Last week saw no major changes at index level, with the Nordic growth exchanges unchanged. However, there are always opportunities for share price gains in individual stocks. Last week’s winner was a company focusing on big data, which rose by +80%. At the same time, there were good increases for the Danish First North companies, where 4 shares in particular have really gained momentum in 2023.

We have launched a new newsletter: Danish Bioetch Weekly, where we follow all the listed Danish biotech companies at home and abroad. Read the latest edition here. You can sign up for the newsletter here.

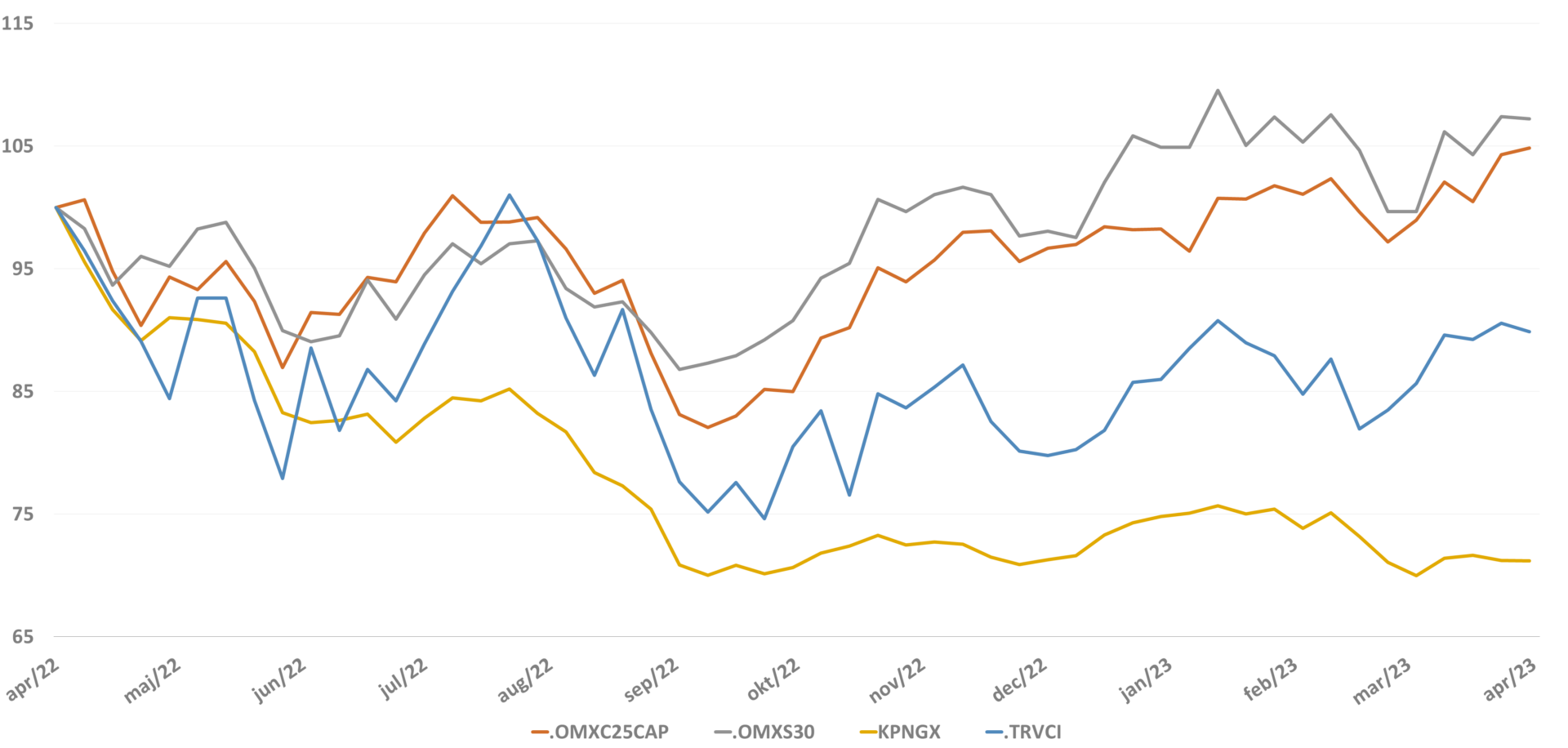

Last week was without major changes at the index level. Thus, the KPNGX index was unchanged, while the TRVCI index fell 0.8%. The KPNGX index now stands at 89.95. The C25 index in Denmark rose 0.5%, while the Swedish S30 index fell 0.1%. Stocks on the Nordic growth exchanges have underperformed both the Thomson Reuters Venture Capital Index and the C25 and S30 indices over the past year, with only the C25 and S30 indices delivering positive returns over the past year.

