The 2022 annual report from EKOBOT is without information that can have a significant price impact and after the recent successful rights issue, it would also have been surprising. The upcoming price triggers are therefore still news about the delivery of the sold robots and further sales. An acquisition of the company is still lurking.

Ekobot: Ticker EKOBOT | Price: 3,47 SEK | Market Cap.: 37 MSEK | YTD share price development: -38%

EKOBOT has developed and sells an agricultural robot that both removes weeds and collects data about the crops, allowing farmers to reduce their costs by up to 20%. Ekobot focuses on crops that are difficult/costly to grow in terms of weed control, and thus also the segment of agriculture that has the greatest economic benefit from using robots. Especially, but not only, organic farms benefit from robots for weed removal, as they do not use pesticides. The focus markets are Sweden, the Netherlands and Denmark.

See the investment case on Ekobot here

Turnover this year

Revenue in 2022 was SEK 214,000 and profit after tax was SEK -10.4 million. The result is due to 2022 being the first year of robot sales. Revenue coincides with the delivery of the robots, which is scheduled to take place in connection with the start of the customers’ season. EKOBOT has not stated any expectations for revenue this year, but has not changed the expectation of sales of 25 robots this year. In addition, the revenue in 2023 will depend on whether the robots are purchased or rented by customers. EKOBOT’s primary business model is to rent the robots on 36-month contracts, which is why the company will probably continue to have a negative cash flow from operations.

Capital

In the recently completed and oversubscribed rights issue, EKOBOT received gross proceeds of SEK 27 million. However, a substantial part of the proceeds has been used to repay loans, and with a rental-based business model, EKOBOT will therefore continue to need a capital injection this year. With a successful issue with full participation of the cornerstone investor, Navus Ventures, and the first deliveries around the corner, EKOBOT is relatively well positioned to raise additional capital. When EKOBOT truly transitions into a commercial company, we also see good opportunities for strategic and professional investors to become interested in investing in the company – possibly to take over EKOBOT, which currently only has a market capitalization of SEK 37 million (DKK 24 million).

Share price

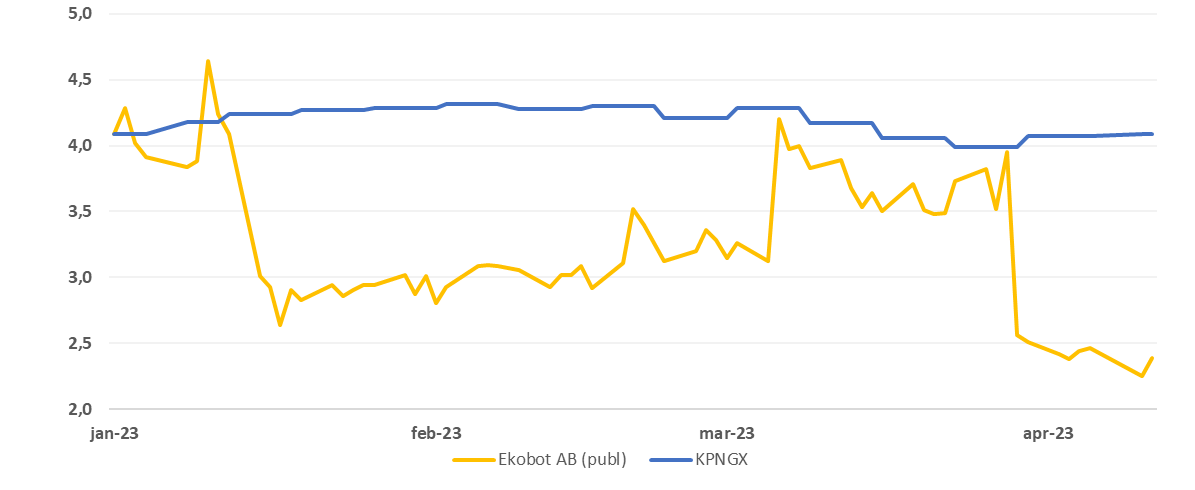

EKOBOT’s share price has been negatively affected by the rights issue in March, as it was carried out at a price of SEK 2.50 and thus at a significant discount to the market price before the announcement of the issue. With the many potential price triggers this year (see the investment case), there is evidence of a positive price trend going forward.

Price development for Ekobot this year