EKOBOT’s CEO, Erik Jonuks, is resigning, which will probably cause some standstill in relation to the company’s ability to attract new capital and possible interest in buying EKOBOT. This could put pressure on the share price until a new CEO is found.

EKOBOT: Ticker: EKOBOT | Price: SEK 1.87 | Market Cap.: SEK 28 mio. | YTD price development: -61%

EKOBOT has developed an agricultural robot that both removes weeds and collects data on the crops, allowing farmers to reduce their costs by up to 20%. EKOBOT focuses on crops that are difficult/costly to grow in terms of weed control, and thus also the segment of agriculture that has the greatest economic benefit from using robots. Organic farms in particular benefit from robots for weed removal, as they do not use pesticides, but conventional farms also benefit economically.

EKOBOT has started commercialization, with Denmark, Sweden and the Netherlands being the main markets.

Up to 6 months until new CEO

Erik Jonuks has resigned from his position as CEO to join another undisclosed company. Erik Jonuks will continue as CEO during the notice period of 6 months and will also be active in hiring a new CEO.

Read more: The investment case for Ekobot

EKOBOT needs additional capital within the next 12 months. The capital need is therefore not urgent and the process will probably be postponed until a new CEO is found. Before a permanent CEO is found, there will probably not be interest from large investors, including investors who could be interested in buying the entire company. This part of the investment case is therefore not so relevant at the moment.

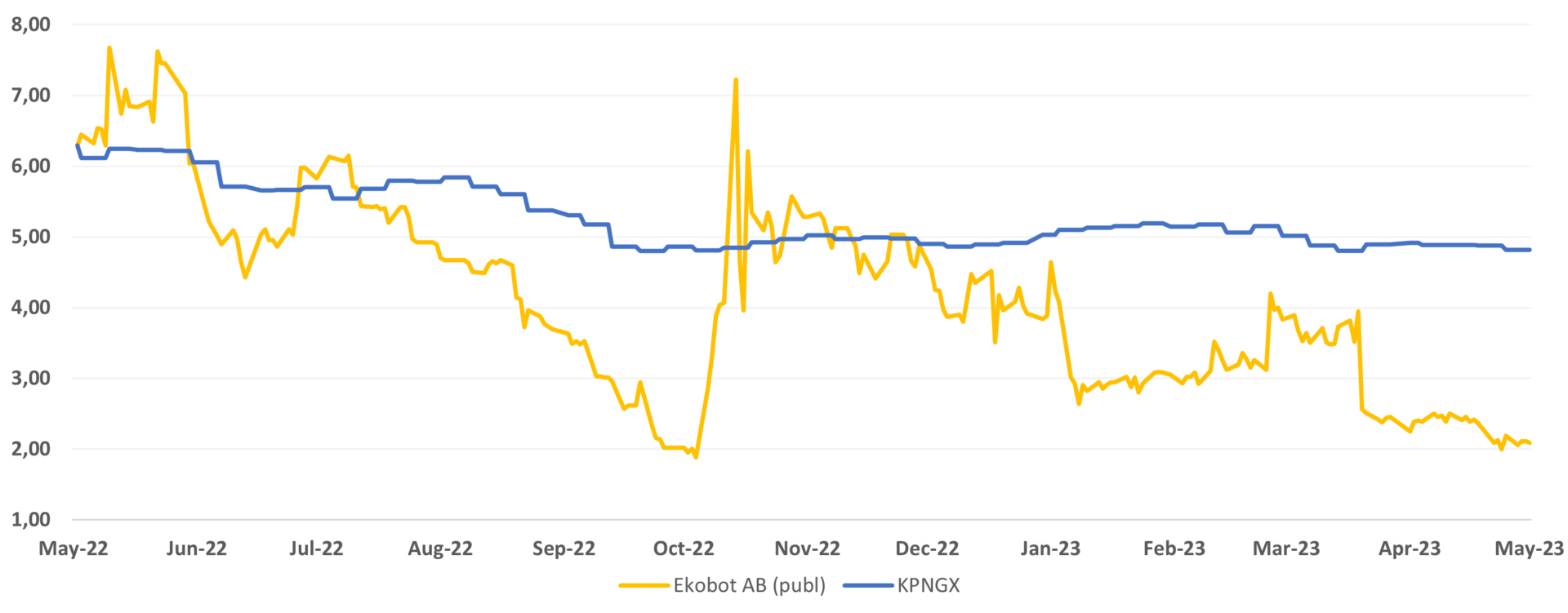

Price development for Ekobot vs. Nordic Growth Stock Exchange Index (KPNGX) the past year

Erik Jonuks har opsagt sin stilling som CEO for at tiltræde i en anden og ikke offentliggjort virksomhed. Erik Jonuks vil fortsætte som CEO i opsigelsesperioden på 6 måneder og vil også være aktiv med at ansætte en ny CEO.

Læs mere: Investeringscasen for Ekobot