Biosergen’s H1-2022 report and major shareholder loan to the company point to more share price triggers this year and ahead of product launch and thus potential for new positive share price development.

Biosergen: Ticker: BIOSGN | Price: SEK 5,11 | Market Cap.: SEK 141M | YTD price development: -5,72%

Biosergen is a biotech company listed on Nasdaq First North Sweden in June 2021. The company is developing an innovative drug to treat fungal infections that kill 1.5 million people annually – in both industrialised and third world countries.

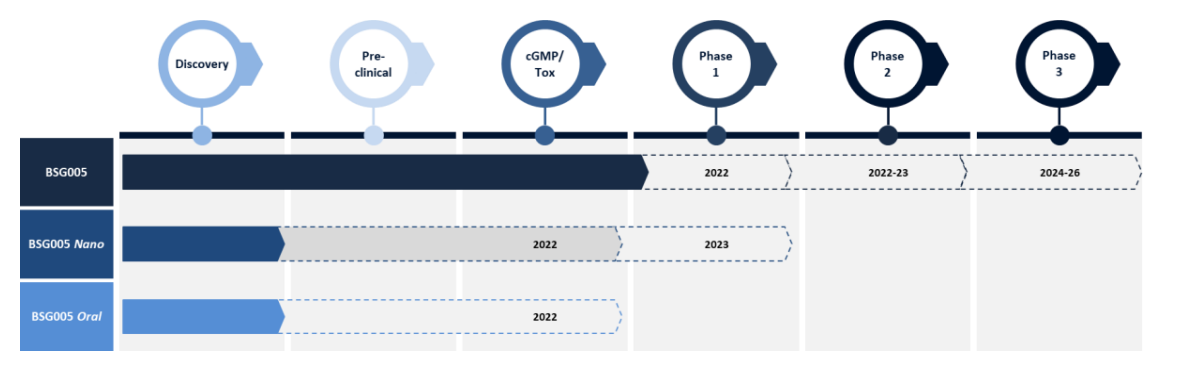

The company’s BSG005 medical drug has demonstrated significant safety data and potency advantages over existing products developed in the 1950s-70s. BSG005 is in clinical phase I (the first of three phases of development towards the market launch), from which positive data have emerged. The first of several drugs is expected to be on the market in 2026/27.

Read the full investment case on Biosergen here

H1 and support from the main shareholder

Biosergen has followed the planned development of BSG005, which has enrolled the third group of subjects in the phase l trial. However, the company’s share price, although outperforming the healthcare sector, has not developed positively and therefore no capital was raised from warrants issued at the time of the IPO.

Biosergen’s cash balance at the end of June 2022 was mSEK 5.7 and with cash flow from operations for the half year of mSEK -25, the company needs to raise capital to fund ongoing and future studies. As bridge financing, Biosergens’ main shareholder Östersjöstiftelsen (43.2% of the shares) has provided the company with a convertible loan of mSEK 7.0. The loan, which matures in December 2023 and carries an interest rate of 8% p.a., will finance the company’s development this year.

Biosergen’s pipeline

Phase l study and potential share price triggers

The preliminary positive results from the phase I study (in healthy subjects) of BSG005 indicate that the fungicide is not harmful to humans and that therefore one can look towards increasing the dose and towards phase II studies where the patient group will be expanded and the correct dosage clarified.

The stock has often responded positively to the Phase I study, including the enrolment of a new group of subjects. There will be continuous news from the phase l study, so there will be continuous opportunities for price triggers until spring.

If Biosergen continues the positive development of BSG005, we expect the company to make a capital increase on the back of positive news and thus potentially at a higher share price than the current and almost historically low price level.

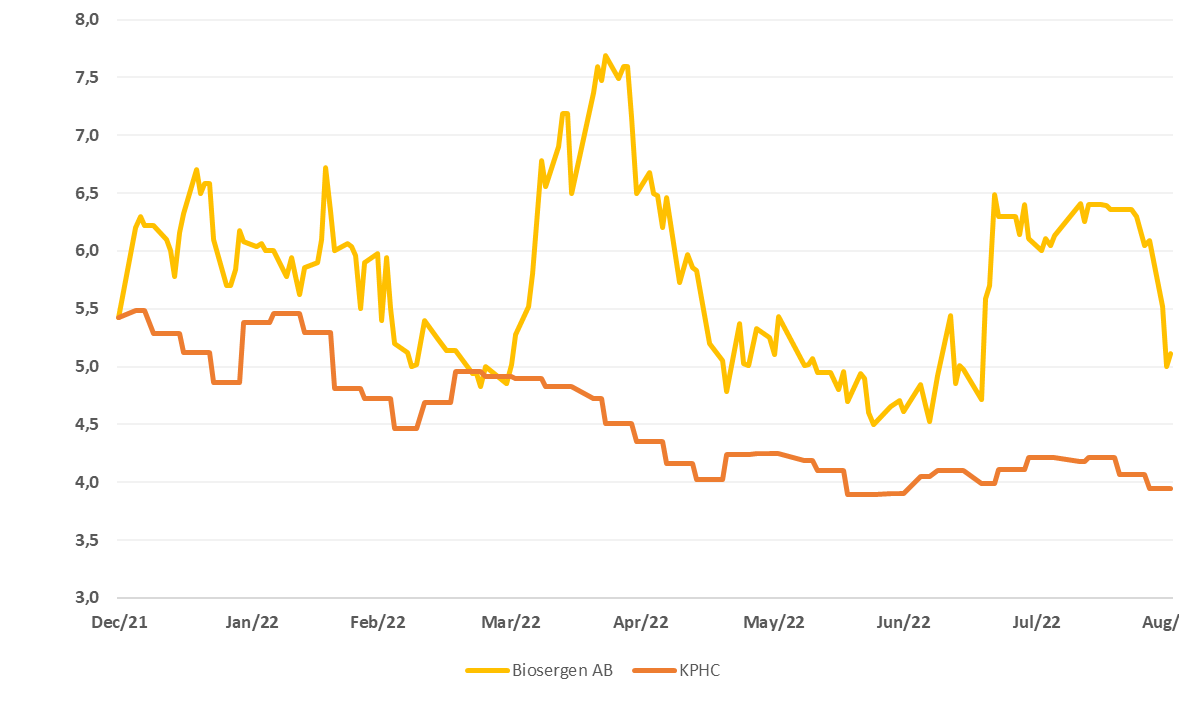

YTD share price development versus Kapital Partner Healthcare Index