2.26 | Market Cap: DKK 32 million | YTD price development: 19%

About: Nexcom delivers automated IT and AI systems (SaaS) for handling customer inquiries, especially for B2C companies within telephony, insurance and energy. Customers are from Scandinavia, Europe and North America and include Telenor in Denmark and the US, Telia in Denmark, Norway and Lithuania, and Groupon, RealPage and Lash in the US.

See the Nexcom investment case here

Focus on cash flow led to a decline in revenue, but improved results

Due to a lack of growth, especially in the US, and limited liquidity, Nexcom shifted its strategic focus last year to achieving cash flow positive operations at the expense of short-term growth. In Q1 2023, Nexcom achieved a turnover of DKK 1.5 million (2.4), EBITDA of DKK -2.2 (-4.0) and a result before tax of DKK -3.8 (-5.4) and thus a result in line with the strategy.

Significant improvement of the result

Nexcom has long-term contracts and thus also good financial visibility. For the year, the company maintains a revenue of DKK 11-15 million, corresponding to a revenue growth in the range of 40% – 90% compared to 2022, where revenue fell to DKK 7.9 million from DKK 13.4 million the year before. In addition, a significant improvement in operating profit (EBITDA) from -14.0 million in 2022 to the level of (2) – 1.5 million is maintained.

The investment case depends on two factors

In order for Nexcom to reach its revenue and earnings guidance for this year with revenue of DKK 11-15 million and EBITDA of DKK (2) – 1.5 million respectively, a capital injection of approximately DKK 7.5 million is required. Nexcom expects the capital injection to be completed during Q3 this year.

Conversion of the ongoing pilots with especially American companies to customers during the second quarter, which can prove the interest in Nexcom’s services, is also required for both the company’s operations and investors’ confidence in the case.

A case that invites special investors

With a customer base including large US companies and a US sales office, Nexcom could be an interesting company for investors specializing in tech scaleups. There have already been two such investments this year on First North Denmark, and with a market capitalization of approx. 2x revenue, Nexcom is probably an interesting investment case for specialized Saas/tech investors.

(AI) Price triggers

With a share price that has been negatively impacted by a lack of delivery on the announced expectations, including customer additions, we continue to expect that the share price will primarily be influenced by 1) the signing of contracts with new customers and 2) the completion of the capital increase. There has been relative silence around Nexcom’s AI product developed in collaboration with Telenor. With the existing hype around AI, news about AI could probably also have a significant – positive – effect on the share price.

Price development for Nexcom vs. Nordic Growth Exchanges Index (KPNGX) over the past year