The Nordic growth markets are broadly diversified, and even though the growth markets have underperformed at index level over a long period of time, there have been large returns to be found in individual stocks and stockpicking. On the Kapital Partners website, we regularly write about possible investment cases with potential capital gains.

Development of the KPNGX index over the past year

The 3 best performing stocks on the Nordic growth exchanges last week

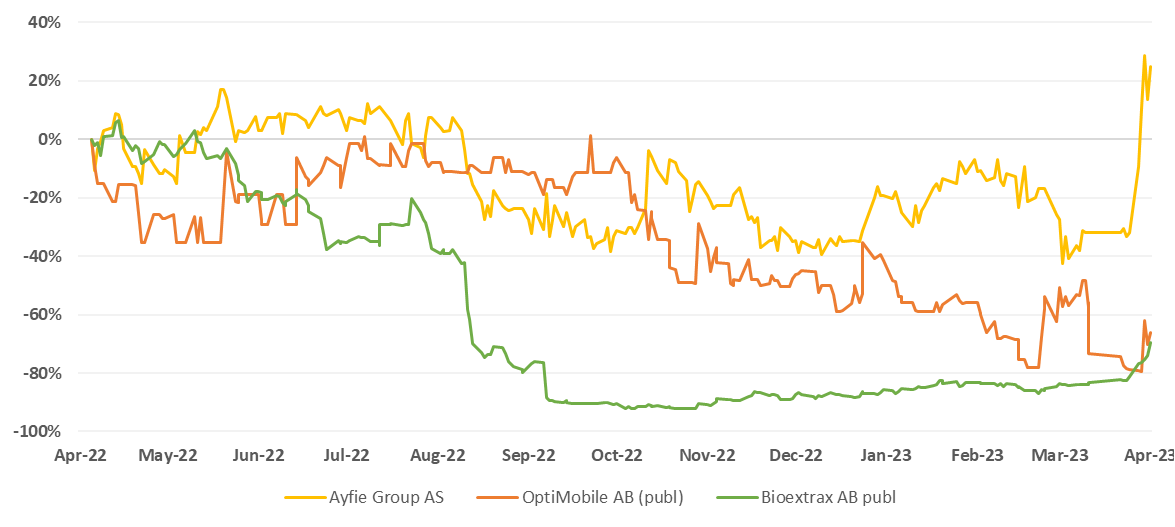

Ayfie Group AS (83%) specializes in the development of big data. The software is self-developed and is primarily used for analysis and follow-up. The customers consist primarily of corporate customers such as Rambøll, operating in a variety of sectors. There was no company-specific news last week, but big data, AI, etc. is really a hot topic at the moment, i.a. on the basis of ChatGPT, which helps to put further focus on the company’s services.

OptiMobile AB (60%) provides solutions for mobile operators based on a SaaS business model used in the transition to 4G/5G networks and interoperability with WiFi networks. The company offers cloud-based solutions as well as communication solutions for the e-commerce market, providing a voice-based interaction between merchants and customers. Last week, OptiMobile signed an LOI to acquire Iron Branch PVC for 16 MSEK, of which 2.18 MSEK are shares in OptiMobile. In comparison, OptiMobile has a market cap of 8 MSEK.

Bioextrax AB (60%) specializes in research and development of technology platforms used to convert organic waste into various environmentally friendly materials. Customers are primarily among material producing companies, with the largest presence in the Nordic market. Last week, the company signed an agreement with a US startup for production based on Bioextrax’s technology.

Share price development for Ayfie Group AS, OptiMobile AB og Bioextrax AB Pharma AB the past year

