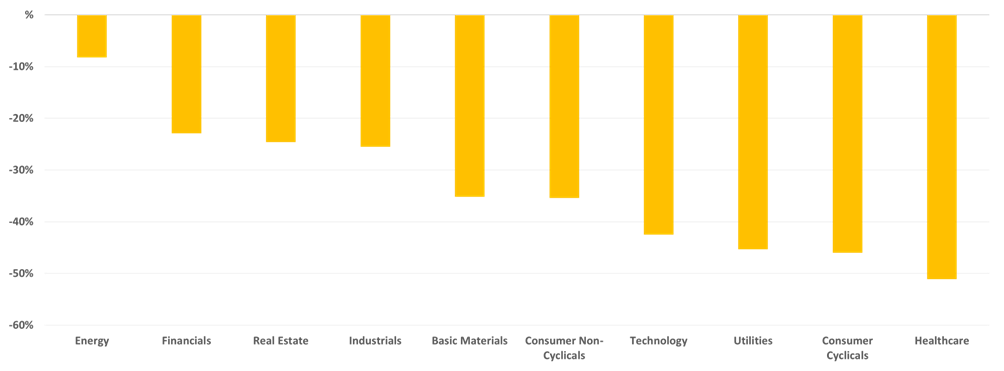

The total return on the Nordic growth exchanges was -44% in 2022. Although none of the sectors managed to deliver a positive return, the energy sector was the right place to be – partly because it performed best and partly because there were large returns to be had. It looks like this is the sector to invest in this year too.

The best performing sector this year was energy, down 8.2%. This should be seen in the light of the war in Ukraine and rising energy prices, which have boosted earnings for energy companies. At the opposite end of the scale is the healthcare sector, which has more than halved in size. The healthcare companies on the emerging markets are mainly biotech companies or are non-profit generators. Like other high-risk companies with earnings prospects far into the future, healthcare has been hit hard in 2022 due to investors’ lack of risk appetite.

Returns for the different sectors on the Nordic growth exchanges in 2022

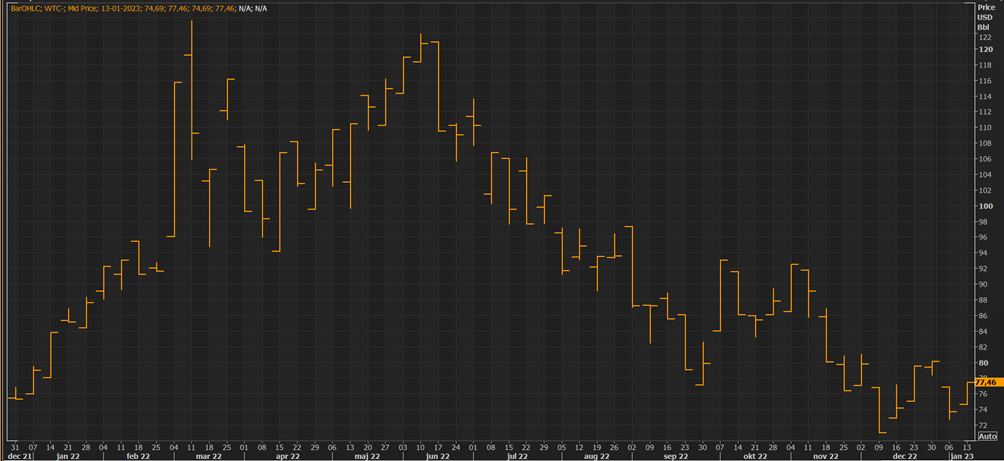

The energy sector has been driven by high oil prices

The energy sector is not quite as green as you might think, with a number of companies involved in oil. Therefore, the high oil price at the beginning of 2022 was a contributing factor to the large price increases. Towards the end of the year, however, the price has fallen. Thus, the spot price of WTI Crude Oil peaked at around USD 124, while at the time of writing it stands at around USD 77. Compared to the last 10 years, however, this is still a high price and it is crucial for the sector that the oil price remains high.

Spot price of crude oil (WTI) 1 January 2022 – 12 January 2023

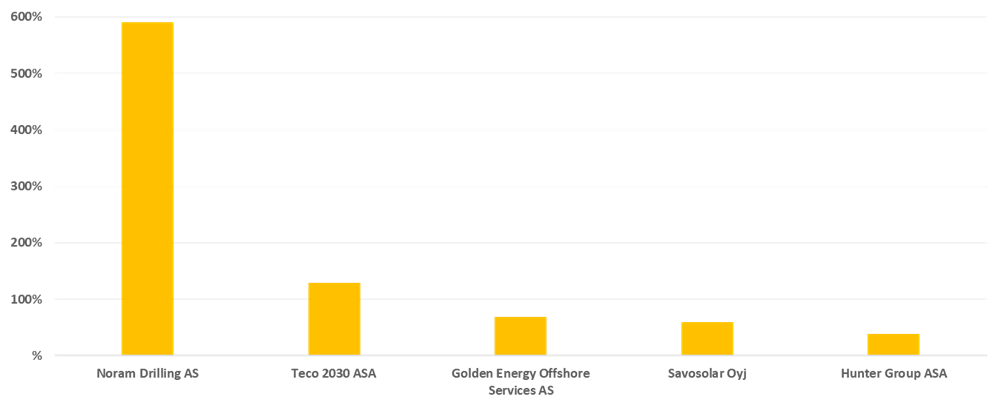

5 companies gave tailwind to energy sector in 2022

It’s no wonder, then, that three of the five best-performing energy stocks in 2022 were oil-based, while there was one in solar and heating systems and one within the maritime industry.

