Biosergen: 1.5 million people die each year from fungal infections. Biosergen, which has FDA orphan drug status, is developing an antifungal drug that is more effective and has a significantly better side effect profile than existing antifungal drugs developed 40-70 years ago. With USD 16.7 billion spent annually on antifungal drugs, Biosergen’s drug has blockbuster potential (annual sales of more than USD 1 billion) and is expected to be launched in Q2 2026.

Biosergen: Ticker: BIOSGN | Price: SEK 1,218 | Market Cap: 52 MSEK | YTD price performance: 16%

Price trigger in the near future

After the positive results of the phase 1 trials in the first quarter of this year, Biosergen is already ready with a phase 2 trial. The first patients are expected to be enrolled at the end of the second quarter of this year, and will consist of 15 patients with invasive fungal infection, including “Balck Fungus”, who as a last treatment option are or have been treated with Amphotericin B, but who are taken off this treatment due to life-threatening side effects such as kidney failure. The serious side effects mean that 20-40% of people treated with Amphotericin B are taken off treatment again, leaving them with no other treatment option. The study is being conducted in India and top-line results are expected already after 6 months, corresponding to late 2023/early 2024.

Biosergen’s treatment for invasive fungal infection has just shown in the phase 1 trials that it does not have the serious side effects of the most effective treatments. If the results of the phase 2 study show that the agent is also effective (efficacy) for the treatment of patients with no other treatment options, the way is paved for further phase 2 studies, approval and launch potentially in 2025 – as well as the possibility of partnerships. Positive results will therefore be a significant price trigger.

Partnership rather than capital

Biosergen does not need new capital for the completion of the phase 2 study. If positive results are obtained, Biosergen will design phase 2 studies targeting approval of BSG005 for the treatment of an indication – for example, aspergillosis, for which Biosergen has Orphan Drug Designation, or mucormucosis. As there is a real possibility that Biosergen’s drug will be used as the first line of treatment – i.e. the primary drug – there is blockbuster sales material (sales of over USD 1 billion). Therefore, Biosergen will also be in a good position to be attractive to Big Pharma and thus obtain financing from them – and thus without further capital increases.

Upcoming price triggers

- Initiation of the phase 2 study in India and first patient

- Presentation of data to FDA and discussion of Phase II study Q2 2023

- Topline results for the Indian Phase 2 study in Q4 2023/Q1 2024

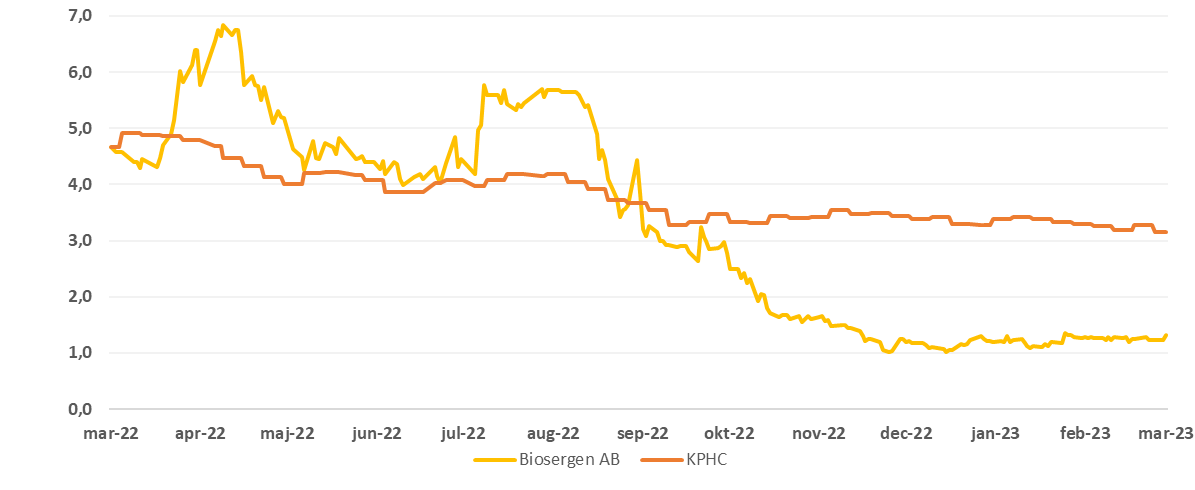

The price development for Biosergen vs. Kapital Partner Healthcare Index (KPHC) the past year