CS Medica has achieved positive results of a clinical study with its pain patch with CBD. With clinical proof of efficacy, the possibilities are fot to increase sales in the USD 317 million. major market have been improved. With yet another positive clinical study, CS Medica is in a better position compared to the general competition.

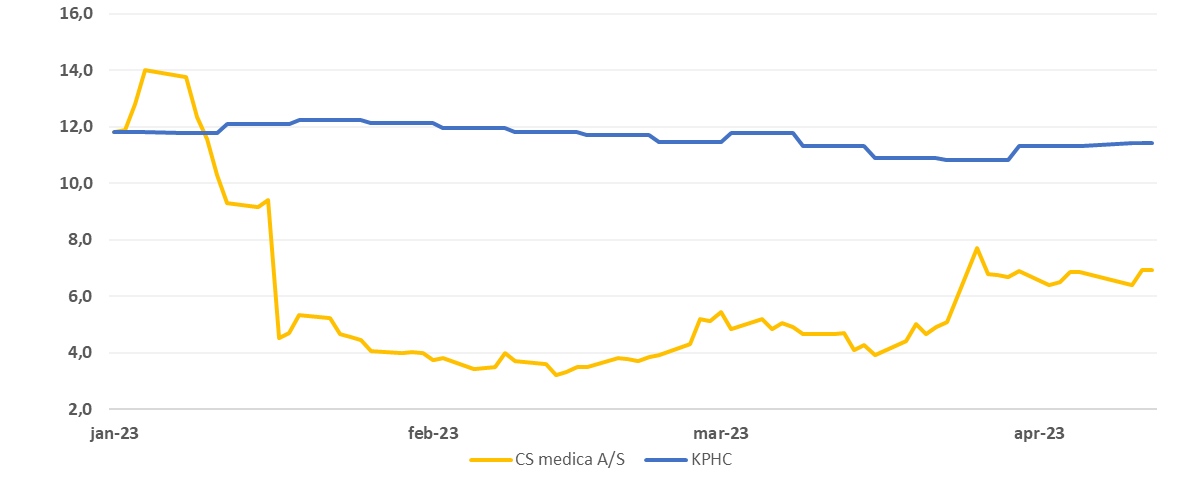

CS Medica: Ticker: CSMED | Price: DKK 7.0 | Market Cap.: DKK 85 million. | YTD price development: -37%.

CS Medica is a Danish MedTech/biotech company with a focus on i.a. treatment of pain, stress and autoimmune diseases with CBD (non-euphoric substance from the cannabis plant) as a primary ingredient. The products are also sold under the CANNASEN brand for e.g. pharmacies and retail chains such as Matas, and as an OEM for pharmaceutical companies and manufacturers. Several of CS Medica’s products are probably the only CBD products registered as “medical device” under the European MDD directive, which gives the company a first mover advantage within CBD-based products.

Positive clinical study

The clinical study consisting of 80 people showed that the product was well tolerated and significantly reduced muscle and joint pain, swelling and stiffness. In addition, the study showed that there was also a long-term effect (7 days).

Presumably little price impact

CS Medica generally differs from the “CBD competitors” by having a pharma approach, and the positive results of the study will therefore increase both interest in the pain patch product and for CS Medica as a collaboration partner for distributors and others. CS Medica has not disclosed any expectations for sales of the pain patch, and the positive study will probably not in itself have any significant short-term effect on either sales or share price.

China remains in focus

The most important price trigger in CA Medica continues to be the implementation of the investment agreement with the Chinese cooperation partner, according to which the Chinese company invests DKK 60 million. at a share price of DKK 28.13, of which 30 million, when CS Medica’s products are approved on the Chinese market. It is CS Medica’s expectation that approval will be obtained after approx. 3 months from submission of the application.

The share market does not yet have a great deal of faith in the Chinese investment, as the share, despite an increase after the investment agreement, trades at the level of DKK 7. Within a period of approx. four months, there is thus the potential for a significant price trigger.

The price development for CS Medica A/S vs. Kapital Partner Healthcare Index this year