Nexcom experienced a 41% drop in revenue in 2022 to DKK 8M and a net loss of DKK 19M (DKK -21M in 2021). This year, growth of 38-88%, revenue of DKK 11-15M and EBITDA of DKK (2M) – 1.5M is expected. The investment case is hit by another capital increase, while new large customers in the US can act as price triggers.

Nexcom: Ticker: NEXCOM | Price: DKK 1.9 | Market Cap: DKK 28M | YTD price performance: -3%

About: Nexcom delivers automated IT and AI systems (SaaS) for handling customer inquiries, especially for B2C companies within telephony, insurance and energy. Customers are from Scandinavia, Europe and North America and include Telenor in Denmark and the US, Telia in Denmark, Norway and Lithuania, and Groupon, RealPage and Lash in the US.

Decline in revenue, but improved net profit

Nexcom’s 2022 revenue of DKK 8 million hit the bottom of the recently announced range of DKK 8-12 million. Lower customer activity and fewer new customers than expected have put pressure on revenue in 2022. However, significant cost reductions and initiatives throughout the year have resulted in EBITDA remaining at the same level as the previous year with DKK -14M (as last expected), while lower financial expenses meant that net profit ended at DKK -22M and almost DKK 4M better than 2021.

The investment case depends on two factors

For Nexcom to reach its revenue and earnings guidance for this year of DKK 11-15M revenue and EBITDA of DKK (2) – 1.5M respectively, a capital injection of DKK 7.5M is required. Nexcom expects the capital injection to be completed during the second quarter of this year.

Nexcom cites the turbulent global market conditions as crucial for the weak development in both revenue and the low conversion of customer leads/pilots to customers. Conversion of the ongoing pilots with US companies to customers during the second quarter will therefore be crucial for the company and the investment case in the short term.

A case that invites special investors

With a customer base consisting of large US companies and with a US sales office, Nexcom could be an interesting company for investors specializing in tech scaleups. There have already been two such investments this year on First North Denmark, and with a market capitalization of approx. 2x revenue, Nexcom is probably an interesting investment case for specialized tech investors.

Price triggers

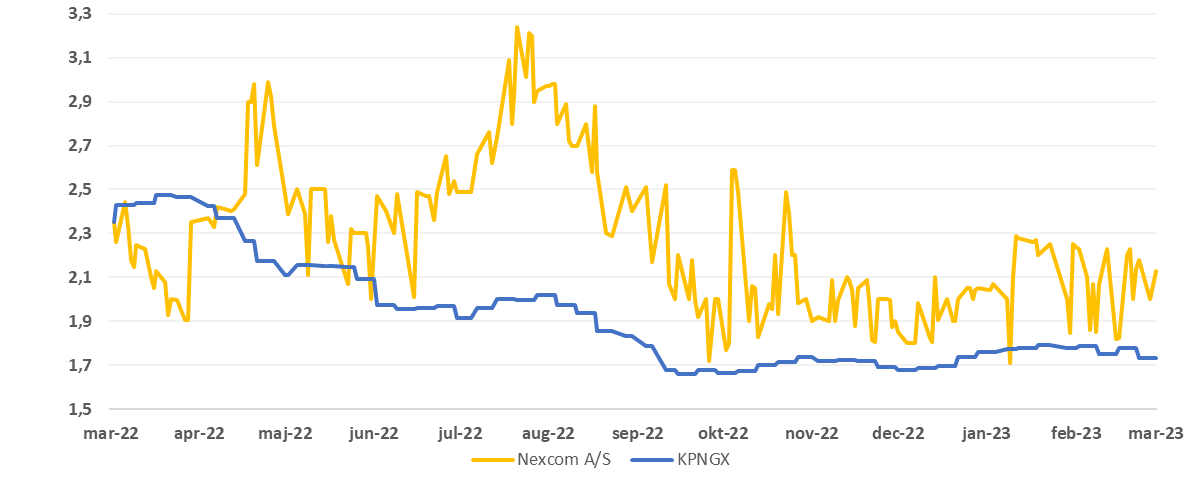

The past year has been something of a roller coaster for Nexcom’s share price and investors. However, since Q3 2022, the share price has remained at the level of DKK 2. Until the long-term financial situation has stabilized, the share price will probably be depressed by this. On the other hand, the conclusion of one or more agreements with new customers in the US could raise the share price significantly.

Price development for Nexcom vs. Kapital Partner Nordic Growth Exchange Index (KPNGX) the past year