Developments during the week at the Nordic growth exchanges

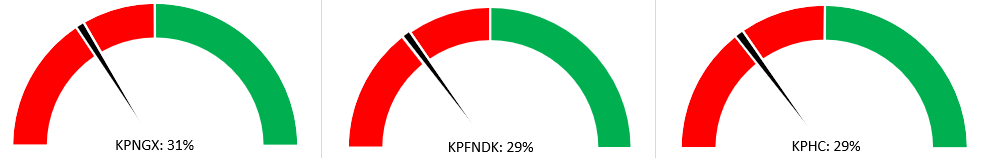

The Kapital Partner Nordic Growth Exchanges (KPNGX) index fell 2.5% last week. The Swedish S30 index fell 2.7% while the Danish C25 index dropped as much as 6.3%. Since 1 January 2020, the KPNGX index has fallen 5%, while the Thomson Reuters Venture Capital Index has fallen 3%. The trend in the Nordic growth exchanges since 1 January 2020 is thus in line with the trend in venture at international level. Year to date, the KPNGX index has fallen 41%, while the Thomson Reuters Venture Capital Index has fallen 53%. 286 out of 913 companies in the KPNGX index delivered a positive return last week. The 3 best performing stocks on the Nordic growth exchanges were Triboron International AB (+62%), SensoDetect AB (+36%) and Waste Plastic Upcycling A/S (+34%). The worst performing stock of the week was Barramundi Group Ltd, down 49%.

KPNGX index development since 01.01.2020

The sentiment on the Kapital Partners index last week:

Sector development the past week

Academic & educational services and real estate were the only sectors to deliver a positive return after increases of 0.9% and 0.1% respectively. Industrials, consumer cyclicals, technology, utilities, healthcare and energy dragged the KPNGX index down, with energy the worst performing sector of the week after falling 4.6%.

The 3 best performing stocks on the Nordic growth exchanges last week

Triboron International AB (+62%) is active in environmental technology. The company’s specialised expertise is in tribology technology used in biofuels. The product range primarily includes proprietary concentrates used to reduce wear and friction in motor vehicles.

Triboron International AB last week entered into an agreement with Sainsburys, one of the UK’s largest supermarket chains. Triboron International AB will supply additives for the treatment of diesel fuel used by Sainsburys’ delivery and transport vehicles. The company has a market capitalisation of SEK 36 million and its share price has fallen 1% year to date.

Share price development of Triboron International AB year to date

SensoDetect AB (+36%) specialises in developing equipment used to analyse the response to sound stimuli in the patient’s brain. The technology is primarily used in psychiatry, when patients are treated to distinguish between potential mental disorders. The product consists of electrodes that are attached to the patient’s head to analyse brain activity. The results are compared with a database for further analysis.

The company has a market capitalisation of SEK 38 million and its share price has fallen 38% year to date.

Share price development of SensoDetect AB year to date

Waste Plastic Upcycling A/S (+34%) is a Danish company that has developed a technology that, without any processing or sorting, can turn waste plastic into oil, which can be used to produce entirely new plastics or various types of fuel for aircraft, for example. The company’s specialist expertise lies in the development of systems used to recycle plastics.

The company has a market capitalisation of NOK 740 million and the share price has fallen to zero since the company was listed in April at NOK 15. However, the share price has been around NOK 30 at the end of April.

Share price development of Waste Plastic Upcycling A/S year to date

Developments during the week on First North Denmark

The Kapital Partner First North Danmark (KPFNDK) index fell 3% last week. The KPFNDK index is one of the best performing stock indices in the Nordic region relative to the other indices year to date. However, since 1 January 2020, the index has delivered a negative return, which is worse than both the KPNGX index, the C25 index and the S30 index, which have all delivered positive returns since 1 January 2020.

Read more: Nexcom secures funding for continued growth

KPFNDK index development since 01.01.2020

Developments during the week on First North Denmark at company level

19 out of 51 companies in the KPFNDK index delivered a positive return. Alefarm Brewing A/S was the winner of the week with an increase of 18%. NORD.investments A/S followed with an increase of 16%. Mapspeople A/S and LED iBond International A/S were the worst performing stocks of the week on First North Denmark after both fell 19%. Mapspeople A/S is down 43% year to date, while LED iBond International A/S is down 67% year to date.

Development on First North Denmark last week and year to date

Best performing stock of the week on First North Denmark: Alefarm Brewing A/S

Alefarm Brewing A/S (18%) is a Danish brewer specialising in beer brewing, where the beer is sold under its own brand around the Nordic market. The company has a special niche that it has chosen to focus on and that is with the beer types IPA and stout, which are brewed in its own production facilities.

The company has a market capitalisation of 32MDKK and the share price has fallen 21% year to date. The company’s stock rose 19.4% on Thursday, September 15, on volume of 500 shares. In other words, the increase happened on the back of a small trade in a relatively illiquid stock.

Price chart of Alefarm Brewing year to date

Developments during the week for the Nordic healthcare stocks

The Kapital Partner Healthcare (KPHC) index fell 4.4% during the week. 84 out of 293 companies in the index rose during the week. SensoDetect AB (+36%) was the winner for the week. S2 Medical AB (26%) and Bioporto A/S (18%) also rose to the top among Nordic healthcare stocks after increases of 26% and 18%, respectively. Enzymatica AB was the worst performer, down 33%.

KPHC index development since 01.01.2020

Read more: Success leads to launch of next phase