The companies on the Nordic growth exchanges have a reputation for being exciting, but at the same time also being without real earnings. There are, however, a number of companies that have both made strong financial and price progress via sound business development – which has resulted in a high price on the stock markets. We take a closer look at 4 companies that have outperformed the KPNGX index on both a 1-year and 3-year term, have healthy margins, good growth, low debt and a fair valuation. The companies have even delivered dividends.

The acquisition machine that runs like clockwork

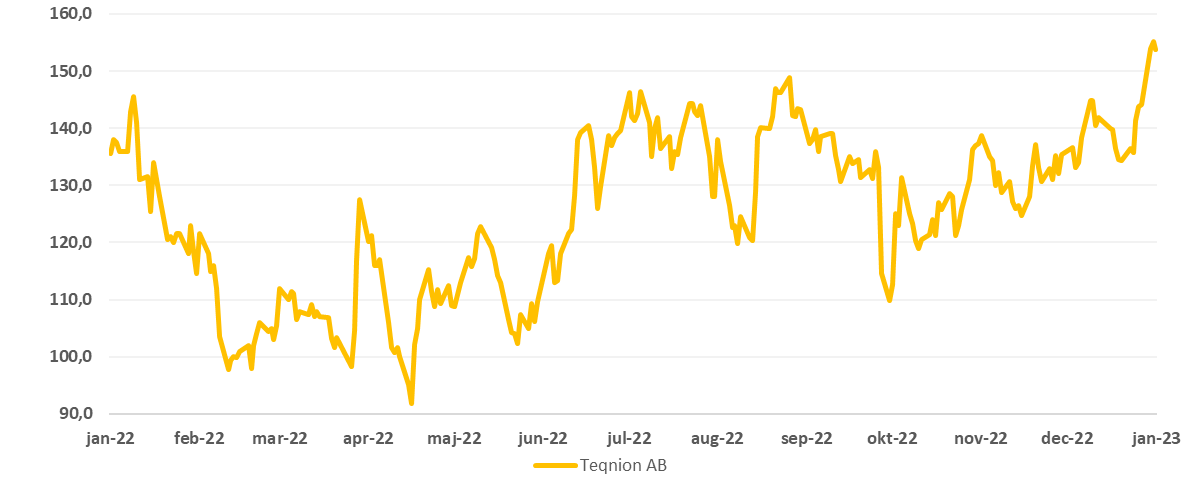

Teqnion AB is a true acquisition machine and an industrial conglomerate consisting of 24 subsidiaries. The company uses the earnings to buy more companies within industrial niches with the goal of doubling earnings per share every 5 years. An interesting detail about Teqnion is that, unlike traditional conglomerates that try to integrate acquisitions, Teqnion instead believes in a decentralized model, where the acquired companies run the business themselves. This enables Teqnion to continue a high pace of acquisitions, where resources for integration of acquisitions are not an obstacle. The company has a market capitalization of DKK 2.5 billion. and is traded at a P/E of approx. 23 for the past 12 months. From 2017-2021, revenue increased 36% annually, while earnings per share increased 32% annually.

Price development for Teqnion AB the past year

Air purification for billions

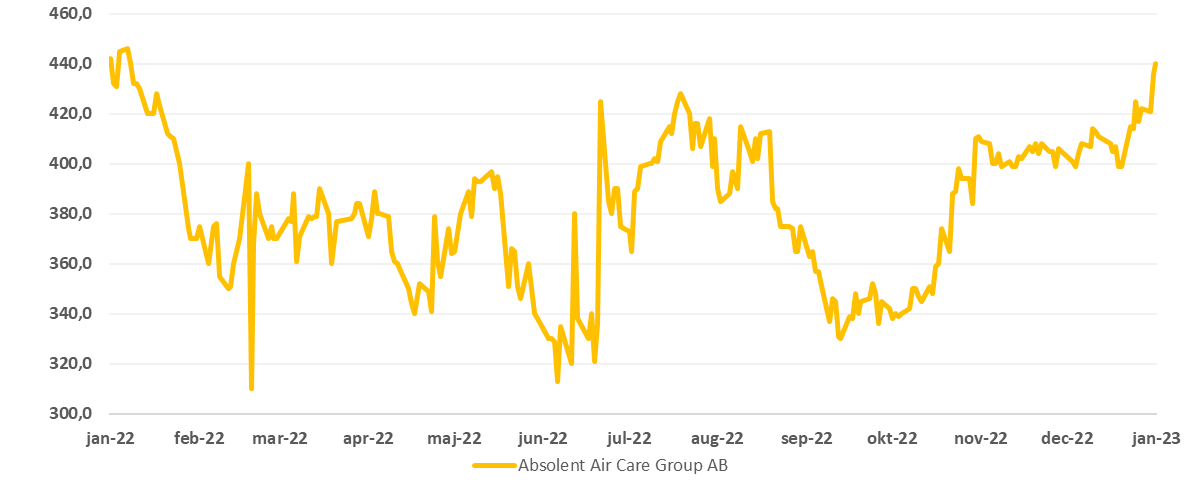

Absolent Air Care Group AB develops, installs and maintains advanced air purification solutions for industry such as Danfoss. The company consists of 11 brands with sales in 60 countries and own production facilities. In recent years, the company has invested heavily in next generation air purification systems, which are on track for launch to drive growth in the coming years. In other words, the company is poised for further financial success in the years ahead. The company trades at a P/E of 34 for the past 12 months, while forward P/E is 28 for 2023 and 24 for 2024. From 2017-2021 to the company delivered 20% annual revenue growth, and 9% earnings growth per share.

