Energy prices have run away in 2022. Ørsted and Vestas are familiar names to Danish investors, but looking beneath the surface, the next Vestas or Ørsted might be found. The hype for green stocks is currently gone, and that makes for attractive price points – we’ve found four of them.

The spot price for a barrel of crude has risen from about $78 to about $86 year to date. In the same period, the price of European natural gas has risen from about €80 to about €186 per megawatt-hour. This hits private consumers through lower affordability, and companies are hit by increased costs resulting in lower profits if they do not raise prices.

During the oil crisis of the 1970s, Vestas explored the potential of wind turbines and in 1979 produced its first wind turbine, which is today the world leader in wind turbines. Today’s energy crisis could be the breeding ground for tomorrow’s green winners. Below are 4 interesting stocks in the green transition.

- Energy form with highest CO2 savings per krone invested

Swedish Sterling AB uses a Stirling engine to convert thermal energy into electricity. The company’s latest product – PWR BLOK – is a self-developed solution for recycling energy from industrial waste gases, converting it into 100% CO2-neutral electricity with high efficiency. Independently certified, PWR BLOK is one of the cheapest ways to generate electricity and offers greater CO2 savings per penny invested than any other form of energy.

Swedish Sterling AB has a market capitalisation of SEK 873 million and its share price has fallen 55% year to date.

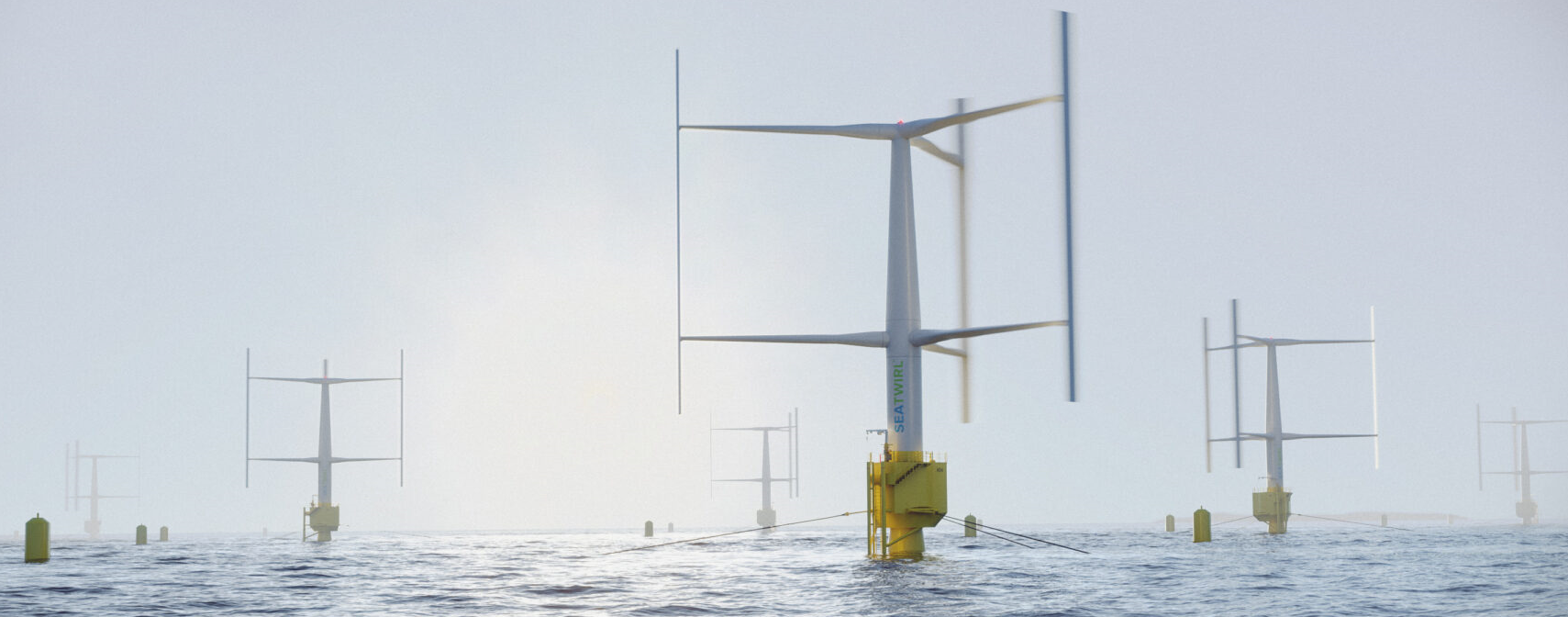

- Floating offshore wind turbines with vertical axis

SeaTwirl AB develops floating wind turbines adapted to the sea. The company’s technology uses a wind turbine with a vertical axis as opposed to traditional wind turbines which have a horizontal axis. A key advantage of Seatwirl’s floating wind turbines is that they can be placed at greater depths than conventional wind turbines in that they do not require a fixed foundation. As a result, Seatwirl wind turbines can be installed in areas that are currently inaccessible to conventional wind turbines.

