Biosergen has raised SEK 42.2 million gross from the offering, providing the capital to both complete the ongoing Phase 1 study and initiate the next phase – fully in line with the investment case.

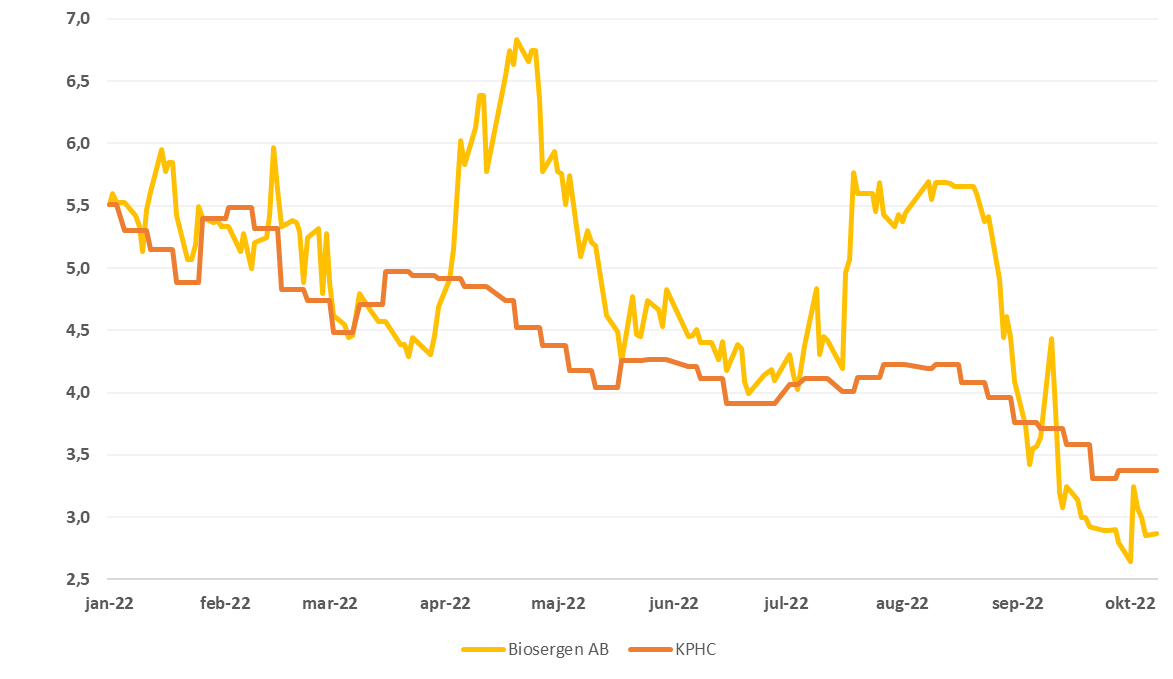

Biosergen: Ticker BIOSGN | Price: 2,865 | Market Cap.: SEK 138M | YTD price development: -39%

Biosergen is a biotech company developing an innovative drug to treat fungal infections that kill 1.5 million people annually – in both industrialised and developing countries. The company’s BSG005 drug has demonstrated significant advantages over existing products developed in the 1950s and 1970s. BSG005 is in clinical phase I (the first of three phases of development towards the market), from which positive data have emerged. The first of several drugs is expected to be on the market in 2026/27.

Sufficient capital and imminent price triggers

In the rights issue at SEK 3.0, Biosergen has received SEK 42.2 m. The issue was thus 70% subscribed and the underwriters have subscribed for 31% of the issue. After costs and loan repayments, Biosergen has raised up to approximately SEK 30 million, which is sufficient to complete the existing Phase 1 trial and initiate the next studies. In addition, investors in the issue have received a total of 8.43 million warrants, exercisable to purchase one share per warrant in August 2023 at a 70% discount to the then prevailing share price, not to exceed SEK 4.50. At the existing share price of SEK 2.64, the exercise of all warrants will result in Biosergen receiving an additional SEK 16 million.

Go to Biosergen’s investment case here

With the capital injection, the flow of news from the ongoing study will continue – news that has so far been positive. The next course triggers, as per the investment case, will be news in Q4 of this year on the results of multi-dosing of the subjects. So far, there have been positive results from the single-dose trial. In addition, top-line results of the single-dose phase 1 trial are expected in Q4.

Share price development for Biosergen AB year to date vs. Nordic Healthcare (KPHC)