Overview of the 5 best performing stocks in the energy sector in 2022

The top five energy stocks in 2022 were:

- Noram Drilling AS (541%) owns and operates a portfolio of eleven advanced drilling rigs upgraded to maximize drilling efficiency in the Permain Basin in Teexas, the largest oil producing area in North America. The company has thus benefited from high oil prices. The company has a market capitalisation of NOK 2.4 billion.

- Teco 2030 ASA (129%) operates in the maritime sector, where its products include exhaust gas cleaning, water and environmental systems. The company has a market capitalisation of NOK 1.9 billion.

- Golden Energy Offshore Services (68%) carries out offshore activities within the oil and gas industry. The company’s fleet consists of a variety of vessels adapted to different purposes. The various services provided include maintenance and subsea work, pipe transport, project management and ROV support. Consultancy services are also offered. The company has a market capitalisation of MNOK 70.

- Savosolar Oyj (59%) supplies solar heating systems for district heating and industrial process heating. The heating systems supplied by the company include proprietary solar collectors, around which the company builds complete subsystems, including control, heat storage, supply and integration with other heat sources. Savosolar is a Finnish company but is listed in Stockholm with a market capitalisation of SEK 720 million

- Hunter Group (38%) is also active in the oil and gas industry. The company uses The Badger Explorer technology, which involves the use of machines that scan the seabed for potential oil resources. The machines attach themselves to the ground and analyse the contents of the ground, reducing the risk and potential complexity than conventional drilling. The company has a market capitalisation of NOK 1.4 billion.

Energy continues to perform this year – and especially for one company

The energy sector has had a good start to 2023, rising 5% year-to-date, while the KPNGX index (the Nordic growth stock exchange index) is up 2.4%. Supply uncertainty, which generated strong returns in 2022, still applies, with the war in Ukraine with no imminent end. In other words, the high uncertainty means that there may still be good opportunities to be found in the sector.

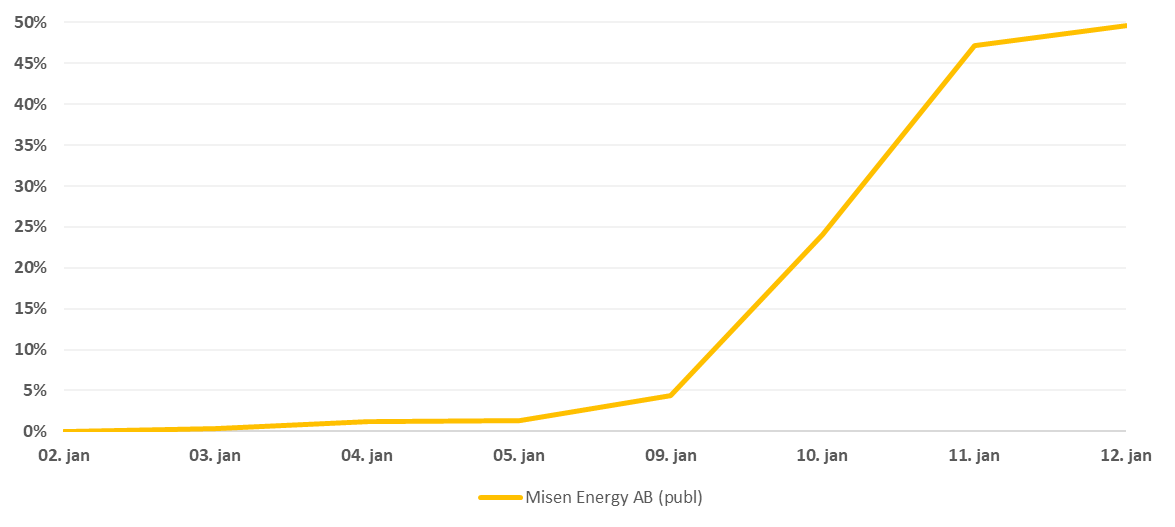

Misen Energy AB has come out on top in 2023, with a 50% gain. Misen Energy AB is also engaged in the oil and gas sector, where the company seeks to identify and develop major oil and gas fields that need capital to operate and establish production. The company has a market capitalisation of SEK 229 million.

The price development of Misen Energy AB in 2023