Mdundo A/S has today published the Q1 report for 2022/2023, which has offered new cooperation agreements and growth in the number of active users in line with the investment phase.

Mdundo A/S: Ticker MDUNDO | Price: 7,48 DKK | Market Cap.: 72MDKK | YTD development: 70%

Mdundo is a music service similar to Spotify, but focused solely on the sub-Saharan African market. Mdundo is Danish-led with operational headquarters in Kenya, but developed 100% according to African consumer needs and wishes. The company had 21.5 million active users at the end of the quarter.

New deals

Cooperation agreements with telecommunications companies are an important part of Mdundo’s growth strategy, as they open up large customer bases. In the quarter, Mdundo signed an agreement with MTN Ghana, opening up a customer base of 28 million users. Similarly, Mdundo entered into a licensing agreement with Universal Music Group, which has made Universal Music Group’s world-leading music catalogue available to Mdundo users. The new agreements put Mdundo in a better position to increase the number of monthly active users, thereby potentially triggering a price trigger of 50 million active users by 2025 in line with the investment case.

Read the investment case of Mdundo here

25 million users this fiscal year

Mdundo expects monthly active users to increase from the current 21.5 million to 25 million monthly active users by the end of the 2022/2023 financial year (June 2023). The longer term target is 50 million monthly active users by June 2025.

The company has also guided for a negative EBITDA in the range of -7 to -8.5 MDKK and a turnover of 13-16 MDKK. In comparison, Mdundo ended the last financial year with a negative EBITDA of -8 MDKK, and a turnover of 7,3MDKK.

Stock in good shape

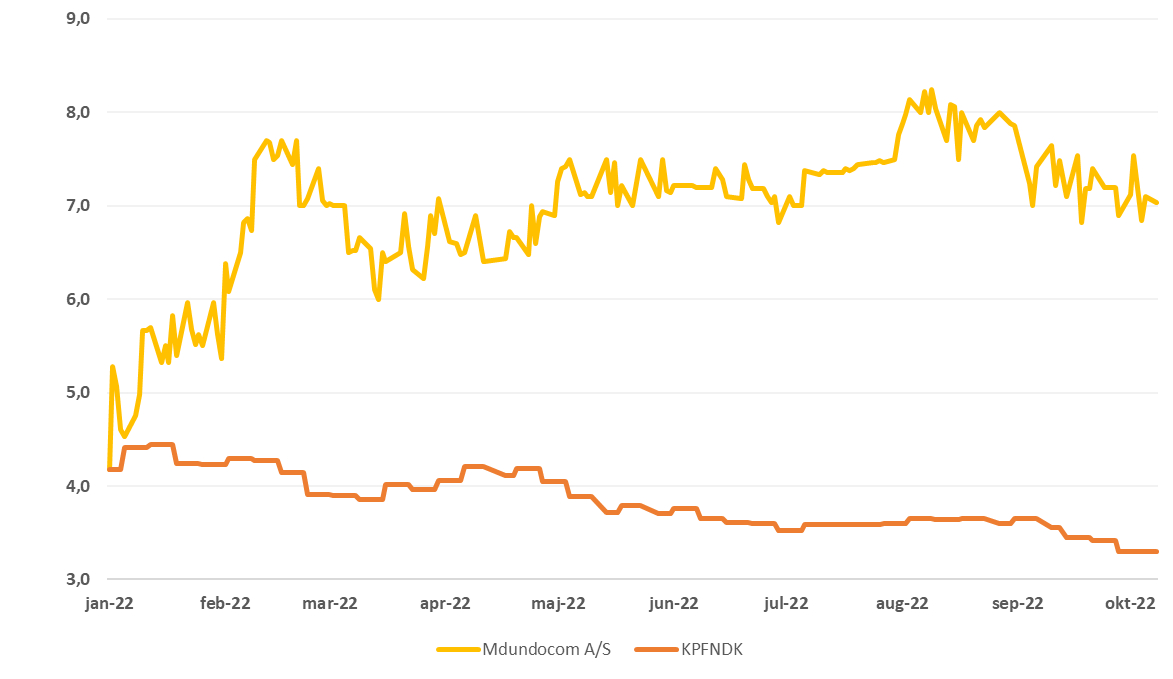

Mdnundo’s share price has risen 70% this year. At the same time, both Frist North in Denmark and the shares on the Nordic stock exchanges have generally fallen. As Mdundo does not need to raise capital in the short term, continued growth in the number of users, markets and earnings will support a continued positive share price development.

Share price development year to date for Mdundo vs. First North Denmark (KPFNDK)