Nexcom (share price DKK 2.76), listed on First North Denmark, has completed a capital increase and a strengthening of its capital structure to ensure continued and more efficient growth – particularly in the US.

In total, Nexcom is making a capital increase of DKK 9.5 million at a share price of DKK 3.0, which is 9.5% above the share price prior to the announcement, and refinancing existing convertible debt. This will provide Nexcom with both capital for expansion in the US and a significantly improved financial position.

Nexcom’s share price YTD

With an increased focus on achieving a positive bottom line, growth is downgraded. Expectations for revenue this year are reduced by DKK 5.5m to DKK 14-17m (DKK 11m in 2021). The reorientation of the strategy will result in costs totalling DKK 10m, so the EBITDA forecast for 2022 is maintained at between DKK -5.7m and -7.7m.

Read Kapital Partner’s investment case on Nexcom

The total financing package consists of a private placement of DKK 3 million at DKK 3.0 from existing shareholders, a further guaranteed private placement within 30 days at DKK 3.0, conversion of loans totalling DKK 3.5 million at DKK 3.0 and a non-convertible loan of DKK 6 million with a maturity of 2 years.

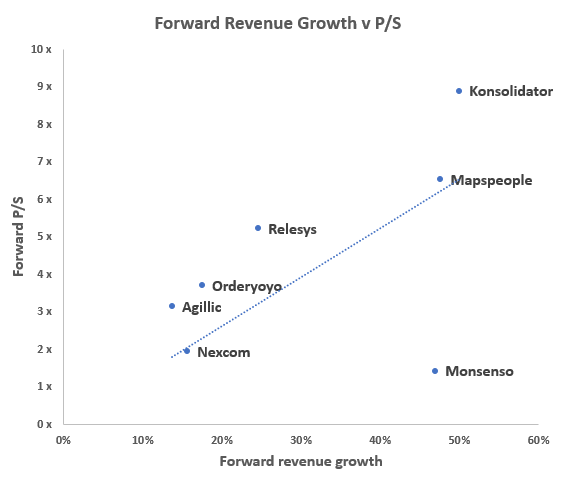

With the revised strategy, revenue growth this year is expected to be 27-54%, giving the company’s investment case a shot in the arm. The investment case in Nexcom consists primarily of achieving a sales breakthrough in the US, which the company still expects, and that Nexcom, especially in this perspective, is priced low compared to other SaaS companies.

Risk that conversion of loans and/or a share issue at a low price has put the share price under pressure. The negative pressure should now be over. However, with the revised growth, Nexcom is not priced significantly lower than peers, but the announcement of significant new customers in the US is likely to have a material positive price impact.