First North Danmark

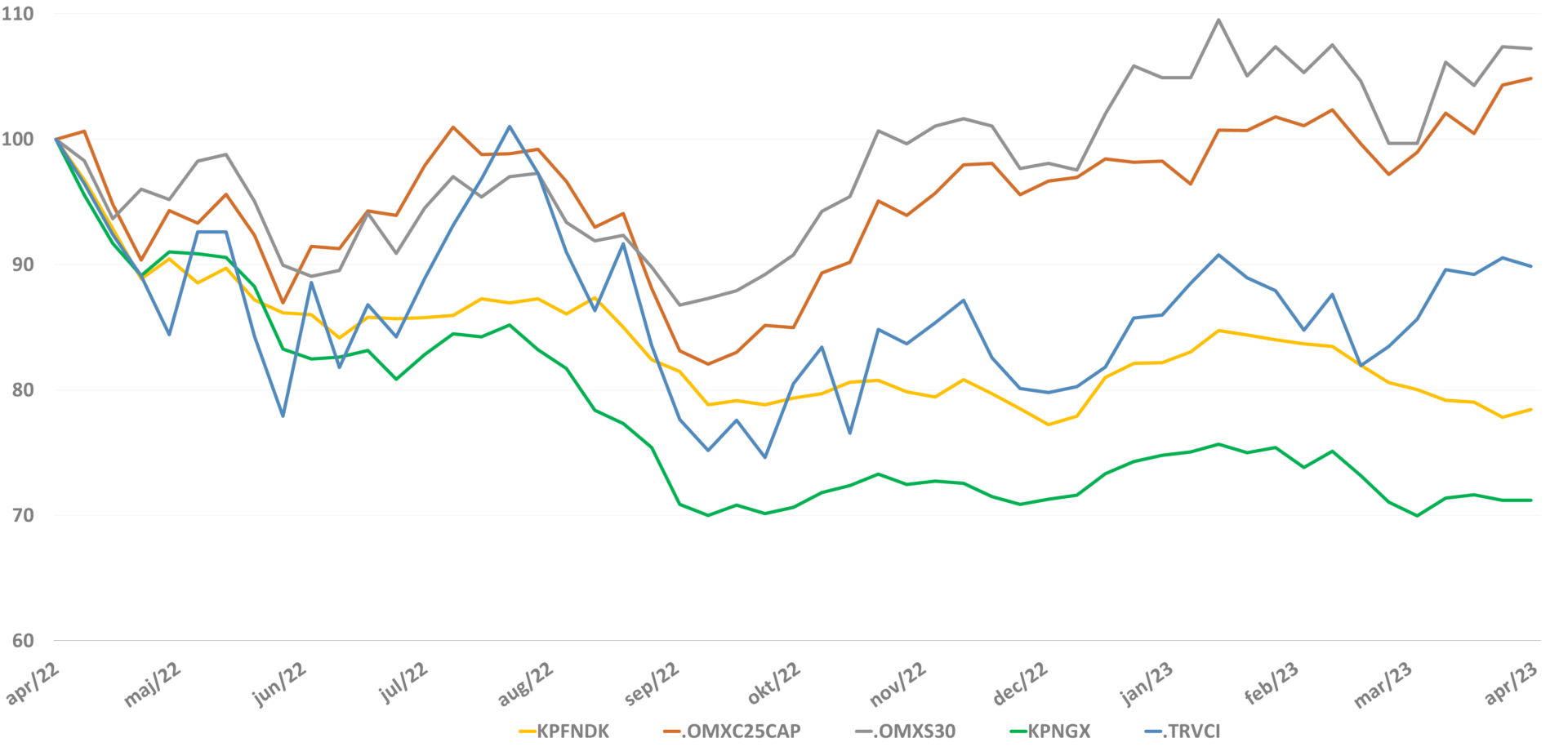

The Kapital Partner First North Danmark (KPFNDK) index rose 0.8% last week, outperforming both the KPNGX index and the C25 and S30 indices. The KPFNDK index now stands at 84.20, and has underperformed relative to the Thomson Reuters Venture Capital Index, the C25 index and the S30 index over the past year, while outperforming the overall Nordic growth exchanges. However, since the start of 2020, the index has fallen by 16%.

Development in KPFNDK-index the past year

Development at First North Danmark on a company level

IT company Monsenso A/S was the week’s winner with an increase of 13.6%, followed by WindowMaster International A/S and Danish Aerospace Company A/S. Especially Alefarm Brewing A/S, Scandinavian Medical Solutions A/S, Scape Technologies A/S and Samesystem A/S have done very well in 2023 with increases of 72-119% year-to-date, which has contributed positively to the average return this year of 7.7% for the Danish First North companies. At the bottom was ViroGates A/S with a drop of 42.6%. Second to last is Hydract A/S, which was last week’s best performer.

Development on First North Denmark the past week (1W) and year to date (YTD)