SeaTwirl AB has a market capitalisation of SEK 318 million and its share price has risen 15% year to date.

- Danish hydrogen specialist

Everfuel A/S develops technical systems for hydrogen supply to heavy vehicles and industrial operators. Everfuel A/S owns and operates green hydrogen infrastructure and partners with vehicle OEMs to connect the entire hydrogen value chain. Green hydrogen is a 100% clean fuel produced from renewable energy and is considered part of the green solution for the transport sector in Europe.

Everfuel A/S is a Danish company but is listed on Euronext Growth in Oslo. The company has a market capitalisation of NOK 3.5 billion and its share price has risen 17% this year.

- Classic supplier of solar energy projects

Norsk Solar AS is a full-service solar project provider that develops, installs and sells solar energy solutions. In addition to the main business, it offers aftermarket services, support and maintenance. Customers are primarily companies. Norsk Solar has 107MW in operation or under construction including a project in Ukraine.

Norsk Solar AS has a market capitalisation of MNOK 315 and the share price has fallen 42% year to date.

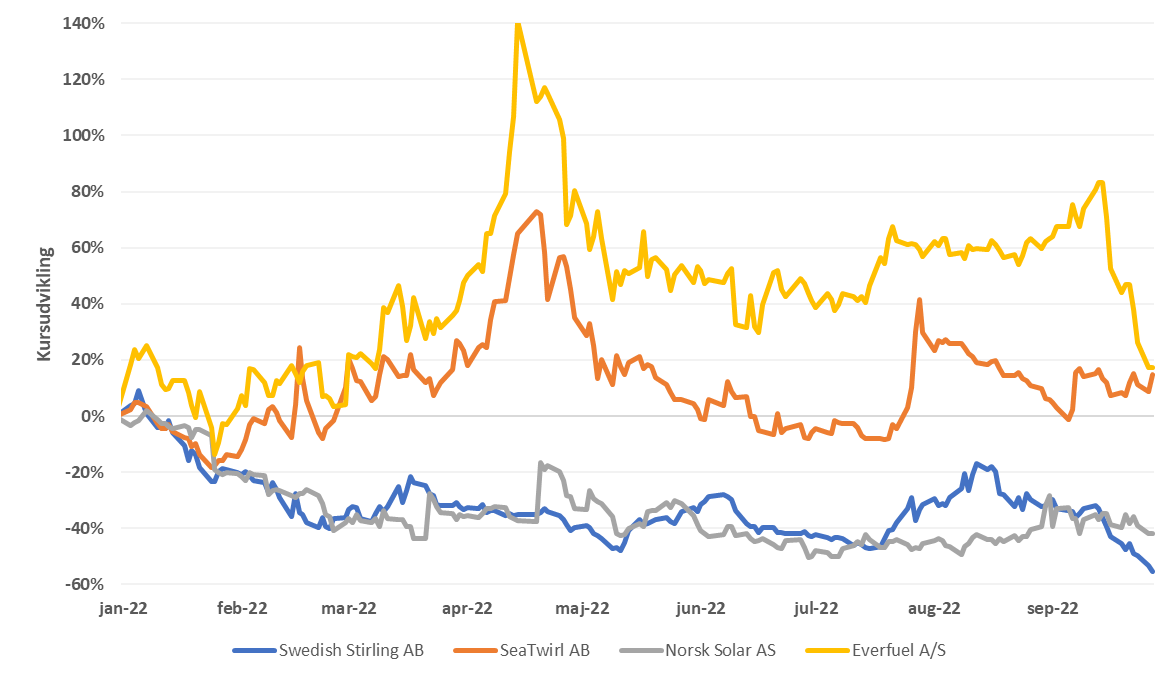

Price development year to date for Swedish Stirling AB, SeaTwirl AB, Everfuel A/S and Norsk Solar AS