Price development for Absolent Air Care Group AB the past year

IT consultancy firm

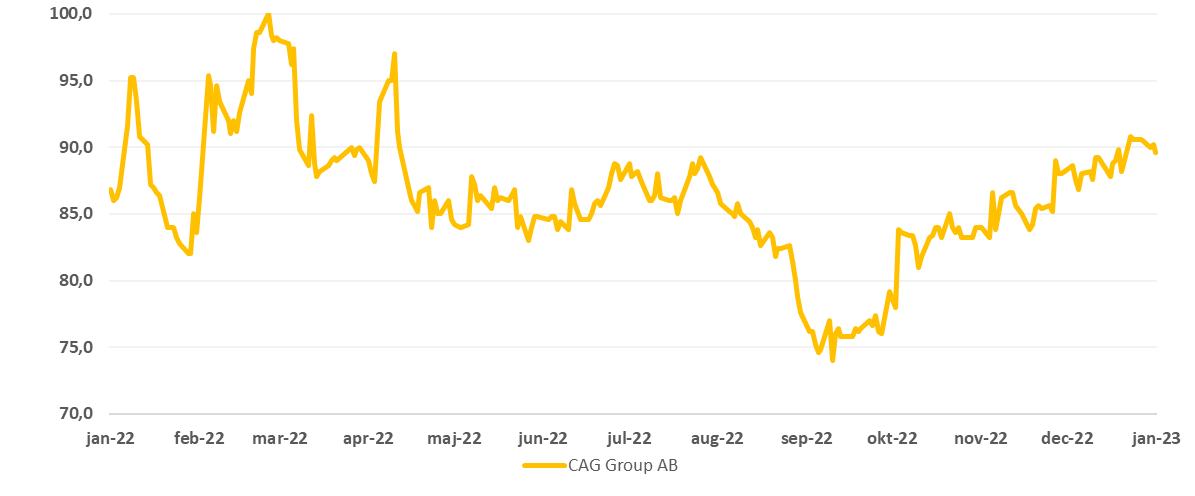

CAG Group AB is a consulting firm focused on the IT industry. The company specialises in systems development, cyber security, etc. aimed at sectors such as finance, industry, healthcare and defence. Among the company’s clients are international companies such as ABB, Nasdaq, Atlas Copco and Volkswagen. The stock is trading at a P/E of 16 for the past 12 months. From 2017-2021, the company delivered revenue growth of 14%, while earnings per share growth was only 5% per share. However, it should be mentioned that from January-September 2022, the company managed to increase earnings per share by 54%, the management is looking at possible price increases that can generate further earnings growth and to this end, the company has paid dividends of $11.6 in dividends since 2019, while the share price stands at 90.

Price development for CAG Group AB the past year

The Danish First North veteran

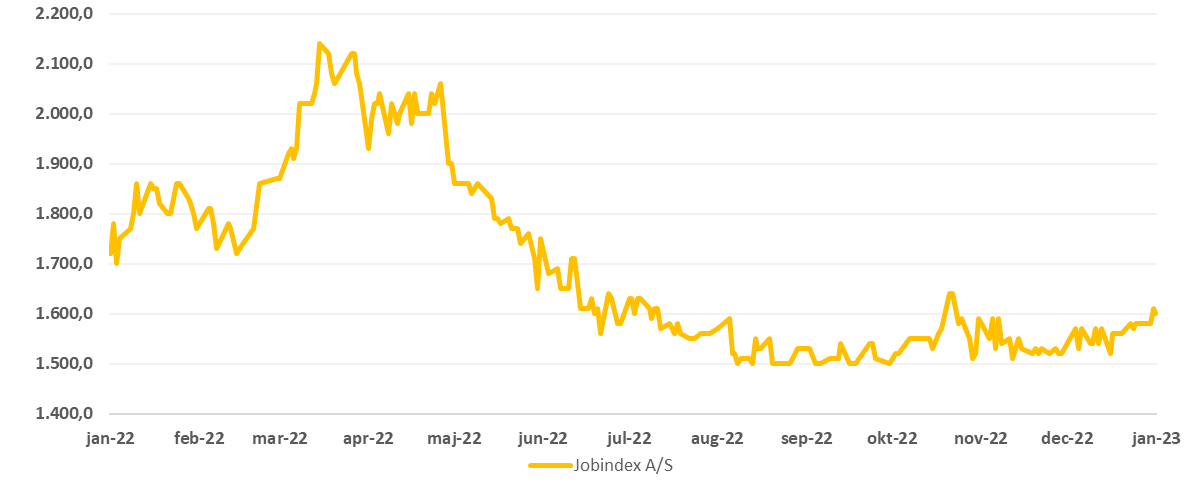

Jobindex A/S operates a digital job portal where companies post job advertisements that individuals can apply for. The platform is a market leader in Denmark with strong network effects that give the company a competitive advantage over its competitors. Jobindex is run and controlled by its founder, Kaare Danielsen. The share is trading at a P/E of 10. From 2017-2021, the company delivered revenue growth of 9% and earnings per share growth of 18%. In addition to the nice growth, the company has managed to pay dividends of DKK 500 in total per share since 2017, while the share price now stands at DKK 1600. The company has thus managed to deliver both solid earnings growth and a high dividend.

Price development for Jobindex A/S the past year