This week’s developments for all Nordic healthcare stocks

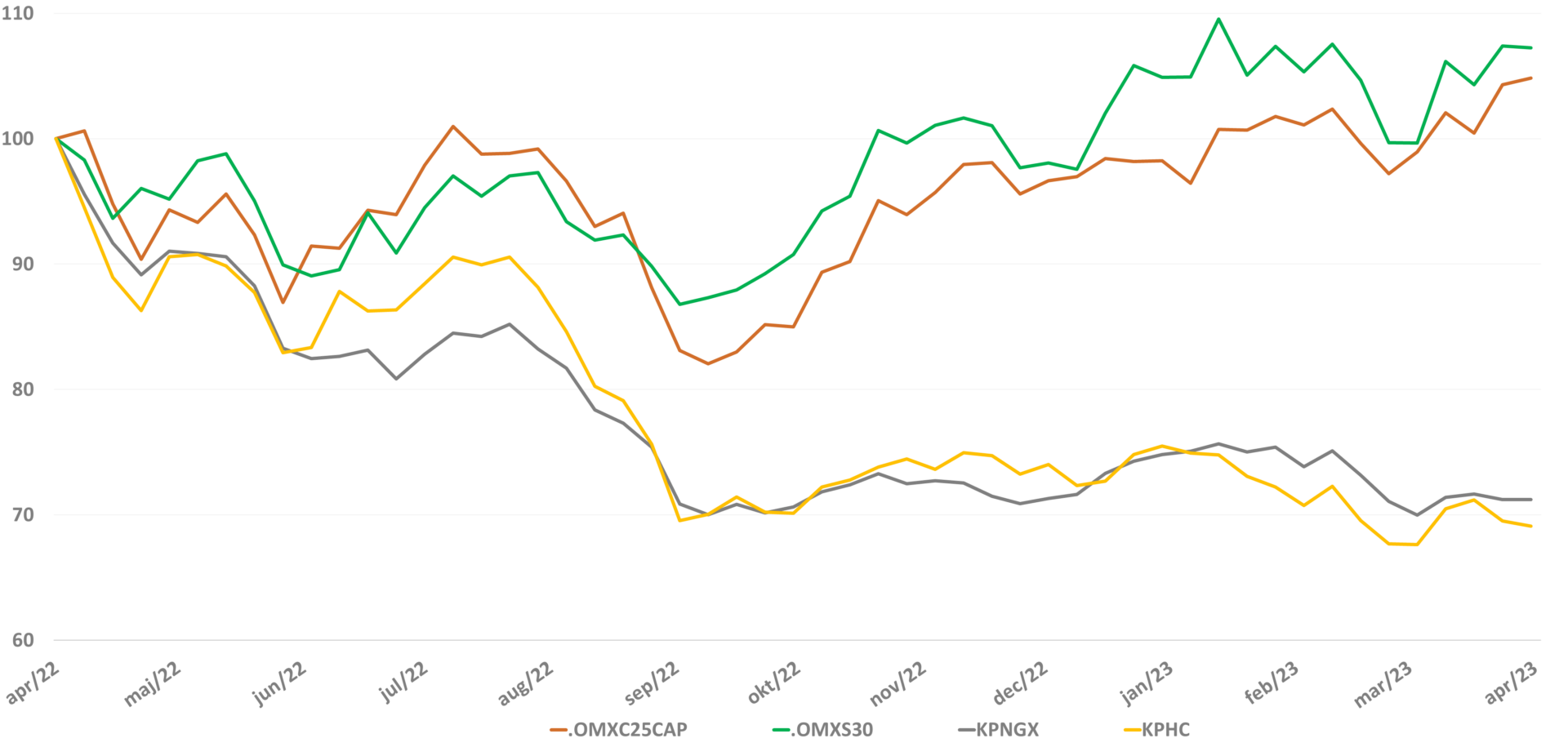

The Nordic healthcare shares (Kapital Partner Healthcare Index/KPHC) fell 0.6% last week and are now at 77.85. The index has underperformed the larger C25 and S30 indices, but is roughly in line with the Nordic growth exchanges. Swedish Eevia Health AB (56%), Hemcheck AB (54%) and Prostatype Genomics AB (49%) made up the top 3. Prostatype Genomics AB was also on the podium last week. At the opposite end was Promore Pharma AB Holding AB, which fell with a bang (71%) after their phase 2 trial of Ensereptide failed to show any effect versus placebo.

Development for the KPHC-index the past year

The 3 best performing stocks on the Nordic growth exchanges last week

Eevia Health AB (56%) is a life science company. The company offers production protocols and procedures for the supply of organic products to international customers. The products are sold to corporate customers and include ingredients for manufacturers of dietary supplements, food and cosmetics on a global scale. Products include, for example, blueberries, chaga mushrooms and pine bark. Eevia Health was founded in 2017. The company in the wake of sales orders of more than 24 MSEK.

Hemcheck AB (54%) develops and markets products for the detection of hemolysis in blood samples. When red blood cells rupture in the blood vessels, there is no sample analysis. The company has developed products that ensure that hemolysis is detected at an early stage, which means that the blood sample can be treated immediately. The company is also developing digital reading that is used as a complement to the main product.

Prostatype Genomics AB (49%) is active in medical technology. The company specializes in the development of medical-technical genetic tests used for the identification, analysis and further follow-up of prostate cancer. In addition to the main business, services and related ancillary services are also offered. In the previous, the share price rose 54%, so the share price has more than doubled in 2 weeks.

Share price development for Eevia Health AB, Hemcheck AB, Prostatype Genomics AB over the past year

New newsletter from Kapital Partner: Danish Biotech Weekly

We have launched a new newsletter where we follow Danish biotech closely. We keep you updated on the companies’ news flow, new IPOs, study results, etc. We follow large and small companies in Denmark and abroad. For example, we follow Curasight A/S, Biosergen AB and Genmab A/S.