The Q3 report (January-March 2023) from Mdundo shows a high user growth to 24.5 million monthly active users, which has led the company to raise the expectations for MAU at the end of June from 25 million to 26 million. The investment case has therefore been further strengthened.

Mdundo: Ticker MDUNDO | Price: 7.30 DKK | Market Cap: 77 MDKK | YTD price development: 11%

Mdundo is a music service similar to e.g. Spotify, but with a sole focus on the sub-Saharan African market. Mdundo is Danish-led with operational headquarters in Kenya, but developed 100% according to African consumer wishes and needs. Mdundo’s streaming product consists of a music service optimized for unstable internet connections and low-end smartphones, which can be accessed online via the website www.mdundo.com and via an Android app for mobile phones. Mdundo has over 24 million active users on both the web and the app.

44% user growth triggers upward adjustment

An important factor for the investment case in Mdundo is that they have a high growth in the number of monthly users. In the latest quarter, Mdundo grew the number of monthly users to 24.5 million, a 44% growth compared to the same quarter last year. The figures are ahead of the company’s own forecasts, which has led to an upward revision of the expectations for the number of monthly users at the end of June 2023 by 1 million from 25 to 26 million. The development in the number of users is in line with Mdundo’s long-term goal of 50 million users by 2025.

Attractive marketing platform for larger companies

The majority of users on Mdundo’s streaming service are non-paying customers. This means that in practice they receive advertisements 5-10 seconds before songs can be played. During the quarter, Mdundo was able to attract major companies such as Coca Cola, Netflix and Nestle to make ad campaigns on the platform, which we see as an endorsement of the platform that Mdundo has created.

Maintains financial guidance with 100% growth

Although Mdundo has adjusted the expectations for the number of users at the end of June 2023 from 25 to 26 million, the financial guidance is maintained. The guidance is a negative EBITDA of 7-8.5 MDKK and a revenue of 13-16 MDKK compared to a revenue of 7.3 MDKK in the last financial year. In the longer term, the company also maintains the target of a positive EBITDA in 2025.

Positive share price development

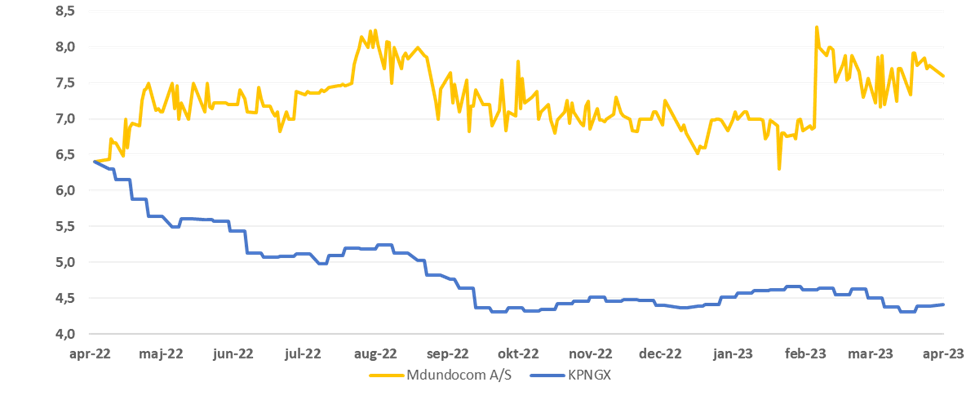

Over the past year, the share price has performed significantly better than other shares on Nordic growth stock exchanges, and the company has even managed to deliver a positive return in a stock market environment characterized by great uncertainty. The share has also had a good start to 2023 with an increase of 11% year-to-date.

Share price development for Mdundo vs. the Nordic Growth Exchanges (KPNGX) over the past year