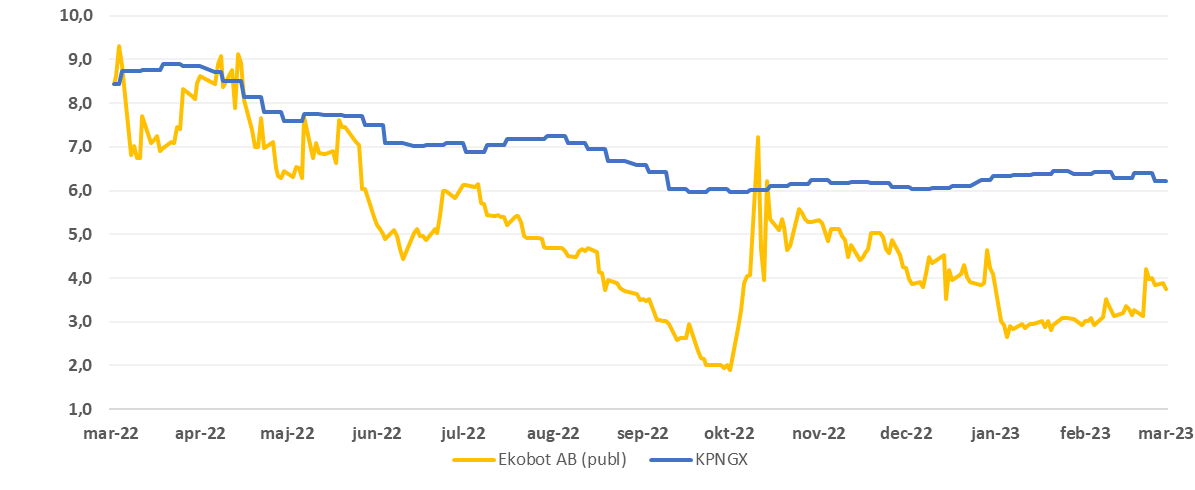

Ekobot: Ticker EKOBOT | Price: 3.49 SEK | Market Cap: 47 MSEK | YTD price development: -12%

EKOBOT has developed and sells an agricultural robot that both removes weeds and collects data about the crops, allowing farmers to reduce their costs by up to 20%. Ekobot focuses on crops that are difficult/costly to grow in terms of weed control, and thus also the segment of agriculture that has the greatest economic benefit from using robots. Especially, but not only, organic farms benefit from robots for weed removal, as they do not use pesticides. The focus markets are Sweden, the Netherlands and Denmark.

SEK 28 million for growth capital

The preliminary result of the issue of SEK 21M shows a subscription of 130%. This means that the issue guarantees will not be needed and there is also the possibility of using the right to over-allotment of approximately SEK 6M. Ekobot is thus secured capital to be able to deliver the robots for which orders have already been received and to be able to sell the 25 robots that are expected this year.

Price trigger

The share issue was offered at a share price of SEK 2.50 and thus at a significant discount to the share price before the issue. After the issuance of the new shares, Ekobot’s market capitalization is still only around SEK 50 million and that is including the new capital. The successful issue, which gives Ekobot the opportunities to realize its revenue and sales expectations for 2023, is therefore a potential price trigger.

Price development for Ekobot AB vs. Kapital Partner Nordic Growth Exchange index (KPNGX) the past year