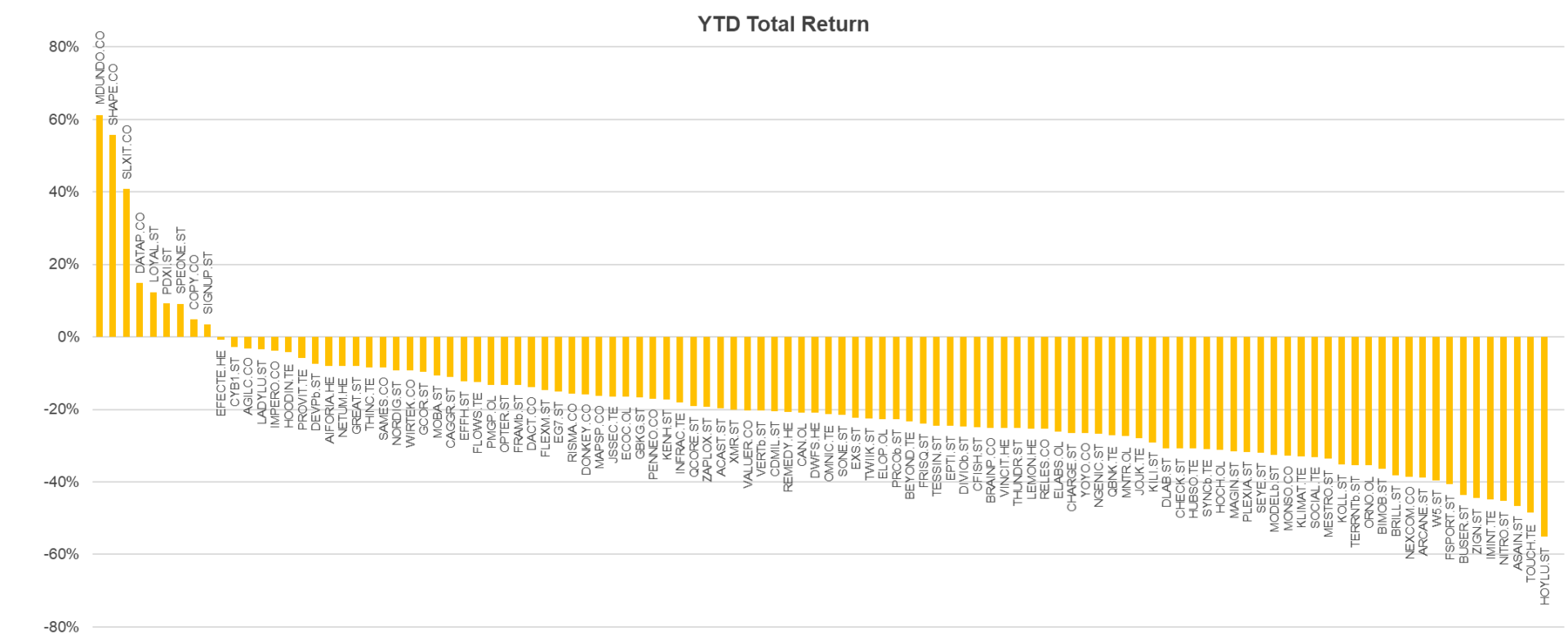

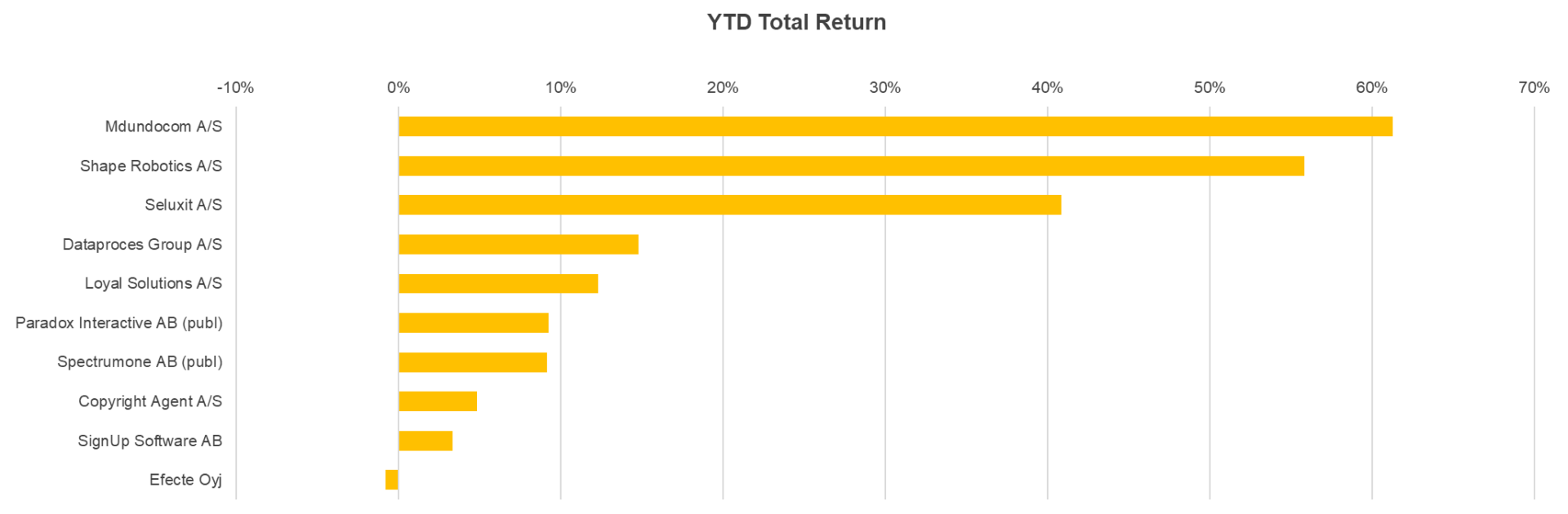

Software-as-a-Service as a growth sector did like many other sectors not avoid price drops caused by e.g. rising interest rates and geopolitical unrest. Yet 5 companies had an increase in share price of more than 10% this year. We look into what made the 5 companies avoid this trend. In short, SaaS companies offer a cloud-based service that customers can access via the Internet by paying a subscription.

Mdundo is a music service similar to e.g. Spotify, solely focused on the African market south of Sahara. Mdundo is Danish-led with operational headquarters in Kenya and developed 100% according to African consumer wishes and needs. The share has risen by almost 60% this year driven by an impressive growth in the number of monthly users.

The Shape Robotics share has risen by approx. 55% this year. The stock has been strengthened by strong growth in revenue. In just a few years, Shape Robotics has built a strong position in the global EdTech market. The company has developed Fable, a unique modular robot that makes it easy and fun for children to design and program robots. Since the launch of Fable in 2017, thousands of robots have been sold and shipped to classrooms around the world.

Despite a downgrade of expectations for the full year, Seluxit increased with more than 40% this year. It comes in the wake of a difficult 2021, where the stock was under pressure. The company works with IoT produkter, which stands for Internet of Things. In short, Seluxit connects physical products to the Internet. It can be anything from a lawn mower, electricity meter or industrial robot – in fact, it is only the imagination setting the limits.

The Dataproces Group stock has risen around 15% this year, following a difficult 2021 where the stock was under pressure. This year, the share price has been driven by new contracts. Dataproces is an innovative IT and consulting house specializing in solutions targeted the country’s municipalities and their digital administration. The solutions range widely from RPA and automation on revenue optimization to teaching and competency sharing.

The Loyal Solutions share has risen approx. 12% this year, however, the share has decreased significantly after an immediate price stop of SEK 20 driven by increased earnings expectations.

Loyal Solutions launched its operations in 2009 and offers the market-leading Software-as-a-Service platform LoyalTFacts, which allows customers to pair anyone with a Visa, Mastercard or American Express with any business and webshop.