The half-year report shows the beginning of sales of the Ven hearing aid, which are expected to be approximately 10 times higher this half-year than in the first half. The investment case is intact, but capital raising is urgent and will probably take place in connection with the move of the stock exchange from First North to Spotlight in mid-September.

Audientes: Ticker: AUDNTS | Price: DKK 6,66 | Market Cap.: DKK 63 million | YTD share price development: -43%

Approximately 500 million people worldwide who suffer from hearing loss either cannot afford or do not have access to viable hearing aid solutions. Audientes offers quality self-adjusting hearing aids for around DKK 2,400 (1/6 – 1/14 of the price of traditional hearing aids). This improves the options for the many people with hearing loss around the world.

Sales of Ven in India have begun

Audientes launched Ven in India at the end of March, generating revenues of approximately DKK 1 million in the first half of the year. With a retail price of approximately DKK 2,400, sales are probably in the region of 1,000 hearing aids from the company’s own webshop and the currently approximately 350 retail outlets in India. For the year as a whole, sales are expected to be in the region of DKK 9-12 million, with a strong acceleration in sales.

Building up sales channels

Audientes has doubled the number of points of sale in the first half of the year to over 350 locations. In line with this, Audientes has also set up pop-up stalls, which among other things help to raise awareness of Ven. In addition, there will be an increased focus on B2B channels rather than B2C channels, as conversion rates in B2B channels have been the best.

Launch of Companion in Q4

Growth this year is also expected to come from the Companion hearing aid announced in July and scheduled to launch in Q4. Companion is targeted at the US and the smart non-medical consumer electronics category, which means Audientes can sell it without FDA approval.

Capital injection on the way – crucial for 2022 expectations

At the end of the half-year, Audientes had a cash balance of DKK 3.7 million. With a monthly cash burn of approximately DKK 1 million, the capital injection is near ahead. If the capital injection is to take the company all the way to next year, it is likely to be at least DKK 13m, as the company has a loan of around DKK 8m due later this year. Audientes has not announced how much capital it is seeking to raise now, but if the full amount is not raised, full-year expectations could be revised downwards.

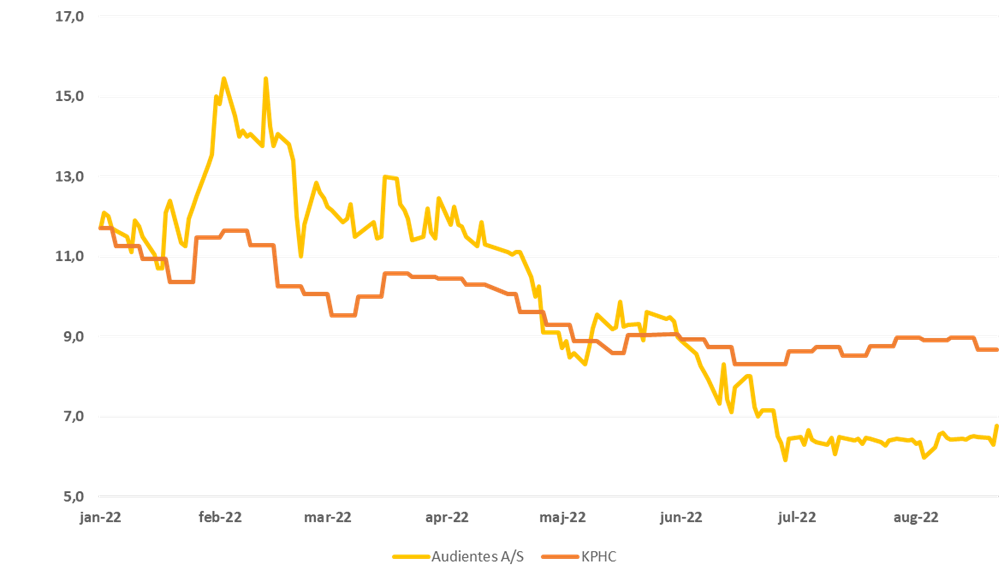

Several factors for the negative price development

Companies that need to raise capital are currently being penalised on the stock markets. The prospect of a share offering is probably one of the reasons for the negative price performance since February this year. We therefore do not see a major positive price development in the near future until the financing situation is clarified. In addition, there may be – albeit minor – selling pressure for shareholders who cannot or do not want to trade on Spotlight. Audientes has a last trading day on 16 September 2022 on First North (first trading day on Spotlight on 19 September), and it would be obvious that an announcement regarding the financing is made in this context.

Price development year to date for Audientes and Kapital Partner Nordic Healthcare Index